HempFusion Wellness, the CBD firm that caused much excitement last year when it conducted a late stage financing round with numerous retail investors, has finally filed to complete it’s initial public offering. The company expects to raise a total of US$17 million through two different instruments being offered for sale.

The first portion of the financing for the hemp focused operator is that of common shares, which are anticipated to raise US$7.0 million. The second portion is expected to raise a further US$10 million, through the sale of units of the company. Presently, HempFusion anticipates the units to be offered between US$0.90 and US$1.35 per offered share and unit, respectively.

Units sold under the offering are to consist of one common share and one half warrant of the issuer. Each full warrant is valid for a period of five years following the close of the transaction, with an exercise price not provided at this time. Units sold under the offering will be subject to a hold period of four months following the commencement of HempFusion’s listing. Shares sold under the offering will not be subject to restrictions.

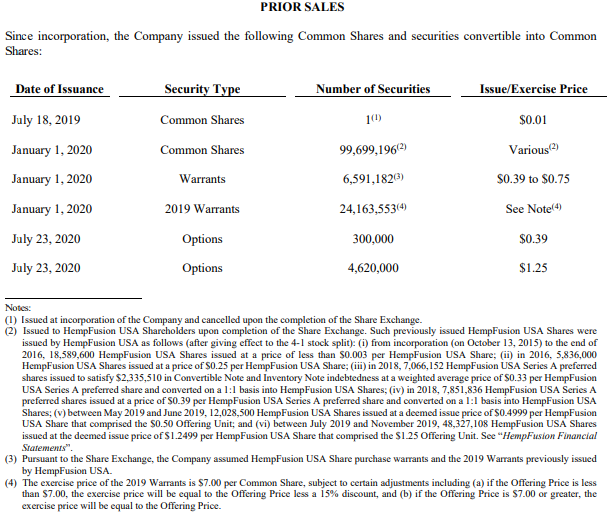

A number of prior share sales have occurred on the equity, including the notable financing that involved a sizable retail following which occurred at $1.25 per unit. Included within the prospectus filing made by the firm this week, was information on prior sales that quite frankly contains far too many notes.

It appears however that most prior sales occurred at prices between $0.25 and $0.50, save for the most recent round of financing conducted at $1.25. All figures below are referred to in terms of US dollars.

The company is expected to list on the Toronto Stock Exchange, for which it has been conditionally approved. The company currently intends to list for sale the offered shares, the unit shares, and the warrants from the IPO round, as well as certain other securities on the exchange. Presently, it is believed that the company will be trading under symbol “CBD.U”.

A closing date was not provided for the offering.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Hi Jay

With Danny Brody and Spencer Maclean leaving TGOD to head up Spinco and join Hemp fusion have you any idea what they plan to do with the Spinco money that was raised prior to there departure from TGOD ?

Regards John