Hercules Metals (TSXV: BIG) has entered into a major arrangement with Barrick Mining (TSX: ABX). The arrangement will see Hercules enter into a strategic option agreement with the mining major to lead a district-scale exploration strategy.

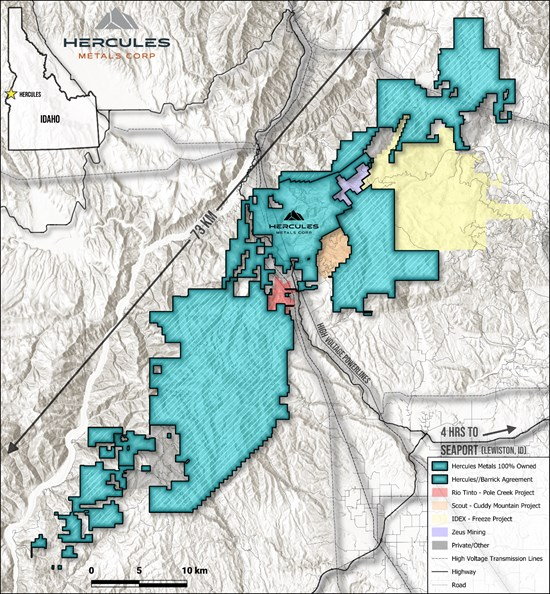

The arrangement will also allow for Hercules to earn a 100% interest in over 74,000 acres of unpatented mining claims, referred to as the Olympus claims, in the area surrounding their Hercules property and the Leviathan porphyry discovery. In exchange, Barrick is set to increase their ownership interest in Hercules.

The option arrangement, if exercised, will increase Hercules’ claim package in the region to over 100,000 acres while establishing the company as a controlling claims holder in the region. The Olympus claims are said to have numerous porphyry targets along trend from Leviathan.

The arrangement will see Hercules pay $8 million for the claims in cash or shares over a three year period, subject to Barrick holding a maximum 19.9% interest in the company. The properties will be subject to a NSR royalty of 1%, which can be bought back and reduced to just 0.25%.

“Consolidating the 73-kilometre Olympus copper belt represents a once-in-a-lifetime opportunity for Hercules shareholders and signifies a strong endorsement of our team’s execution and vision. We are honoured by Barrick’s confidence as we advance Leviathan alongside a greatly expanded district-scale exploration strategy moving forward,” commented Chris Paul, CEO of Hercules.

Hercules Metals last traded at $0.86 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.