Earlier this week, Hexo Corp (TSX: HEXO) announced that they would be seeking approval from shareholders, yet again, for a share consolidation. If approved, it would mark the second time in two years that such a transaction occurs, following the firms four to one consolidation in December 2020.

The trouble for shareholders, is that a share consolidation is a temporary band aid to a much larger problem facing the company.

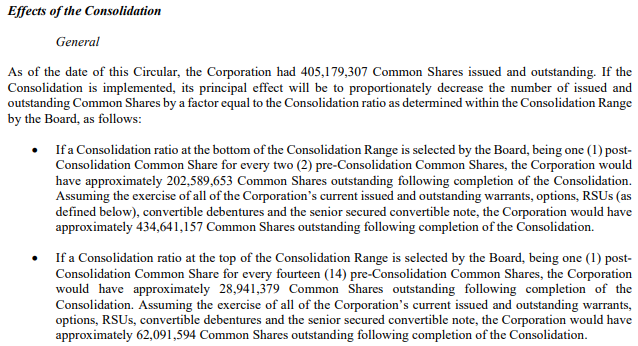

The consolidation itself is being pursued as a means for the company to regain compliance with listing standards for the Nasdaq. Under current regulations in place, equities are not permitted to trade under US$1.00 per share for extended lengths of time. To rectify this, the company has proposed a consolidation ranging from 2 to 1 to that of 14 to 1, which would effectively get the firms share price over that minimum figure. For now.

The reason that this can be viewed as a temporary bandaid, is the same reason that the company got back into this position in such a short amount of time. Unsurprisingly, it’s also believed to be part of the reason that long time CEO and co-founder Sebastian St-Louis got canned back in October by the company. And that reason is an absolutely atrocious debt deal conducted by the firm in May, which was so bad that Stifel-GMP suggested it could lead to bankruptcy for the company.

That debt deal, as depicted above, was for US$327.6 million in proceeds, which was done at a 9% discount to the value of the debt. While the debt carries no interest, it is to be repaid at “a price equal to 110% of the principal amount of the notes being repaid.” Effectively, this acts as the interest rate – on top of the 9% discount ascribed to the note issuance as well.

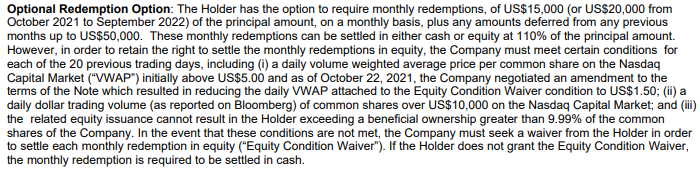

As further confirmation on the premium for repayment, here’s the “optional redemption option,” which has been in place since the issuance of note. The optional redemption option also includes this 110% premium on both cash and equity settlements. Note here that the debt holder can’t hold more than 9.99% of the firms equity at any one time – meaning that they are basically forced to sell if they wish to continue to settle the note in equity.

As depicted, the lender is able to require monthly redemptions of US$15.0 million from Hexo, which can be settled in either cash or equity. There’s a few conditions attached for the debt to be settled in equity, including a minimum price of the common shares and minimum liquidity requirements. Notably, the US$5.00 minimum price per share requirement initially agreed to by the company has already been reduced to US$1.50 per share, which again, is largely the result of ongoing dilution from the debt deal. Equity settlements beyond that minimum bar are to occur at 88% of the current price per share, subject to an equity condition waiver.

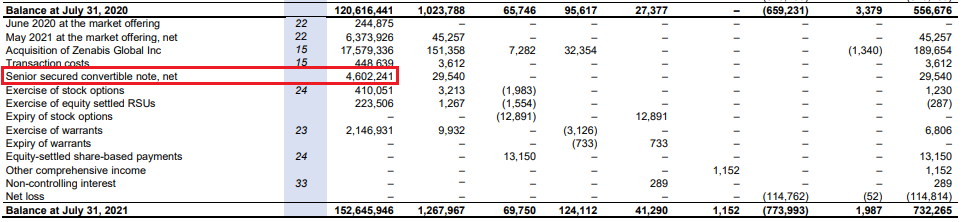

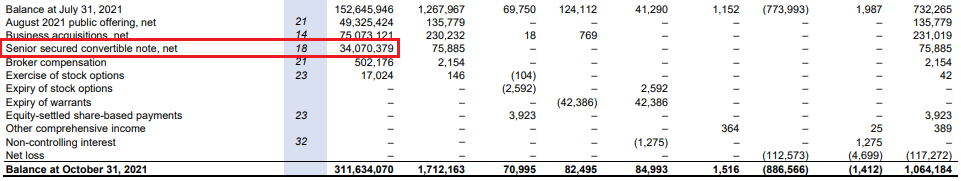

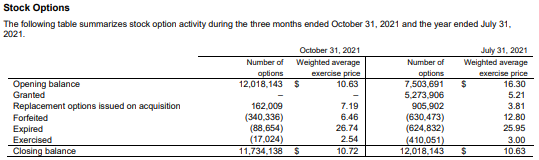

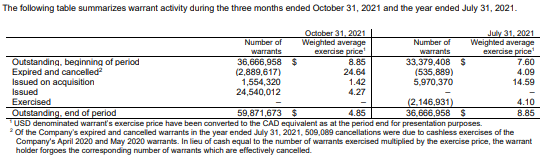

In terms of share issuances to settle the debt, 4.6 million shares were issued in the July quarter, while 34.1 million were issued in the October quarter – a sign of the tumble the company had experienced in a short time frame. In the same three month period, the firm raised US$144.8 million in a financing that saw 49.3 million shares added to the cap table, and half as many warrants, issued 5.4 million shares for the purchase of 48North Cannabis and issued 69.7 million shares for the purchase of Redecan. Collectively, the firm more than doubled its share count in a three month period.

The result, is that as of October 31, 2021, the company had issued a total of ~38.7 million shares to the debtholder, as seen above. At this point you’re likely thinking, “But that’s not a huge number, share issuances for acquisitions are far more dilutive!” And at this point, you’re right.

The problem here, is that after October 31, the firms share price continued to slide. On the closing trading day of the quarter, October 29, Hexo closed the markets at US$1.47 per share. It closed yesterday at US$0.59 per share – a little under a third of the price, which means it takes nearly three times as many shares to settle the same debt.

As seen above, the firms shares outstanding sat at 311.6 million. That figure as of February 14 had ballooned by 30.0% to 405,179,307 shares, based on a circular issued by the company for its annual and special meeting of shareholders. With no options or warrants in the money for the period, it leaves essentially one explanation for where the shares have come from: the issuance of shares to satisfy debt for the months of November, December, and January. As a certain degree of confirmation of this, the company has indicated that November and December redemptions were settled in equity.

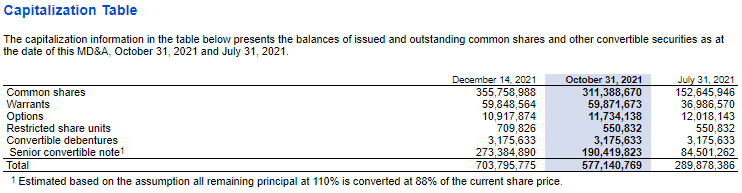

The other side of this argument, is that the company is well aware that this senior secured debt is a major issue for the share structure of the company. Included in the Management Discussion and Analysis section of its last quarterly filings, the firm provided a chart of its current capitalization. Included within, is the estimated impact of the full conversion of the senior secured convertible note, if it were to be converted at the end of the period. From July 31 to December 14, that figure has risen from 84.5 million shares to 273.4 million shares, and has continued to climb as the equity price falls.

And then, there is the circular for the shareholders meeting, which identified the terms of the consolidation. The firm within outlines two scenarios. First, is its share structure if it were to consolidate on a 2 to 1 basis, and second, the share structure if it were to consolidate on a 14 to 1 basis. In both scenarios, they outline the basic common shares outstanding, as well as how many shares can be expected to be outstanding if all outstanding warrants, options, RSU’s convertible debentures and the senior secured convertible note were to be converted.

The numbers aren’t pretty.

In either case, the full conversion of all convertible securities, at a price of US$0.72 per share at the time of filing, would result in the firms share count more than doubling. Assuming that no convertible securities, other than the senior secured note, were converted since the last financial results, it means that in a 2 to 1 scenario, that fully diluted share count figure consists of 194,725,555 shares from the conversion of the senior secured debt. In a 14 to 1 scenario, the fully diluted figure includes 27,817,937 shares from the debt.

And that’s assuming that the price stays flat from here on it, post conversion. Instead, its fallen 18% from the time of that filing – which will result in further dilution. With the further dilution, and the inevitable selling pressure that comes with it, it would be reasonable to assume that the price would continue to fall for the equity, even post consolidation.

And that is why the share consolidation is a bandaid solution.

Information for this briefing was found via Sedar and Hexo Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

would you buy here