i-80 Gold (TSX: IAU) has released a preliminary economic assessment for its Granite Greek Underground Project, found in northern Nevada. The study has outlined an after-tax net present value of $155 million, which is based on a 5% discount rate and $2,175 an ounce gold.

At $2,900 an ounce gold, the project economics are said to improve to an after-tax net present value of $344 million.

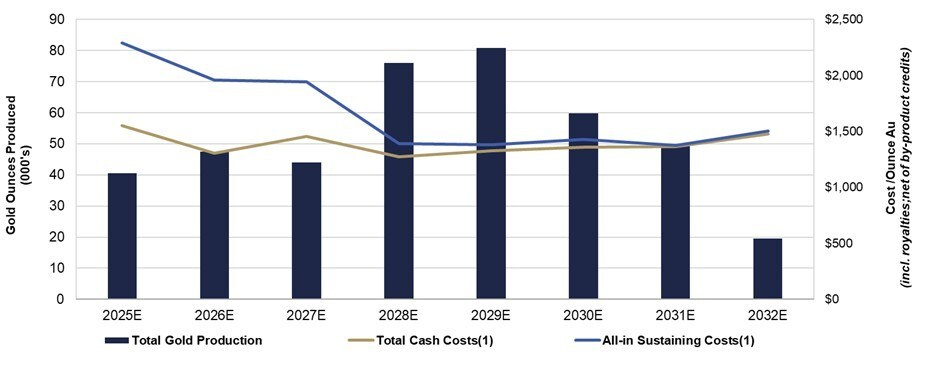

The figure is based on an operation that would see annual gold production of 52,200 ounces of gold, across an eight year life of mine. The project as a whole has measured and indicated resources of 261,000 ounces of gold at an average grade of 10.5 g/t, alongside inferred resources of 326,000 ounces of gold at 13.0 g/t. The estimate however does not include infill drill results from both 2023 and 2024.

The assessment envisions that refractory mineral mined over the next three years will be processed at a third party autoclave facility, with recoveries estimated at 58%. Once the lone tree facility is commissioned in 2028, recoveries are expected to improve to 92%, leading to life of mine average recoveries of approximately 78%.

From a costing perspective, life of mine cash costs are pegged at $1,366 an ounce, while all in sustaining costs are estimated at $1,597 per ounce. Given the fact that mine construction is complete, there is no major initial capital cost, while life of mine development and sustaining capital is estimated at $105 million.

The study however appears to be slightly outdated already. In addition to assay results from the 2023 and 2024 programs not being included in the study, the assessment also does not include the impact of the underground water management conducted this year. i-80 as a result says that the current production forecast differs from what is depicted within the PEA.

Production this year from the mine is slated to be 20,000 to 30,000 ounces.

A feasibility study is expected to be completed on Granite Creek in the fourth quarter of 2025, which is to include assay results from drilling conducted over the last three years.

i-80 Gold last traded at $1.12 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.