On Monday, IAMGOLD (TSX: IMG) announced that it had reached an agreement with Sumitomo Metal Mining Co, their joint-venture partner on the Côté Gold Project. Under the new and updated agreement, Sumitomo Metals announced that it would contribute an additional $340 million to the project over 2023 in exchange for a 10% interest in Côté.

IAMGOLD will also pay a repurchase option fee to Sumitomo Metals; the cost is equal to the 3-month SOFR rate plus 4% on the cash used during construction and up to achieving commercial production, payable in cash quarterly from January 1, 2024. The repurchase agreement will allow IAMGOLD to resume its 70% interest in Côté Gold Project. In the interim, its ownership will sink as low as 60%.

Maryse Bélanger, Chair and interim President and CEO of IAMGOLD said, “The Côté Gold project remains on track for gold production in early 2024, in line with the updated schedule and cost to complete as outlined on our most recent project update at the end of last quarter.”

IAMGOLD currently has ten analysts covering the stock with an average 12-month price target of C$2.67, suggesting that the shares are trading at fair value. Out of the ten analysts, only one has a strong buy rating, and another single analyst has a buy rating. Five analysts have hold ratings, and the last three analysts have sell ratings on the stock. The street-high price target sits at C$3.25 and represents an upside of 30%.

In Canaccord Genuity Capital Markets note on the results, they upgraded the stock from a sell to a hold and raised their 12-month price target to C$3.00 from C$1.50, saying that this news, combined with the recent sale of Rosebel for $360 million in cash has reduced the fear of the company hitting a funding gap.

They believe this transaction is 11% accretive to IAMGOLD’s net asset value, as Canaccord has increased their valuation of IAMGOLD’s ownership to $1.11 billion now versus the $1 billion before the news. Additionally, they lowered the company discount rate to reflect a lower funding risk.

Though Canaccord does not see zero funding risk as they have modeled out a small funding gap in 2024 due to the company’s gold prepay arrangement coming due, though the analysts expect that the company will try and roll the prepay forward. With Sumitomo taking $350 million of CAPEX, Canaccord forecasts IAMGOLD has about $600 million to contribute to the Côté mine over 2023 and 2024.

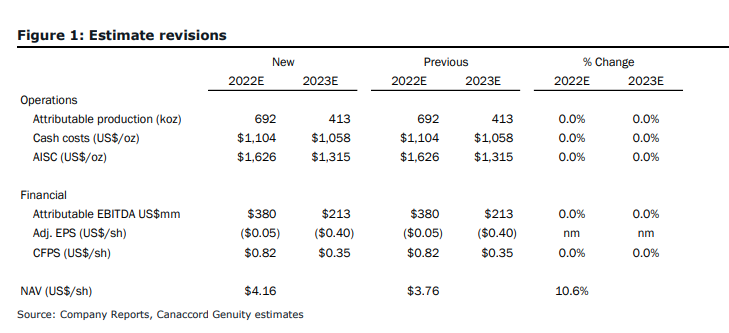

Below you can see Canaccord’s updated estimates.

Onto BMO Capital Markets’ note on the news, in which they call this deal a “well-timed bailout.” They add that this deal values Côté at US$3.4B on a 100% basis. This is well above their estimate of US$857 million. They believe that part of the premium can be explained by, “the fact that the partners have already sunk significant capital into the project and are working to bring it to completion.”

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.