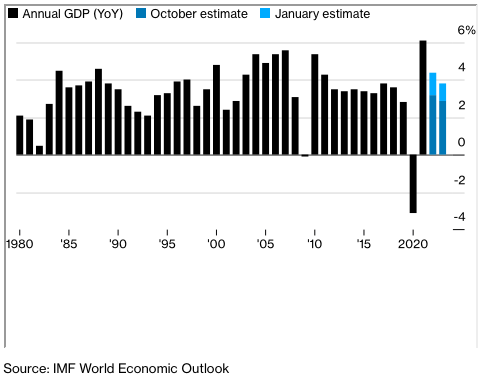

The International Monetary Fund predicts that world economic growth will contract from 3.2% in 2022 to 2.7% next year.

Except for the years of the coronavirus epidemic and the years after the global financial crisis, the IMF’s growth prediction for 2023 is the lowest for the year ahead since 2001.

“We are not in a crisis yet, but things are really not looking good,” IMF chief economist Pierre Olivier Gourinchas told the Financial Times, adding that 2023 will be the “darkest hour” for the global economy.

The fund’s economists determined that there was a greater-than-even probability that the global economy would do worse than its central prediction, and a 25% possibility that growth would dip below 2%.

Gourinchas added that there was a 15% probability that global growth might dip below 1% at some point, breaching the recession threshold and would be “very, very painful for a lot of people.”

China’s zero-covid policy and shaky property market, the need to boost interest rates in Western economies to contain inflation, and increasing oil and food costs as a result of Russia’s invasion of Ukraine were all cited as causes in the expected economic contraction.

The risk of policy miscalculation has grown considerably as the economy remains sluggish and markets show symptoms of stress, according to the IMF’s World Economic Outlook. Around one-third of the world economy faces contraction next year, with the US, European Union, and China all remaining stalled.

Despite this, the fund believes the recent hikes in interest rates are important measures to rein in inflation. Inflation in advanced economies is expected to reach 7.2% this year and 4.4% next year, both of which are more than one percentage point higher than the fund’s earlier April predictions for 2023. Consumer price gains in emerging and developing nations are expected to peak at about 10% this year before slowing to 8.1% in 2023.

“The worst is yet to come, and for many people 2023 will feel like a recession,” Gourinchas wrote in a foreword to the report. “As storm clouds gather, policymakers need to keep a steady hand.”

The IMF admitted that there was a risk of tightening monetary policy too much, but it stated the risks of doing too much were not as serious as allowing inflation to become normalized and engrained in daily life.

“We are far from having won that battle,” added Gourinchas.

Information for this briefing was found via Financial Times and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Jeez… Don’t oversell it!