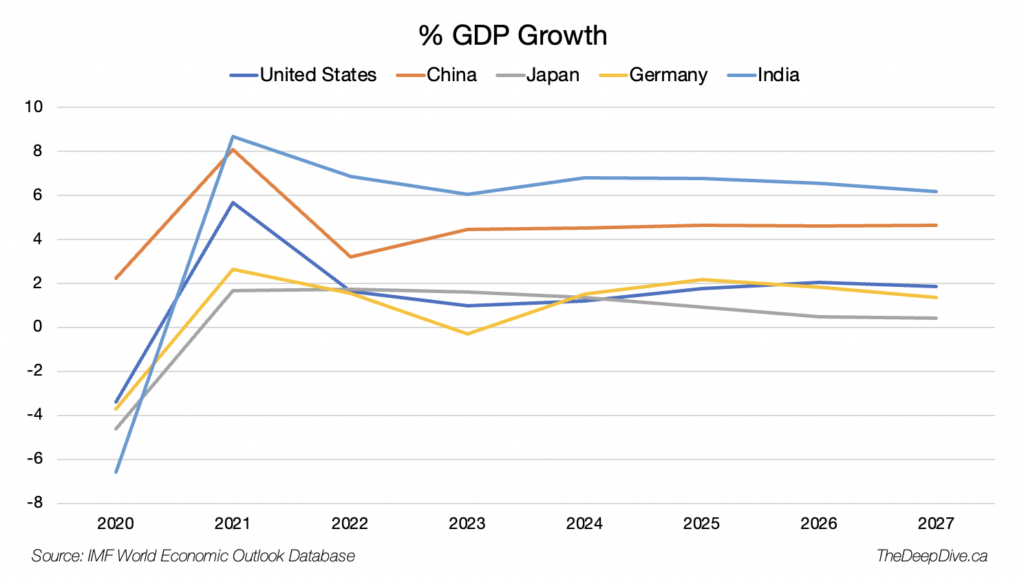

India is on track to become the world’s third-biggest economy by 2027, after the United States and China, a full two years ahead of its target. The South Asian economy is set to take the spot as Japan and Germany, currently third and fourth respectively, fall behind.

Data from the International Monetary Fund’s (IMF) October World Economic Outlook show that India, currently sitting as the fifth largest economy after beating the UK just recently, is growing faster than other economies in the G20, save for Saudi Arabia. From April 2021 to March 2022, India’s Gross Domestic Product grew by 8.7%.

The IMF downgraded India’s 2022 GDP forecast to 6.8% from 7.4% in July and 8.2%, “reflecting a weaker-than-expected outturn in the second quarter and more subdued external demand,” but retained the 2023-2024 forecast of 6.1%, the sharpest projected growth among the G20.

The projection for Japan is 1.7% in 2022, and a lowered 1.6% from an initial 1.7% for 2023. Germany’s GDP growth, on the other hand, is projected to be 1.2% in 2022 and 0.8% in 2023.

As for GDP per capita, the country is set to reach $3,652 in 2027 versus $2,466 in 2022. With China’s dropping birth rate, India is also expected to become the world’s most populous nation by next year.

Fueling India’s economic growth in the next years will be merchandise and services exports, which the country expects to grow exponentially. From April to September this year alone, the country’s exports recorded a rise of 16.96%, according to data from its commerce industry.

Commerce and Industry Minister Piyush Goyal, who spoke on Sunday at the Exporters’ Conclave in Chennai, was confident that the country will achieve its $2 trillion export target for goods and services by 2030 and projected that India will become a $30 trillion economy, with 25% share in exports, by 2047.

In September, the inflation rate rose to 7.4%, the highest in five months. While inflation in the country is still high, it’s not reaching eye-watering levels like in the European Union and the US. The banking sector is in a robust position as the country’s credit cycle picks up.

Information for this briefing was found via the IMF, and Khaleej Times. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.