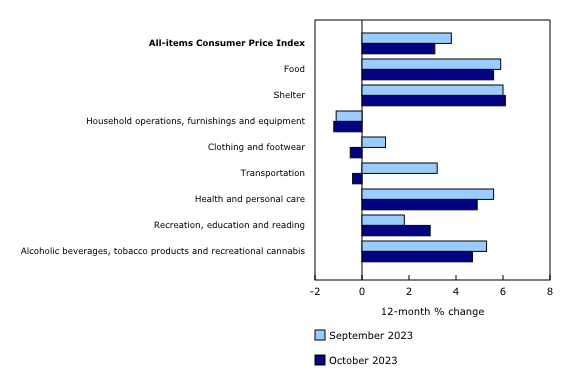

Canada’s Consumer Price Index (CPI) in October rose by 3.1% year-over-year, marking a decrease from September’s 3.8% gain. Excluding gasoline, which saw a 7.8% drop, the CPI increased by 3.6%, slightly less than the 3.7% rise seen in September.

The overall decrease in goods prices, led by lower gasoline costs, contrasted with a 4.6% increase in service prices, driven by higher costs for travel tours, rent, and property taxes. Key contributors to the year-over-year CPI rise included mortgage interest costs, store-bought food, and rent.

Month-over-month, the CPI edged up by 0.1% in October, influenced by annual pricing adjustments in travel tours and property taxes. Seasonally adjusted, however, the CPI witnessed a slight decline of 0.1%.

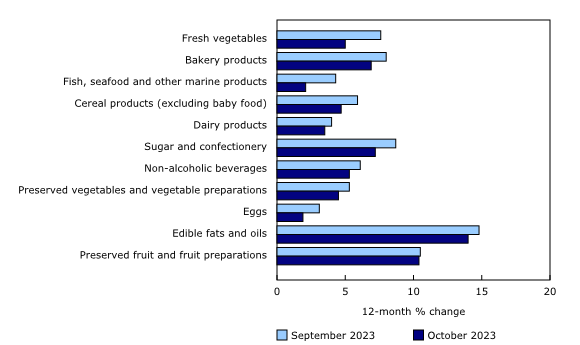

In the energy sector, gasoline prices fell 6.4% month-over-month due to lower refining margins and the transition to winter fuel blends. Grocery prices, though still high, continued their trend of decelerating growth, with a 5.4% year-over-year increase in October, a decrease from September’s 5.8%.

Significantly, rent prices accelerated across most provinces, with notable increases in Nova Scotia, Alberta, British Columbia, and Quebec. Property taxes and special charges saw their largest year-over-year rise since 1992, reflecting increased municipal budget needs.

Regionally, all provinces experienced price increases at slower rates compared to September. Alberta recorded a notable slowdown in electricity price increases, while natural gas prices dropped in three Western provinces, attributed to lower commodity prices.

Information for this briefing was found via Statistics Canada and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.