In the wake of the housing boom during the pandemic that spanned from summer 2020 to spring 2022, institutional homebuying witnessed a surge due to a confluence of factors, including soaring rents, low interest rates, easy access to capital, and spiking home prices. However, this institutional frenzy swiftly dwindled as interest rates experienced a spike.

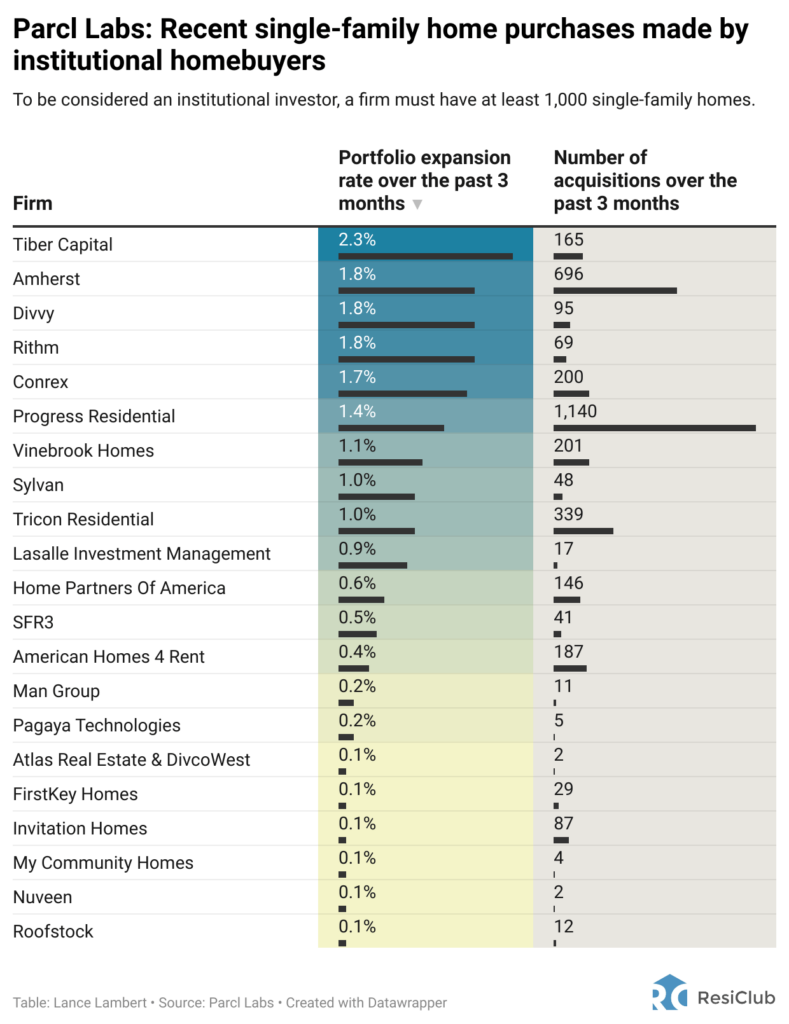

Contrary to recent claims on social media, the reality is that institutional homebuying remains relatively restrained. According to data provided by Parcl Labs, among 21 major institutional operators, only one increased its total home portfolio by over 2.0% in the past three months. Tiber Capital stood out, acquiring 165 single-family homes during this period, resulting in a 2.3% increase in its total home portfolio.

On an overall basis, Progress Residential led the way by acquiring the most homes, adding 1,140 to its portfolio over the past three months. These statistics paint a picture of a market where institutional players are not universally expanding their holdings.

The big question now revolves around the potential impact of falling interest rates on institutional single-family home buying. If interest rates experience a significant decline, the industry may witness a resurgence in institutional activity.

To better understand the dynamics of institutional homebuying, ResiClub sought insights from Parcl Labs, which provided valuable data shedding light on the current scenario. The data reveals that, in aggregate, institutional operators own approximately 0.73% of the total U.S. single-family housing stock—significantly less than the purported 44% claimed in recent social media posts.

READ: Congress Moves to Ban Hedge Funds from Owning Single Family Homes

Jake Shields, a former MMA fighter, recently tweeted a misleading statistic, suggesting that 44% of U.S. single-family home purchases this year were made by private equity firms. However, the truth, as per Parcl Labs, is that this figure was entirely fabricated. In reality, institutional ownership reaches as high as 4.4% in the Atlanta-metro market but remains below 1% nationwide.

It’s important to note that, despite institutional investors entering the housing market in the aftermath of the 2008 housing bust, the majority of landlords still operate with portfolios ranging from 1 to 10 homes. The Parcl Labs data underscores the need for accurate information to guide discussions around institutional involvement in the housing market, dispelling the myths propagated by misleading claims.

Information for this briefing was found via ResiClub and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.