The Central Bank of Iraq (CBI) has announced that the country’s gold reserves have risen to over 132 tons. This is attributed to the recent acquisition of approximately 2.3 tons of gold, amounting to 1.79% of the bank’s current gold assets, taking the total gold holdings to 132.74 tons. Despite this acquisition, the CBI maintains its position as the 30th largest global holder of gold reserves.

The CBI’s aim in purchasing more gold is to bolster its holdings amid current international economic and political instability. Regular increases in gold reserves have positive implications for a bank’s financial stability and enhance a country’s creditworthiness. In the previous year, the CBI bought a significant amount of 34 tons of gold, marking a 35% increment in its gold assets.

After a four-year pause, Iraq resumed its gold purchases in 2022 as part of a strategy to diversify its foreign assets, which are currently estimated at $100 billion. This recent purchase appears to be in line with this strategy, supporting Iraq’s efforts to improve financial stability and bolster its international economic standing.

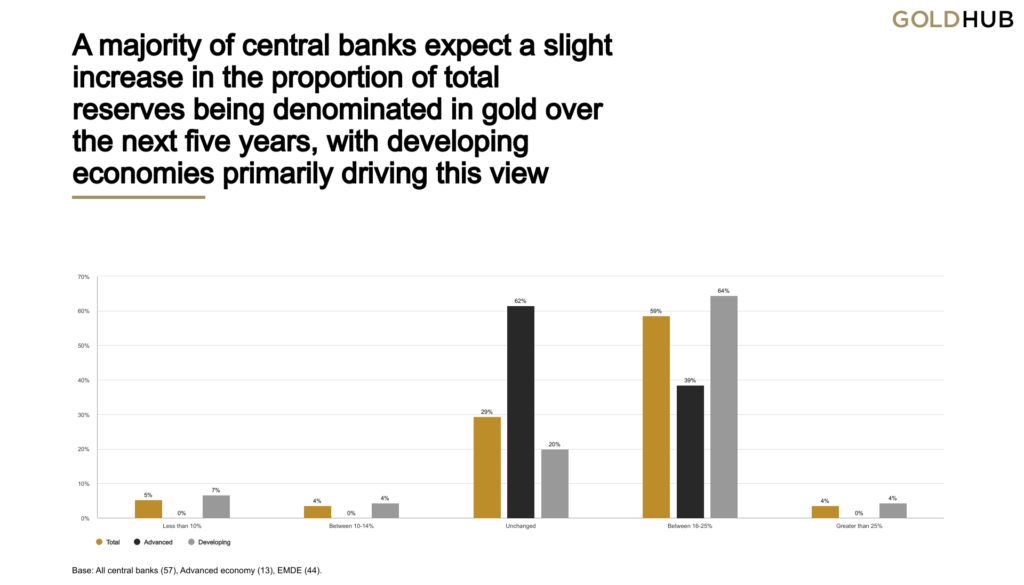

The move also coincides with a broader strategy among developing nations’ central banks to increase gold reserves and cut back reliance on the US dollar.

Information for this briefing was found via the Iraqi News Agency and the World Gold Council. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.