The pace of housing starts across Canada slowed down last month, in what is perhaps a preliminary indicator that the country’s economy could be headed for a slowdown.

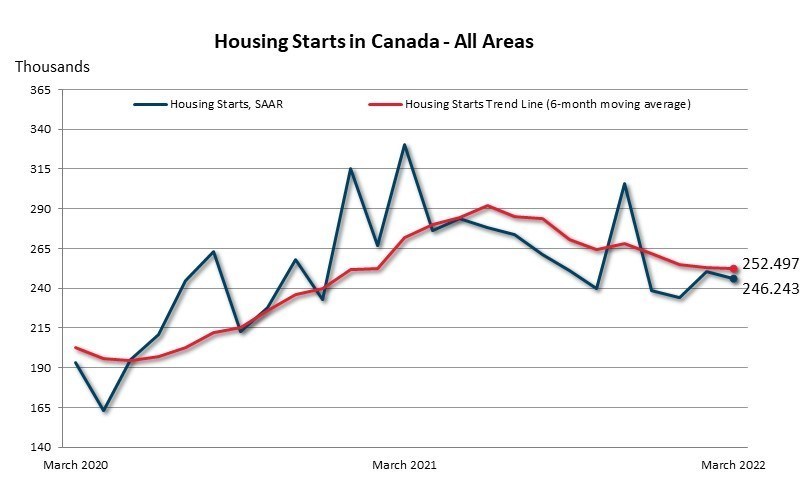

Latest data from the Canadian Mortgage and Housing Corporation shows the seasonally adjusted rate of housing starts slumped from 250,246 units in February to 246,243 units in March, as the pace of urban starts declined 2% to 220,708 units. Multi-unit urban starts fell 5% to 154,876 units, while single-detached urban starts were down 8% to 65,832 units. Rural starts stood at a seasonally adjusted annual rate of 25,535 units last month.

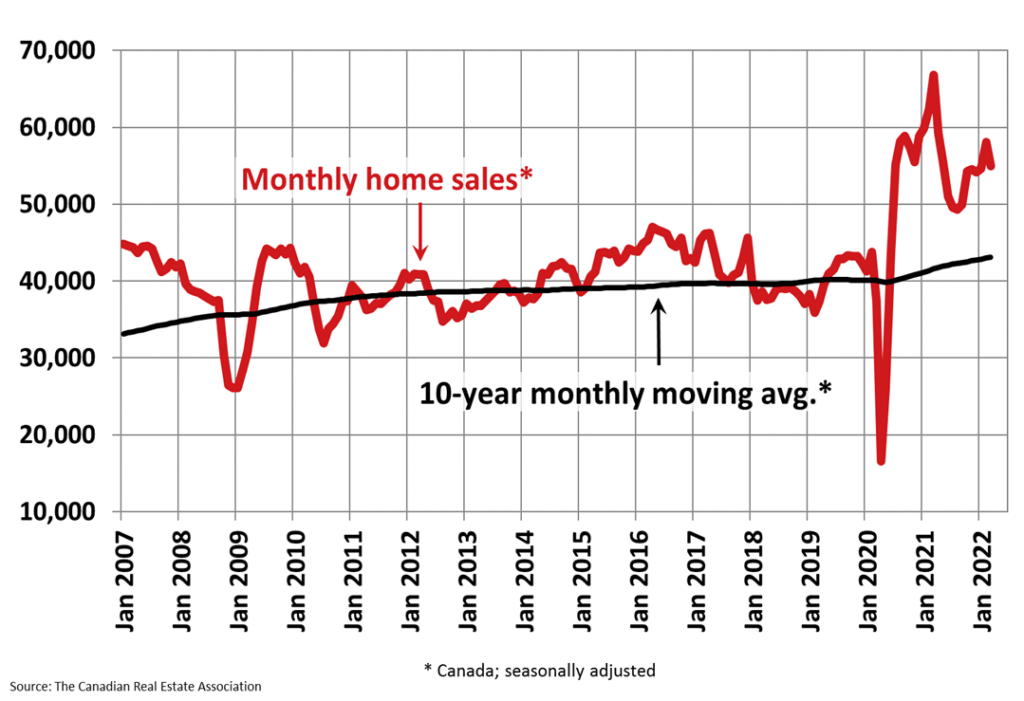

Although the trendline continues to show elevated housing starts activity well above 200,000 units since June 2020, last month’s slight decline could be indicative of a slowdown in the broader economy. Fresh data from the Canadian Real Estate Association showed a 5.4% month-over-month decline in home sales and a 5.5% drop in available listings, while the national average sale price rose 11.2% from March 2021. Although “one month does not make a trend, so we’ll have to wait and see if this is the beginning of the long-awaited cooling off of this market,” said CREA Chair Jill Oudil.

Information for this briefing was found via the CMHC and CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.