Beleave Inc (CSE: BE, OTCMKTS: BLEVF) released their second quarter financials last week, to little fan fair. The once seemingly popular equity has in recent months been left behind as investors flock to companies that are performing at a much higher caliber in terms of revenue and success.

The news last week of pending trouble from the British Columbia Securities Commission has only further dampened investor sentiment. After utilizing a group of consultants known as The Bridgemark Group, the company has been barred from issuing consultant options pending a full investigation by the BCSC.

After a month of a declining share price, and a rough week due to securities investigations, many investors are left begging the question.

Is it Time to Stop Beleave’ing?

The latest financials to be released by Beleave Inc were disappointing to say the least. For the three months ended September 30, 2018, the company managed to sell a whopping 1,666 grams of cannabis. The six month total is only marginally higher at 2,506 grams, with the company receiving it’s sales license within the first two weeks of the fiscal year. This has translated into $315,617 and $524,268 in revenues for the three and six month periods respectively.

These revenue and sales figures are despite the company having product on hand to sell more if the demand exists. As of September 30, the company had 347,968 grams listed as being in inventory, with a total valuation stated as being $1,051,470. An argument can be made that this is the result of waiting to sell the product under recreational legalization, which will be evident in the third quarter. However, the revenues being obtained from recreational sales are lower than that of medical sales.

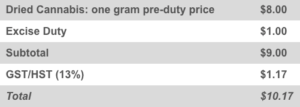

This fact is easily visible to anyone willing to look. Directly via the Beleave website, they list product being available starting at $8 per gram for their lower end variety known as Shishkaberry. Their premium product, Cold Creek Kush, is listed at $10/gram. Meanwhile, over at the Ontario Cannabis Store, these products are listed at $10.60, and $13.40 respectively, wherein this prices includes both HST at 13% and the standard excise tax of $1.00 or 10% per gram, whichever is greater.

What this translates to, is that the OCS is selling Beleave’s product at a price point of $8.38 for the former, and $10.78 for the latter. Assuming that the organization is delivering a 25% margin on the product it sells, it infers that Beleave is really getting anywhere from $6.28 to $8.08 on the product it sells at a wholesale rate. However, this may be overly generous given that the OCS is one of the largest cannabis buying entities in the world and thus they can expect much better wholesale rates.

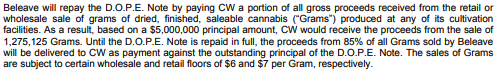

Why does this matter? The significance of the price that Beleave receives on its wholesale cannabis relates to a deal that it signed with Cannabis Wheaton, now known as Auxly Cannabis, that is referred to as the “D.O.P.E note”. Essentially a loan of up to $10,000,000, the deal requires that any funds drawn down by Beleave will be repaid with the sale of cannabis produced at any of the Beleave facilities. At present, the firm has received $5,000,000 in funding from this deal, and has yet to request the remaining funds from Auxly.

The note, a rough summarization of which was posted above via an excerpt from the latest financials, contains a crucial consideration to be made by any investor. The repayment of this note, determined through the sale of cannabis on a per gram basis, has set floor pricing for cannabis. Outlined at $6.00 per wholesale gram and $7.00 per retail gram, it infers that the company could see negative margin for the product in which it sells as it attempts to repay this note as per the terms agreed to.

At present we are at the beginning of a recreational market, wherein arguably the price of cannabis is at an all time high. As more product comes to market the price per gram will inevitably decrease. If this note is not paid off quickly, Beleave will very rapidly find itself losing further funds on each gram of product it sells. As it stands, it is barely above this break even figure.

The excerpt also goes into detail outlining that it estimates the note will require proceeds from the sale of 1,275,125 grams of product. With the terms stating that proceeds from 85% of all grams sold are to be given directly to Auxly, this requires Beleave to produce slightly more than 1,500 KG of product.

The current facility, with a stated production capacity of 950KG a year, will take an estimated 1.5 years to produce this product provided it is running at full capacity. This doesn’t appear to be the case at this time though, given that it has produced an estimated 350KG of product over the previous six months, with a further estimated 366KG of product in current production. At the current run rate this implies that it will take at minimum two years for the note to be paid off and for Beleave to potentially see positive cash flows.

This potential for positive cash flows however does not take into consideration current expansion plans that the company has for three separate facilities. The earliest of which, as per their refreshed investor deck posted November 30, is not to start until Summer 2019.

The kicker? We’ve been overly optimistic for the company. Within their investor deck, they state that they are forecasting at a wholesale price of $5.33 per gram. This provides some insight as to what they are currently receiving from the Ontario Cannabis Store.

In a recent effort to drum up some excitement for the equity, the company went through a seven for one stock split on November 5. This successfully gave the company an $0.11 run, equivalent to $0.77 on a pre-split basis. However, the stock has since returned to exactly where it was before as investors realized that the stock wasn’t suddenly on sale and that nothing had materially changed.

There was also that previously mentioned issue with the BC Securities Commission. More on that story tomorrow.

Information for this briefing was found via Sedar, The CSE, The Ontario Cannabis Store, and Beleave Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.