As the Federal Reserve continues to pump trillions of dollars into the pandemic-ravaged US economy (albeit we still aren’t quite sure where all the dollars are going given that consumer confidence has yet to rebound six months into the coronavirus stimulus), many economists as well as basic economic theory postulate that soaring inflation will ensue very shortly.

However, the latest CPI figures released by the DOL show a rise of 0.4% for the month of August, and a mere 1.3% increase over the previous 12 months. So where is this much anticipated rise of inflation? Well, according to Harvard professor Albert Cavallo, the true cost of inflation is actually significantly higher than the DOL leads us to believe, with the pandemic-induced consumer expenditure patterns as the reason for the disparity.

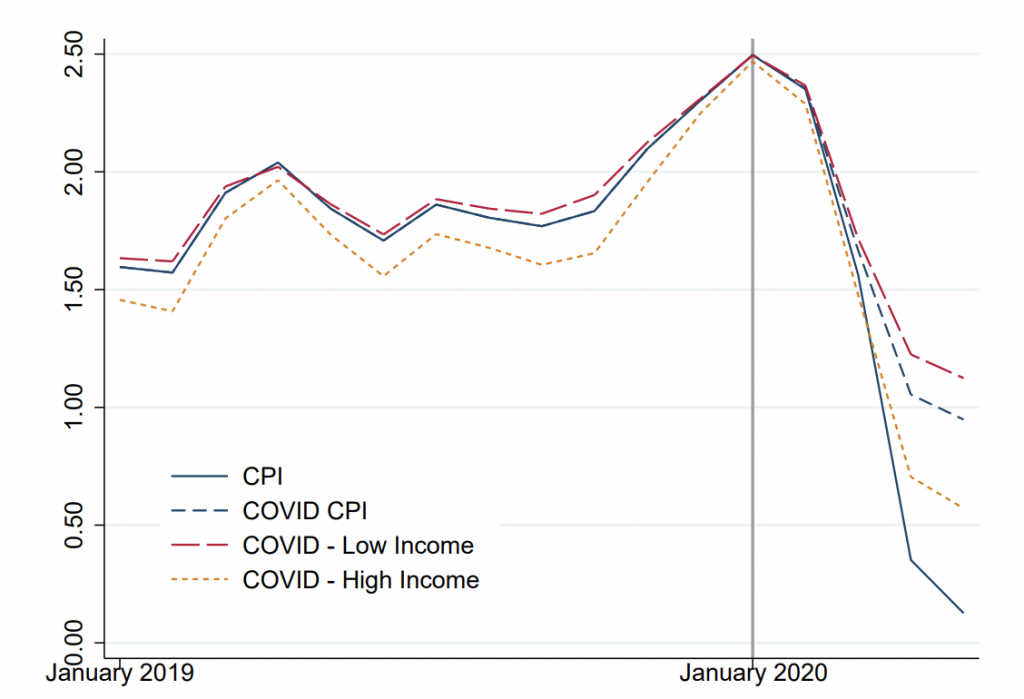

The measurement of inflation in the US has not been exposed to the sudden changes in consumer behaviour as a result of the pandemic. Instead of referring to the standard basket of goods that are used to calculate the CPI, Cavallo compiled data on consumer debit and credit transactions across the US, and came to a startling conclusion: contrary to what the DOL reports, the true cost of inflation in wake of the coronavirus pandemic sits at a alarming 1.85%, which is more than 40% higher than the widely accepted CPI figure.

Moreover, the Harvard professor also found that the cost of living for lower-income households is greater compared to the inflation experienced by those households in the higher income quintiles. He attributes this observation to the fact that spending on non-core products, which have been the subject of surging price increases, amounts to a greater percentage of the low-income household’s paycheck.

Cavallo attributes the disparity between his calculations and the DOL’s reported CPI figure to the evident pandemic-induced rapid changes in consumer behaviour that are being overlooked. He notes that social-distancing rules and infection prevention behaviours are pushing consumers to spend more on necessities that are experiencing a rise in inflation such as food, and less on other goods and services such as transportation, which are evidently the subject of a significant deflation.

The professor’s recent revelation brings into focus the real money question in all of this: what is it exactly that the CPI even measures? Given that it sure isn’t the changes to the true cost of living for many Americans. Despite the growing evidence for an ulterior pandemic-focused CPI figure, it is still unlikely that the Fed will pursue deeper calculations into the true cost of living, because that would require significantly less groupthink to determine the appropriate target for inflation. Nonetheless, as the pandemic continues to push the US economy into an even deeper pit of doom, the increasingly eroding American middle class will have to watch on by as their purchasing power dwindles away with each passing day.

Information for this briefing was found via the National Bureau of Economic Research and the DOL. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.