To the horror of markets, Fed Chairman Jerome Powell raised borrowing costs another 25 basis points, opting to salvage what confidence is left in the central bank and continue the fight against inflation rather than appease horrified banks whose deposits are in peril.

Jerome Powell just stopped by Wendy’s and ordered 5 Baconators.

— John W. Rich Kid (Wendy’s Fry Cook) (@JohnWRichKid) March 22, 2023

He seemed REALLY nervous and said something about a 75 bp rate hike.

Also his card got declined.

This is NOT good

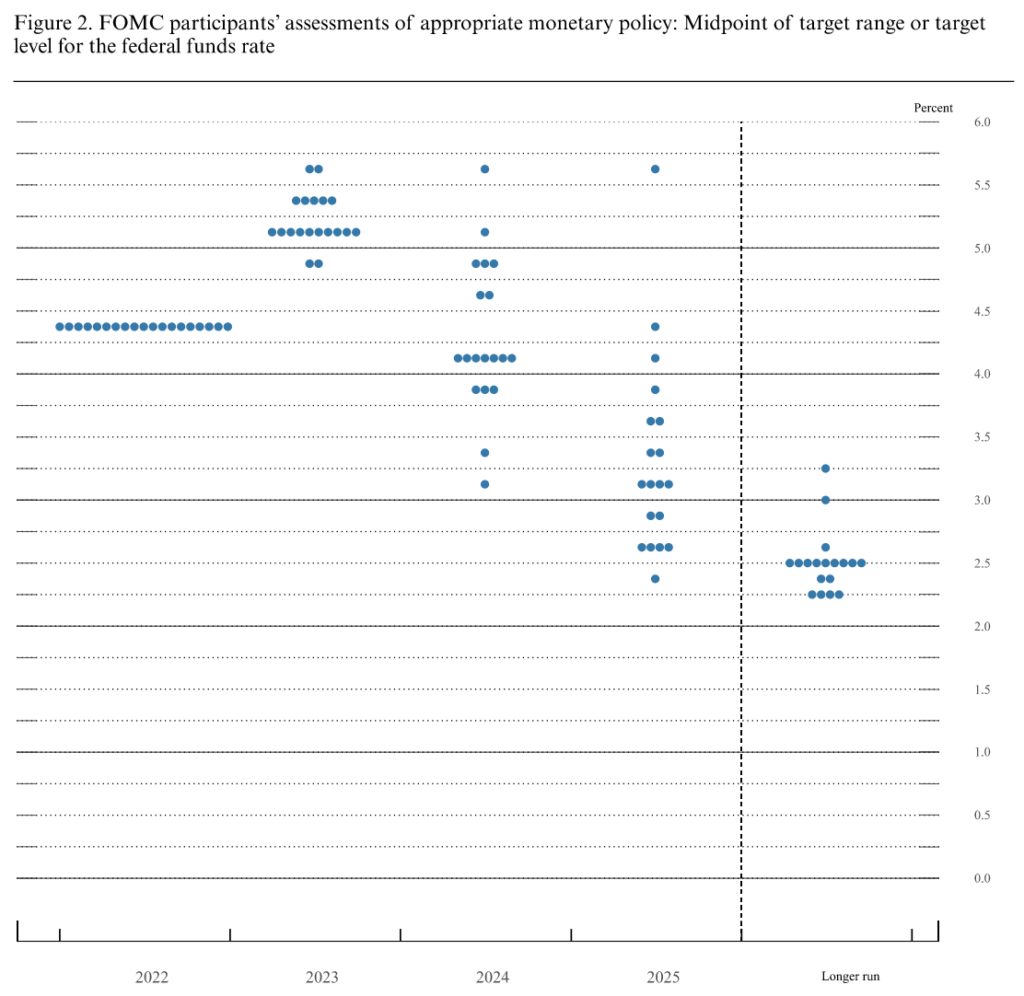

First and foremost assuring everyone that there’s nothing to worry about because the “US banking system is sound and resilient,” FOMC members unanimously decided to bring the federal funds rate to a range between 4.75% to 5%, all meanwhile acknowledging that the “extent of [such] effects is uncertain.” Going forward, FOMC projections suggest markets should brace for at least one more quarter percentage-point rate hike this year, followed by 75 basis-points-worth of rate cuts in 2024.

In the meantime, the Fed stressed it will maintain its current trajectory of quantitative tightening, adding that policy makers will “closely monitor incoming information and assess the implications for monetary policy.” However, “the Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

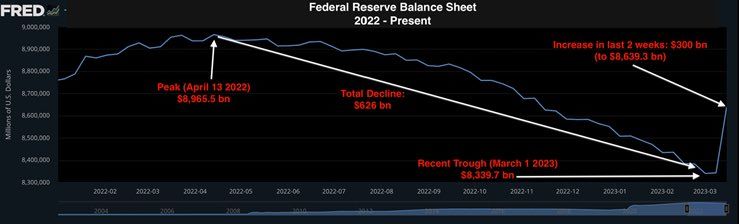

Odly, such a move is certainly confusing, given that the Fed just unwound months-worth of balance sheet reduction within the span of a weekend…

Information for this briefing was found via The Federal Reserve and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.