JPMorgan Chase & Co (NYSE: JPM) won the bidding war to acquire First Republic Bank (NYSE: FRC) in an emergency government-led intervention after private rescue efforts failed to fill a hole on the ailing lender’s balance sheet and customers withdrew their savings.

JPMorgan will acquire First Republic’s assets, which include around $173 billion in loans, $30 billion in securities, and $92 billion in deposits. JPMorgan and the Federal Deposit Insurance Corp. (FDIC), which oversaw the sale, agreed to share the risk of losses as well as potential recoveries on the firm’s single-family and commercial loans, the agency said in a statement early Monday.

To protect depositors, we entered into an agreement with JP Morgan Chase Bank to purchase and assume all deposits and assets of First Republic Bank. Read more ➡️ https://t.co/8KCKgJ2ZWR. pic.twitter.com/FRrIZk5aBY

— FDIC (@FDICgov) May 1, 2023

According to the FDIC, First Republic’s 84 branches in eight states will reopen as JPMorgan Chase Bank branches, and depositors will have full access to all of their deposits.

Regulators labored all weekend to find a solution before the U.S. stock market opened. Many markets around the world were closed Monday for the May 1 holiday. The two Asian markets that were open, Tokyo and Sydney, climbed.

Based on reports from multiple sources, the sale of First Republic Bank, $FRC, should have already happened.

— The Kobeissi Letter (@KobeissiLetter) May 1, 2023

However, futures opened and Asian markets are trading but no deal has been announced.

US markets open in 13 hours and the FDIC is completely silent.

What is happening?

“Our government invited us and others to step up, and we did,” JPMorgan chief executive officer Jamie Dimon said in a statement. “Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimize costs to the Deposit Insurance Fund.”

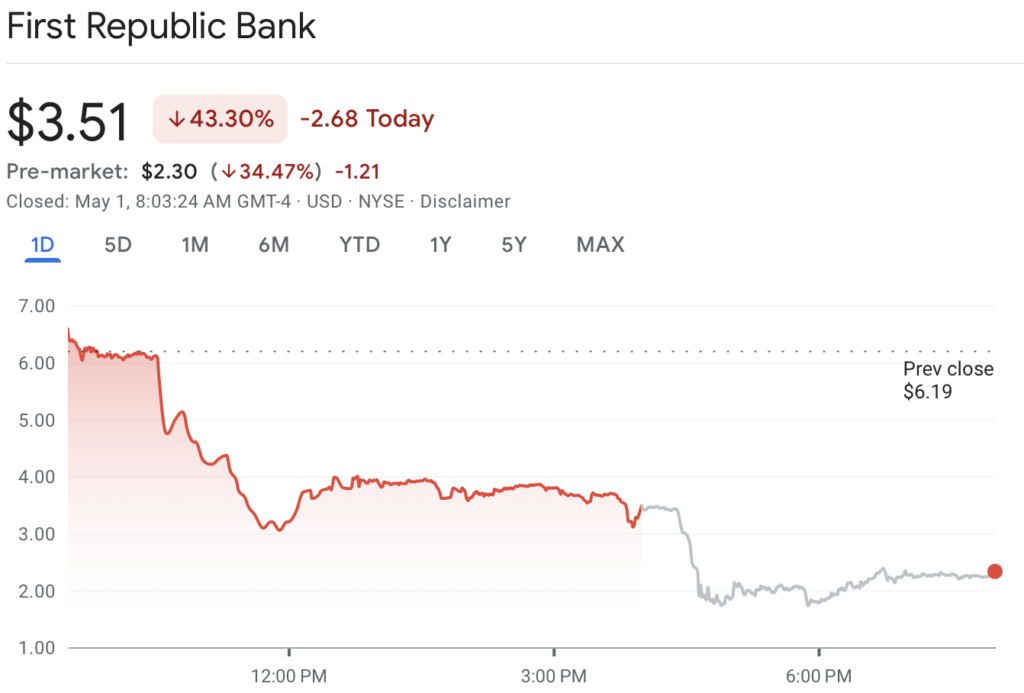

First Republic shares fell more than 34% in premarket trade in New York, extending the company’s 97% decline this year, before being halted for trading. JPMorgan’s stock increased by 3.1%.

According to a statement, JPMorgan expects to register a one-time gain of $2.6 billion as a result of the deal. Over the next 18 months, the bank expects to incur $2 billion in restructuring costs.

The $92 billion in deposits includes the $30 billion invested in the troubled lender by JPMorgan and other large US banks in March to try to stabilize its finances. JPMorgan promised to repay the $30 billion.

JPMorgan and the FDIC engaged into a loss-sharing arrangement to cover single-family residential mortgage loans and commercial loans, as well as $50 billion in five-year fixed-rate term financing, for the $173 billion in loans and $30 billion in securities included in the deal.

JPM FRC deal recap pic.twitter.com/FdE83I1ZWu

— zerohedge (@zerohedge) May 1, 2023

The acquisition comes after the FDIC was reportedly preparing to place First Republic into receivership imminently, with JPMorgan and PNC Financial Services (NYSE: PNC) reportedly bidding to buy the lender in a transaction that would reportedly follow a government seizure of First Republic.

"Regulators Prepare to Seize and Sell First Republic" Yep, @NYTimes is only one that's got this right. In other words, the auction was a bust. Bank will be seized, assets marked down to FV and sold at the curb. Look for mortgage rates to move up 50-100bp

— Richard Christopher Whalen (@rcwhalen) May 1, 2023

The FDIC and JPMorgan will split both the losses and any recoveries on the loans, with the agency stating that it should “maximize recoveries on the assets by keeping them in the private sector.” The cost to the deposit insurance fund is projected to be around $13 billion.

“We should acknowledge that bank failures are inevitable in a dynamic and innovative financial system,” Jonathan McKernan, a member of the FDIC board, said in a statement. “We should plan for those bank failures by focusing on strong capital requirements and an effective resolution framework as our best hope for eventually ending our country’s bailout culture that privatizes gains while socializing losses.”

Nailed it. Fun fact: the law containing the 10% limit has a specific exemption for "banks in default or in danger of default." Don't be afraid to do some of your own work every now and then. https://t.co/6c5pAAyr0P

— Keubiko🇺🇦 (@Keubiko) May 1, 2023

The acquired First Republic business will be led by Marianne Lake and Jennifer Piepszak, co-CEOs of JPMorgan’s consumer and community banking division.

As with other regional lenders, San Francisco-based First Republic found itself squeezed as the Federal Reserve raised interest rates to combat inflation, reducing the value of bonds and loans purchased when interest rates were low. Meanwhile, depositors fled, first in search of higher returns and then in fear as concerns about the First Republic’s health spread.

As a result, a capital hole was created large enough to dissuade a full-scale rescuer from stepping forward. The bank’s first-quarter report and news of its attempt to sell assets and organize a rescue sparked renewed alarm in April. The bank stated that it would lay off up to 25% of its workforce, reduce outstanding debts, and reduce non-essential activity.

… $19,427,488 USD assuming RBC is still holding the same number of shares.

— Silbergleit Junior (@SilbergleitJr) May 1, 2023

This goes to show that the equity wipeout of $FRC shareholders is not just California's problem. The effects of this major shareholder loss will be felt across North America including Canada.

On March 16, eleven US banks pledged $30 billion in new deposits to keep First Republic viable, with JPMorgan, Bank of America Corp., Citigroup Inc., and Wells Fargo & Co. each contributing $5 billion. As part of a strategy devised with US regulators, Goldman Sachs Group Inc., Morgan Stanley, and other institutions gave smaller sums. First Republic also used the Federal Home Loan Bank and a Federal Reserve liquidity line.

It was insufficient. The stock, which peaked at $170 in March 2022, had dropped below $5 by late April. The failure of First Republic would endanger not only common stockholders, but also around $3.6 billion in preferred stock and $800 million in unsecured notes.

Over the years, the bank has been bought and sold several times, with Merrill Lynch & Co. paying $1.8 billion to acquire First Republic in 2007. When Bank of America purchased Merrill Lynch in 2009, ownership changed hands again in mid-2010, when investment firms including General Atlantic and Colony Capital paid $1.86 billion for First Republic and then took it public.

Information for this briefing was found via Toronto Star, CBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.