Kerrisdale Capital Management, a renowned short seller, has released a scathing report on Tilray Brands (NASDAQ: TLRY), a Canadian cannabis company, outlining a litany of concerns regarding the company’s financial practices and prospects. In a detailed exposé, Kerrisdale accuses Tilray of engaging in a continuous cycle of dilution to sustain itself while making questionable acquisitions and inflating financial metrics.

“We are short shares of Tilray Brands, a $2.4bn failing Canadian cannabis player running a familiar playbook for unsuccessful businesses trading in the public markets: given structurally unprofitable operations, the company has resorted to ongoing, shameless and massive dilution to stay alive, even as management compensates itself generously while operating metrics further deteriorate,” Kerrisdale said in its report.

We're short $TLRY. Report avail at https://t.co/CF5saDZUXV. Tilray is a $2.4b mkt cap structurally unprofitable Canadian cannabis player diluting shareholders into oblivion (1/9)

— Kerrisdale Capital (@KerrisdaleCap) September 18, 2023

Following the release of the short report, Tilray’s shares plummeted by more than 6% as of this writing.

Kerrisdale’s report highlights that Tilray relies heavily on dilutive equity offerings to fund its operations and acquisitions, all while grappling with a lack of internal cash generation. The company’s dependence on maintaining its share price to avert the penny stock label is concerning for investors, especially given the deteriorating fundamentals of the Canadian cannabis industry.

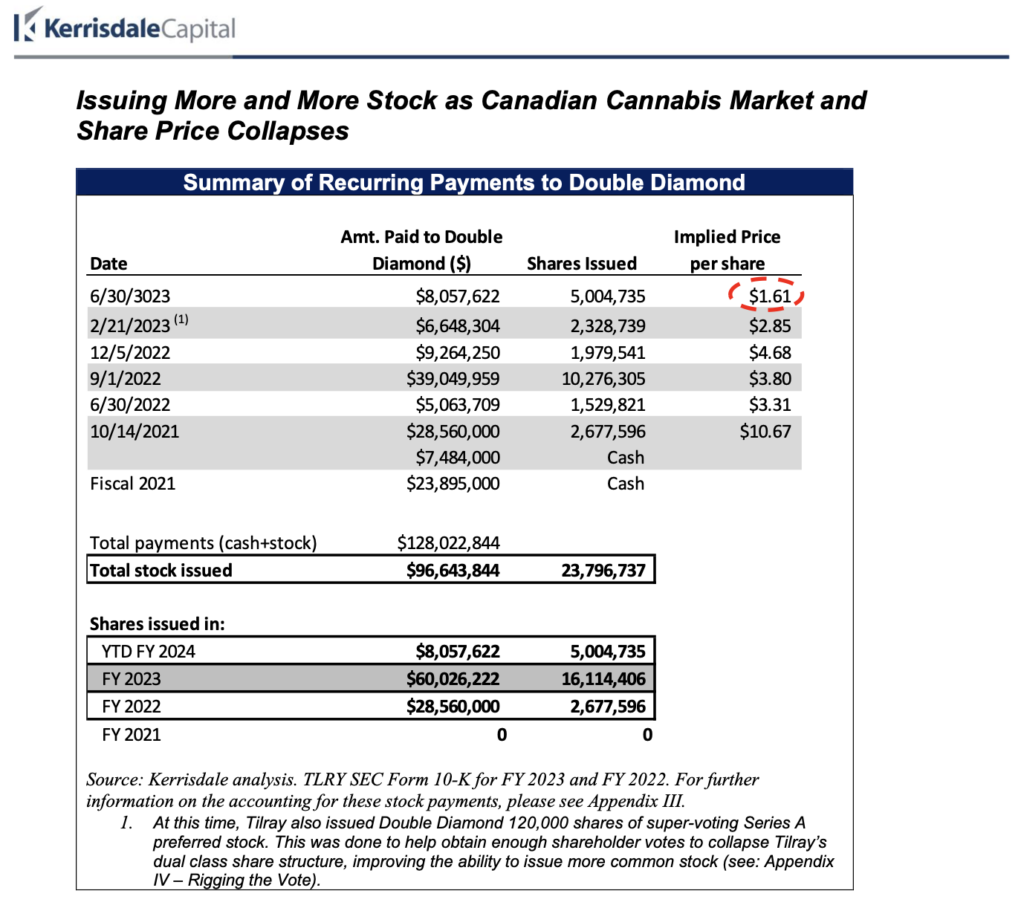

To illustrate this, the report exposes Tilray’s practice of compensating a key cannabis operating partner, Double Diamond Holdings, with increasing amounts of stock rather than cash payments, raising questions about the accuracy of reported EBITDA and free cash flow figures.

“What began as a single $24m cash payment in fiscal 2021 has grown into $100m in stock paid over the last two years. The most recent payment was in June, when Tilray issued shares at an implied price of only $1.61,” Kerrisdale explained.

Tilray’s use of stock payments to Double Diamond creates significant disclosure issues and distorts non-GAAP financial metrics, according to Kerrisdale. By adding back these non-cash payments to adjusted EBITDA and excluding them from the definition of free cash flow, Tilray portrays a stronger financial profile than it would without this practice. The report alleges that without these accounting maneuvers, Tilray’s EBITDA would have been zero last year, and its free cash flow would have been deeply negative.

In a deliberately convoluted process, $TLRY receives a bill from the weed grower, issues stock to settle it (at implied prices as low as $1.61/shr in June) and then registers those shares for resale on the open mkt – all on the exact same day (5/9)

— Kerrisdale Capital (@KerrisdaleCap) September 18, 2023

Tilray’s recent surge in stock price following hopes of marijuana rescheduling by the DEA is described by Kerrisdale as a misunderstanding of potential benefits. The report clarifies that rescheduling would only legalize the sale of marijuana-based FDA-approved drugs in specific forms, not recreational products, and emphasizes that none of the touted financial benefits would significantly aid Tilray due to its lack of significant U.S. cannabis operations.

Furthermore, rescheduling could potentially strengthen Tilray’s competitors and divert political attention away from policies that would allow the company to sell recreational products in the U.S.

“Schedule 3 does nothing to help Tilray sell recreational products or THC infused drinks. None of the financial benefits of rescheduling – tax savings, exchange uplisting, progress on SAFE Banking – help $TLRY, they only help Tilray’s potential US competitors,” Kerrisdale posted on X (fka Twitter).

Schedule 3 does nothing to help Tilray sell recreational products or THC infused drinks. None of the financial benefits of rescheduling – tax savings, exchange uplisting, progress on SAFE Banking – help $TLRY, they only help Tilray’s potential US competitors. (3/9)

— Kerrisdale Capital (@KerrisdaleCap) September 18, 2023

Tilray’s acquisition of craft beer brands from Anheuser-Busch is also criticized by Kerrisdale for lacking strategic clarity. The report notes a decline in retail sales for the acquired portfolio, with one of the largest brands, Shock Top, experiencing a precipitous drop in sales.

“Investors cheered the move, but they might not have if management had disclosed that retail sales for key brands have declined over 20% YTD and the portfolio has only 10-15% EBITDA margins,” Kerrisdale added.

Tilray’s craft beer strategy is a joke. Retail sales for recently acquired brands from $BUD are in steep decline. ShockTop and Bluepoint are both down over -20% YTD and according to $BUD ex-employees the group has only 10-15% EBITDA margins, well below beer industry peers. (7/9)

— Kerrisdale Capital (@KerrisdaleCap) September 18, 2023

While Tilray has mentioned plans to use this acquisition to enter the THC-infused non-alcoholic beverage market, Kerrisdale raises concerns about the viability of this strategy, given the need for substantial marketing and distribution investment.

Even before the recent rescheduling speculation, Tilray’s valuation was described as “silly” by Kerrisdale. With shares trading at 36 times EBITDA and over three times revenue for businesses showing signs of stagnation or decline, the report suggests that the company is vastly overvalued.

Additionally, the report predicts that Tilray may soon need to refinance $127 million in convertible notes, which could trigger substantial dilution for shareholders, as seen in the May refinancing that resulted in a 30% share price decline.

Once buzz over declining craft beers, heavily manipulated earnings, and misunderstood rescheduling benefits wears off, investors will realize $TLRY shares, trading at 40x phony EBITDA, are worth far less than the current price. Our price target is $0.90 (9/9)

— Kerrisdale Capital (@KerrisdaleCap) September 18, 2023

Information for this briefing was found via and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.