Krispy Kreme, Inc. (Nasdaq: DNUT) reported today its Q4 and full-year fiscal 2021 financial results ended January 2, 2022. The firm earned a quarterly revenue of US$370.6 million, up from Q3 2021’s US$342.8 million and also a 13.8% increase year-on-year according to the company.

The quarterly revenue also exceeded the revenue estimate for the firm at US$363.0 million. CEO Mike Tattersfield said that the financial results “demonstrate the benefits of [its] omni-channel model and global expansion strategy.”

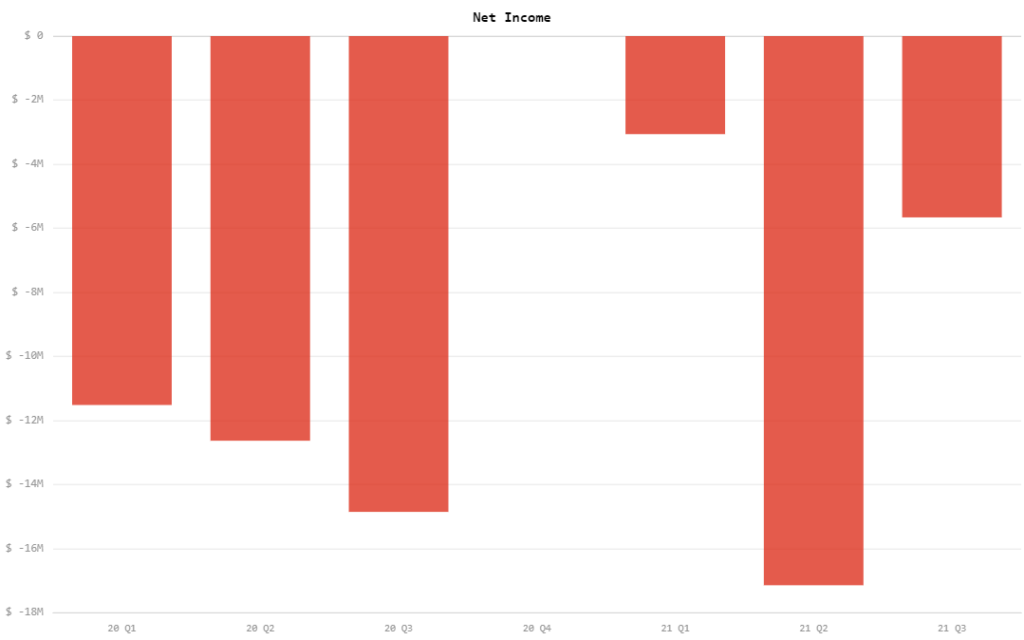

This is also the first quarter in the year that the company recorded a net income, at US$4.3 million. This compares to last quarter’s net loss of US$3.8 million and last year’s loss of US$24.8 million.

The quarterly net income translates to US$0.01 earnings per share, while adjusted EPS came in at US$0.08 per share. This missed the consensus estimate of US$0.09 earnings per share.

Adjusted EBITDA for the quarter ended at US$47.7 million, a 14.4% increase from the year-ago period, according to the company.

In an interview with CNBC’s Squawk Box, Tattersfield said that the company took “9% pricing across the globe.” Recognizing that the consumers are willing to pay a premium for the freshness of their products, he said that the company is exploring looking at the channels of “premiumization,” possibly with a premium price model of two times the average prices.

"We do have pricing power which is really important. We did take 9% pricing across the globe," says @krispykreme CEO Mike Tattersfield $DNUT. "The consumer really values fresh as their clear number one attribute so you are able to take price there." pic.twitter.com/8Ob1RuW8tM

— Squawk Box (@SquawkCNBC) February 22, 2022

For 2021, the company earned US$1.38 billion in revenue, a 23.4% increase from 2020. Annual net loss came in at US$14.8 million compared to last year’s loss of US$60.9 million, while loss per share for the year ended at US$0.18.

As of the end of the fiscal year, the donut brand had US$38.6 million in cash and cash equivalents and total net debt of US$682.2 million.

In 2022, the company estimates to generate net revenue of US$1.53 – US$1.56 billion, adjusted EBITDA of US$210 – US$218 million, and EPS of US$0.38 – US$0.41.

Krispy Kreme last traded at US$13.74 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.