The electric vehicle (EV) battery business is likely to capture significant investor attention over the next month as the world’s second largest battery maker, LG Energy Solution, plans to raise nearly US$11 billion via an IPO on the South Korean stock market in January 2022. LG Energy Solution’s parent, LG Chem, plans to sell 42.5 million shares to the public, which would equate to about a 20% stake in LG Energy Solution.

If successful, LG Energy would have a market value of nearly US$60 billion. According to SNE Research, over the first nine months of 2021, the company had a 23.8% share of the world’s EV battery market, second only to the 31.2% share by China’s Contemporary Amperex Technology Co. (CATL). CATL has a stock market value of around US$230 billion, making it the second largest listed company in mainland China. It trades at an extremely lofty enterprise value-to-EBITDA ratio of around 80x.

By comparison, LG Energy’s IPO valuation is expected to be set at an enterprise value-to-EBITDA multiple of about 33x, a sharp discount to CATL’s, but still a very robust figure. Note that LG Energy is likely to trade at this valuation despite its involvement in the high-profile battery fires and recall action of General Motor’s Chevy Bolt EV model this summer and early fall. LG Energy made the Bolt’s battery and has agreed to pay almost the entire cost of the recall – US$1.9 billion of the total US$2.0 billion cost.

Given these valuation statistics, investors may want to consider a lower-risk EV battery sector play, at least on a short-term basis, to participate in the potential upbeat (euphoric?) sentiment. One such selection could be Solid Power, Inc. (NASDAQ: SLDP), a developer of solid-state EV batteries. Solid Power is the product of a merger with SPAC sponsor Decarbonization Plus Acquisition Corporation III, which closed on December 7.

(As an aside, investors may contemplate participating in the LG Energy Solutions IPO, at least for a trade, if they can access shares in the IPO. The valuation difference between it and CATL looks to be too large for fairly comparable companies.)

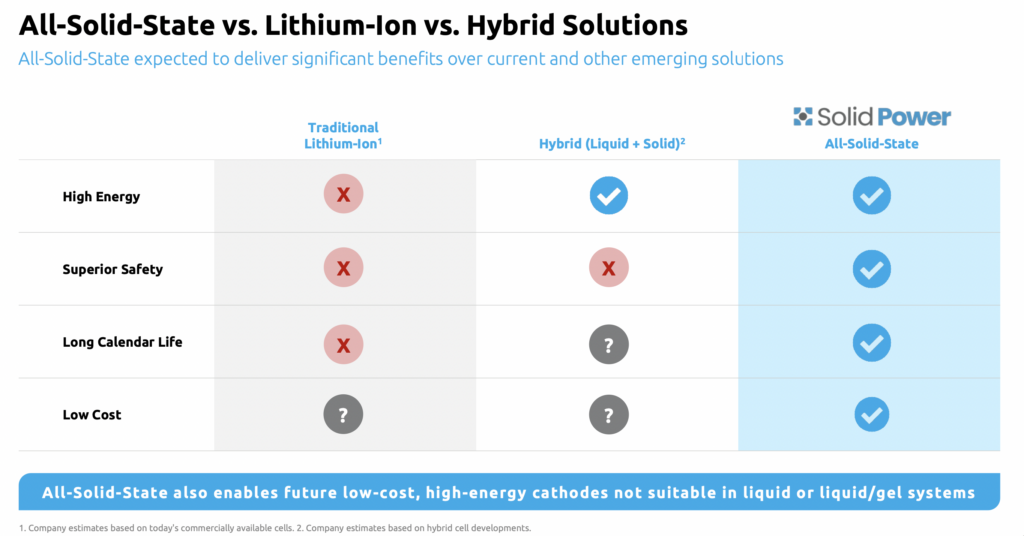

Solid Power is creating a battery which replaces the flammable liquid electrolyte in a conventional lithium-ion battery with a sulfide-based solid electrolyte. An electrolyte is the medium between the cathode and anode of a battery which allows an electrical charge to pass between the two terminals. If they can be manufactured at scale, solid state batteries may be safer, more stable across a broad temperature range, and possess a higher energy density than conventional batteries.

Solid Power has about 184.3 million shares outstanding, making its stock market value around US$2.6 billion. Both Ford Motor Company and BMW are investors in Solid Power, and presumably will eventually be buyers of their technology. A comparable battery company, QuantumScape Corporation (NYSE: QS), which is developing solid-state lithium-metal batteries, and which boasts Volkswagen as an investor, has a stock market capitalization of more than US$10 billion.

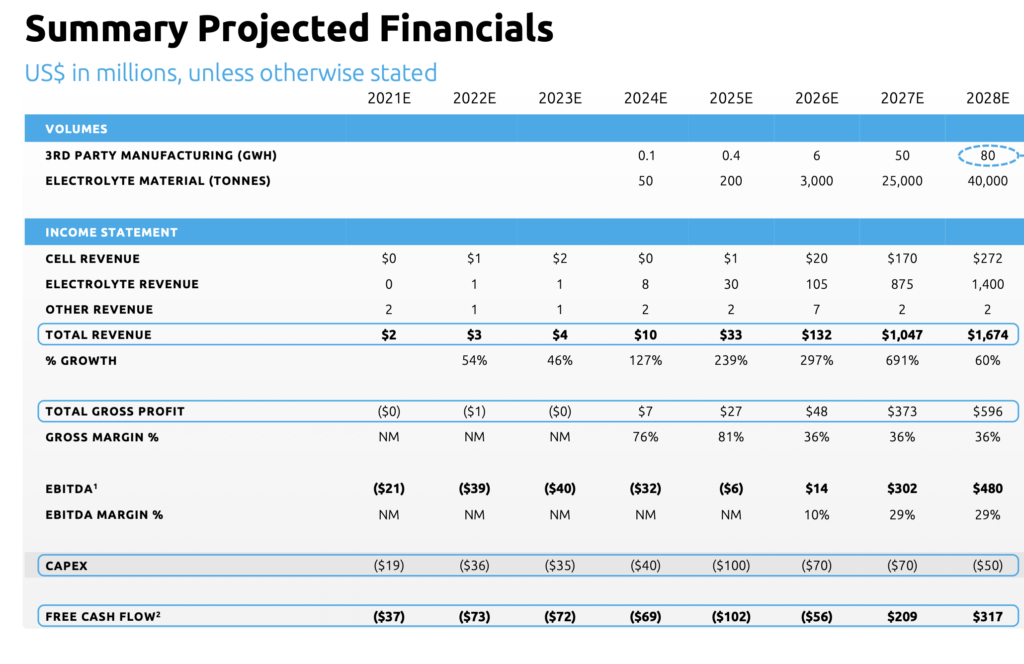

Like many EV-related companies (and EV-related SPACs), Solid Power does not expect to generate significant revenue or cash flow for many years. In its case, Solid Power hopes to record revenue and EBITDA of more than US$1 billion and US$300 million, respectively, in 2027, up from just US$3 million and a loss of US$39 million, respectively, in 2022.

If the high-risk sector of the stock market were to correct significantly as it did in the first few trading days after the Omicron variant was discovered, Solid Power and indeed all speculative EV-related stocks would likely lose value – regardless of its long-term potential.

The next month could be characterized by bullish sentiment toward the EV battery sector as the LG Energy Solutions IPO garners media headlines. Under such conditions, an investment in a relatively discounted EV battery company like Solid Power could potentially yield short-term returns.

Solid Power, Inc. last traded at US$11.52 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.