Fitch Ratings issued a stark warning, highlighting that the incoming Liberal government’s fiscal platform poses a material risk to Canada’s AA+ credit rating, citing sharply widening deficits and structurally higher spending under Prime Minister Mark Carney’s leadership.

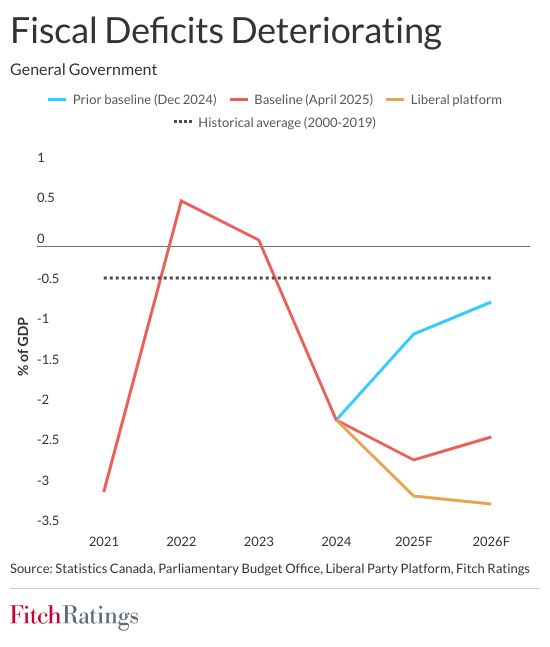

Fitch revised its 2025 and 2026 deficit estimates upward by 0.4 and 0.8 percentage points of GDP, respectively, should the Liberal platform be implemented in full. This would push the 2025 deficit to 3.1% of GDP and 2026 to 3.2%—levels that approach pandemic-era deterioration and far exceed the pre-COVID historical average of a modest 0.4% deficit. By contrast, the prior December 2024 baseline forecasted deficits of 1.1% and 0.7% of GDP for 2025 and 2026, respectively.

When I read the Liberal platform, I said that it put Canada’s AAA credit rating at risk.

— Jean Philippe Fournier (@JeanPFournier) April 30, 2025

Turns out I was right.

Fitch, a ratings agency, sent out a warning a few hours ago saying that Carney’s plan is a risk to Canada’s AAA credit rating.

I didn’t necessarily want to be right,…

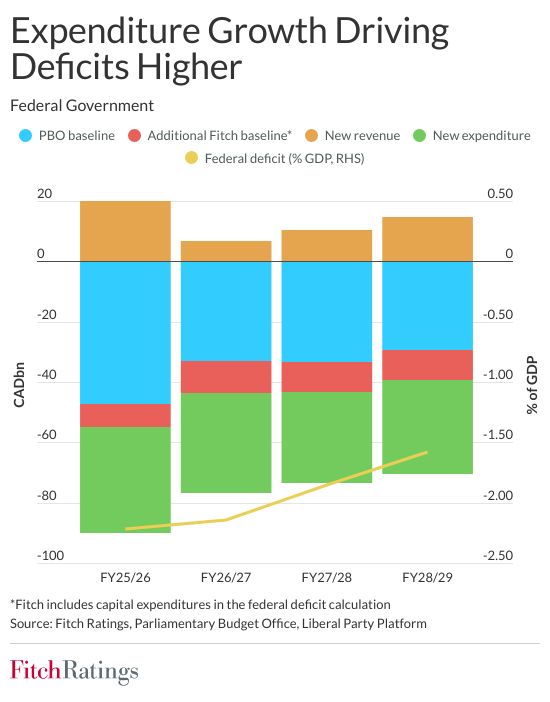

“The Liberals’ proposed $35 billion in new spending for FY25 and $33 billion for FY26 could drive federal deficits to 2.2% and 2.1% of GDP, respectively, even under optimistic revenue assumptions,” Fitch noted.

Spending, not revenues, is the primary driver of the projected deterioration. As shown in Fitch’s expenditure breakdown, over $80 billion in new outlays from FY25 to FY29 are only partially offset by revenue increases. In FY26 alone, only 20% of new expenditures are expected to be covered by additional revenues—most of which are reliant on uncertain savings from productivity gains and speculative retaliatory tariffs.

As a result, gross general government debt—including all federal, provincial, and local liabilities—is expected to exceed 90% of GDP in 2025. This marks a sharp deviation from the pre-pandemic level of 82% and towers over the ‘AA’ median of 50.6%.

While the Liberal platform includes commitments to lower the debt-to-GDP ratio over time, Fitch flagged that “economic weakness and prior fiscal loosening have already shifted the trajectory upward.”

The risks extend beyond the federal budget. Fitch cautioned that additional stimulus from provincial and municipal governments, combined with falling asset prices that could erode pension fund surpluses, may further widen consolidated deficits.

Fitch’s baseline sees real GDP growth of just 0.1% in 2025.

While Carney’s platform may evolve in minority parliament negotiations, Fitch emphasized that “further fiscal loosening seems inevitable.”

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Days after the election, we already see strike one against the new Liberal government.