Lifezone Metals (NYSE: LZM) has released the results of a feasibility study conducted on their flagship Kabanga Nickel project, which is found in northwestern Tanzania. The study is based on an initial development phase for the projct, which would feature a 3.4 million tonne per annum underground mine, mill, concentrator, tailings facility, and related infrastructure.

The estimate has outlined a $1.58 billion after-tax net present value for the project, alongside a 23.3% after-tax IRR and a payback period of 4.5 years. The estimate is based on $8.49 per pound nickel, and uses a discount rate of 8%.

That net present value figure is based on a proposed operation with an 18 year mine life, which would see steady state production of 3.4 million tonnes per annum, which over the life of mine would produce 902,000 tonnes of nickel, 134,000 tonnes of copper, and 69,000 tonnes of cobalt. On average, this is expected to translate to 350,000 tonnes per year of nickel-copper-cobalt flotation concentrate, with 17.7% nickel.

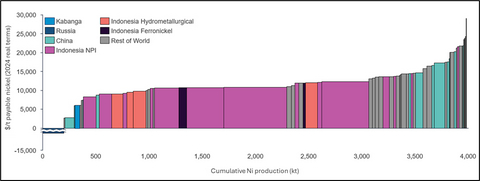

Those tonnes are expected to be produced at a cash cost of $2.90 per pound of payable nickel, before by-product credits, which translates to an all in sustaining cost of $4.48 per pound over the life of mine. After copper and cobalt by-product credits are factored in, the all in sustaining cost is expected to drop to $3.36 per pound.

Pre-production capital expenditures are estimated at $942 million, while capitalized operating expenditures total $168 million, and growth capital expenditures are estimated at $42 million. Sustaining capital over the life of mine, including closure costs, are estimated at $1.34 billion, bringing total capital costs for the project to $2.49 billion.

The study is based on proven and probable reserves of 43.9 million tonnes, containing 1.98% nickel, 0.27% copper, and 0.15% cobalt, with expected recoveries are 87.3% nickel, 95.6% copper and 89.6% cobalt.

Moving forward, Lifezone is said to now be focused on progressing the final technical and commercial workstreams required before a final investment decision is made. The company separately this morning announced that it has acquired BHP’s 17% interest in the project, bringing Lifezone’s ownership interest in the project to 84%, with the remainder owned by the Government of Tanzania.

The company acquired the interest for a $10 million cash payment, which is to be made within the earlier of 12 months after a final investment decision has been made, or Lifezone raising $250 million. That payment is to be followed by a second cash payment to be made after 12 months of production, which is indexed to Lifezone’s share price.

Lifezone Metals last traded at $4.47 on the NYSE.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.