It isn’t known which financial poet came up with the beautifully impossible term “liquidity crunch,” or if they were acting with intent, but the most perfect metaphor in finance is certainly having its day in the sun. This desk anticipates that it will be thrown around a lot more very soon, and that’s a fine excuse to have a closer look.

Liquidity, in an investing and finance context, is the ability of an institution, usually a bank, to meet its withdraw demands with stable, legal tender-currency. True liquidity means depositors’ demands are met with flowing, “liquid,” cash money. The process only makes a “crunch” sound when the assets available to service the withdraws aren’t liquid at all.

Institutions that find themselves in that position have two basic moves. They can either stop meeting withdraw demands, or get some liquid cash on board. They often borrow the cash from another institution before the crunch sound ever happens but, if they get to the point where withdraws have to be suspended, then the borrowing boat has usually sailed.

From there, it can either sell some assets to free up cash, or sell some of its own equity to raise cash. If it can’t manage to do either of those things, because the assets aren’t worth what it owes, and anyone capable of making the investment in the equity can see as much, then the problem is no longer equity. It’s solvency.

The equally beautiful solvency metaphor describes a situation where no amount of liquid cash will matter. The assets of this institution will not dissolve. The chunks in the slurry won’t be able to flow through the banking system as fluid, acceptable currency. Insolvent institutions are effectively aborted, calcified messes that have their remaining drops of liquidity bled off by creditors in some kind of bankruptcy proceeding.

Solvency problems are much worse than liquidity problems, as Bloomberg‘s Matt Levine explained recently in the context of the ongoing FTX liquidity crunch that rapidly became a large, complicated, globalized insolvency. Since the liabilities of financial institutions are often the assets of other financial institutions, big insolvencies like that tend to make everyone nervous. The investments that the Ontario Teachers’ Pension Plan, Blackrock, Sequoia, etc. made in FTX and Alameda are long gone, and any investment that any institution was using FTX to trade is at the very least no longer available to that institution as a potential source of liquidity, and probably also long gone.

When these things get big enough, they have a habit of getting contagious. A sort of head-of-Medusa situation where everyone associated turns to stone, freezing up the formerly liquid investments and deposits they’d all made in each other. So the press that was formerly occupied with the rising value of FTX’s equity in the bold, new crypto frontier, and the remarkable way its founder was able to legitimize and harness modern fintech alchemy, has now turned its attention to figuring out which other institutions were foolish enough to get wrapped up in this over-shilled magic bean factory.

And that’s taken a lot of heat off Romspen.

Mortgage lenders starting to look a little dry…

After reporting on the opaque and obviously fraudulent Bridging Finance, and the rolling FTX mess, the problems of Romspen Investment Corp. are refreshingly straightforward. The mortgage lender is in the business of taking deposits from investors, lending that money to property developers at a high rate of interest, and using the proceeds to pay its investors an also-high yield on their investments, in the form of monthly distributions.

Romspen had been at it a long time. Its flagship mortgage investment fund paid out annual returns of at least 7.2%, and as high as 10.6% every year since 1997. It isn’t publicly listed, but publishes quarterly and annual reports for its $3 billion Mortgage Investment Fund, and its $490 million US Mortgage Investment Fund, but not for its $541 million US Mortgage investment Trust, which only just started in July of 2022.

The financials show two perfectly successful yield-generating investment funds that were good and liquid until October, when it took steps to defer redemptions, before going full-crunch, and freezing them entirely November 8th. Romspen claims that its funds are the high-yield investment choice of high net worth individuals, foundations, endowments, and pension plans… and they probably are.

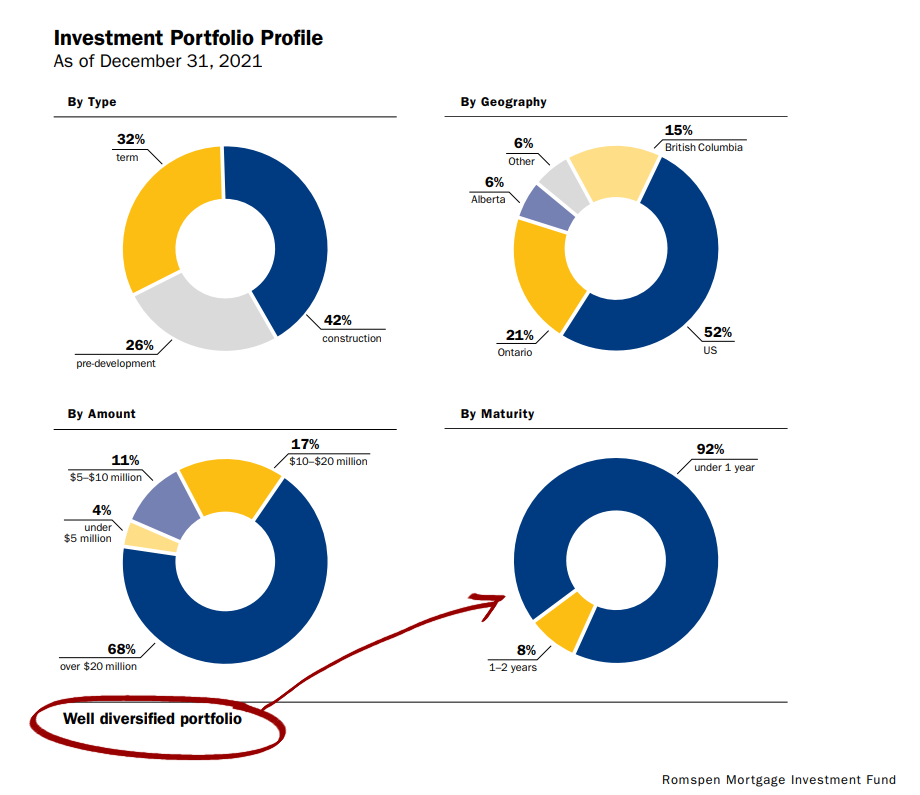

Whether Romspen’s liquidity problems, and the solvency issues that they might become, could spread to its institutional investors will all depend on how these institutions were able to limit their exposure to mortgage lending by diversifying their portfolios, which was something that Romspen claimed to do, but the devil is in the details.

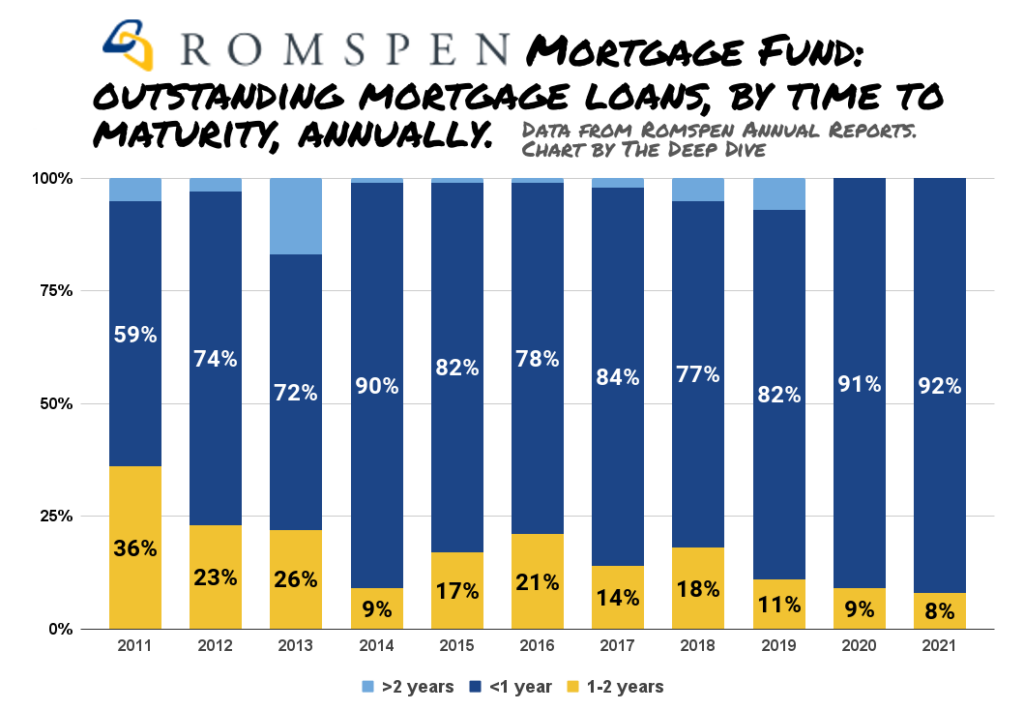

The 2021 annual report informs us that 90% of Romspen’s mortgages were to mature in less than one year. All of them matured within two years. The fund has carried that sort of maturity mix for at least ten years.

Explaining why made perfect sense in a 2014, 2016, or 2020 context. Romspen is lending against projects that don’t generate any income. The borrowers will develop the project, then sell it, or borrow against it at a higher valuation, to pay back the principal and interest.

But when we explain it in a 2022 context, it sounds more like: “Romspen is lending against projects that don’t generate any income! The borrowers aren’t going to pay back the principal and interest until they can develop the project, then sell it, or borrow against it at a higher valuation!“

This is an environment of rising interest rates, and falling housing prices. The real estate trade is off, and the days when Romspen could lend $40 million to a developer, get back $5 million in interest payments a year later, and roll the $40 million into a new $60 million loan against a now-more-developed project, to a developer that has investors lining up for the pre-sales are over.

Today, with house prices dropping like a rock, and mortgage rates climbing just as quickly, nobody has the liquidity or the mandate to stick their neck out on a loan for a work-in-progress that generates no income, on the prayer that borrowers will be able to build something that gets them their money back.

Well… almost nobody.

Information for this briefing was found via the CMHC, Romspen Investments, FTX, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.