On Tuesday, Lithium Americas Corp. (TSX: LAC) made two significant and interconnected announcements related to its Thacker Pass lithium project in the U.S. state of Nevada.

First, General Motors (NYSE: GM) agreed to invest US$650 million in Lithium Americas in a two-stage transaction conditioned on a constructive federal court ruling on the venture. In exchange, GM would have exclusive access to Thacker Pass’ Phase 1 lithium carbonate output and a right of first refusal on Phase 2 production. The price GM would pay for the commodity would be based on a formula linked to market prices.

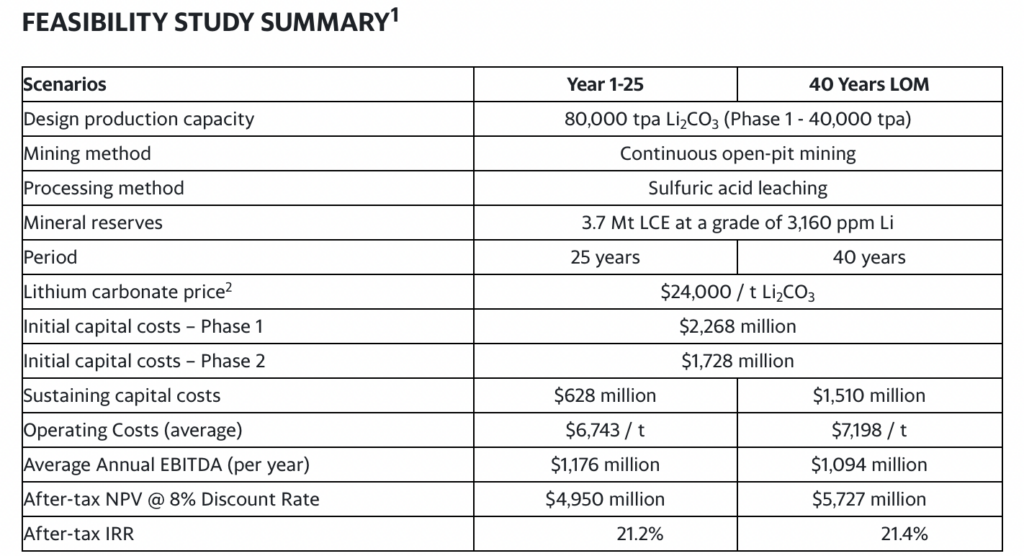

Second, Lithium Americas released a constructive feasibility study which concluded that when the project is fully operational, it could generate average EBITDA of more than US$1 billion annually for forty years based on conservative commodity prices. Lithium Americas owns a 100% stake in Thacker Pass. The property may have sufficient resources to produce 67,000 tonnes of battery-grade lithium carbonate per year for 40 years.

The January 31 announcements increase Lithium Americas’ upside potential, but the GM transaction hinges on a positive decision from the U.S. District Court of the District of Nevada (and on constructive potential further court rulings if complainants were to appeal that decision). Chief Judge Miranda Du is expected to rule within the next few months on the merits of various environmental groups’ contentions that the U.S. Bureau of Land Management erred when it approved Thacker Pass construction in January 2021.

Oral arguments were held on the case on January 5, 2023.

Read: Lithium Americas: Federal Ruling On Thacker Pass Expected As Early As March

Under the GM agreement, the car maker will acquire 15.0 million shares of Lithium Americas at a price of US$21.34 per share, for a total of US$320 million, in the first tranche of the US$650 million investment. The US$320 million of funds will be held in escrow until a positive court decision is rendered and a water rights transfer ruling is obtained. The second tranche meanwhile will be issued pending the previously announced separation of Lithium America’s Argentina and US-based operations – implying that GM wants at least some level of investment in the Argentina operation as well.

According to the feasibility study, Thacker has an after-tax net present value of more than US$5 billion assuming an 8% discount rate and a lithium carbonate price of US$24,000 per tonne. Current lithium carbonate prices are about US$70,000 per tonne, or three times that level.

The Argentina Aspect

While Thacker Pass is important, Lithium Americas’ valuation is much more tied to its key asset — the flagship Cauchari-Olaroz lithium brine project in Argentina. Lithium Americas expects lithium carbonate production to begin at the site in the first half of this year.

READ: Lithium Americas To Split Into Two Firms To Unlock Shareholder Value

Lithium Americas owns 49% of Cauchari and China’s largest lithium company, Ganfeng Lithium, owns the balance or 51%. Lithium Americas will operate the mine. Offtake agreements at market prices are in place for over 80% of Cauchari’s planned Stage 1 production. Based on Cauchari’s own feasibility study (released in September 2020) and adjusting for current, much higher lithium carbonate prices, Cauchari’s annual cash flow could potentially be multiples of US$300 million.

Lithium Americas Corp. last traded at $32.57 on the TSX Exchange.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.