FULL DISCLOSURE: This is sponsored content for Lithium Chile.

Lithium Chile (TSXV: LITH) has completed a pre-feasibility study on its flagship Arizaro Project in Argentina, which outlines a pre-tax net present value (8% discount) of US$3.85 billion.

The massive figure is based on a mine that would produce 25,000 tonnes of battery grade lithium carbonate per year over a 20 year period using direct lithium extraction, or DLE, technology. The use of DLE technology is said to place the project as a leading contender in the race for sustainable lithium production.

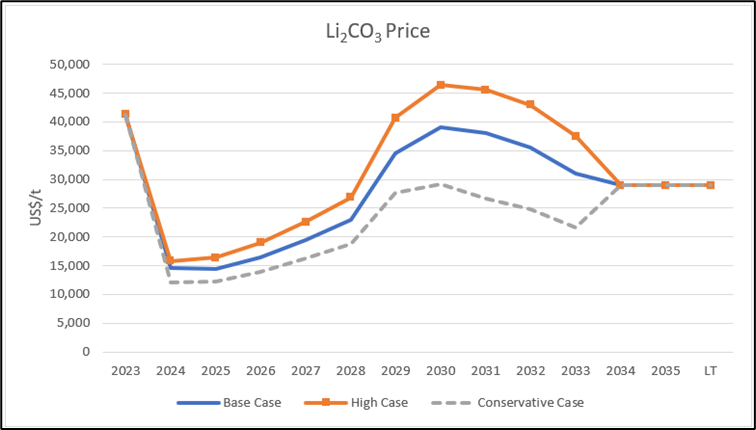

On a post-tax basis, the Arizaro project is estimated to have an NPV(8%) of US$2.83 billion and IRR of 36.3%, based on an average price of US$30,513 for lithium carbonate. The payback period is estimated at 2.7 years, with initial capital costs estimated at US$1.06 billion, while operating costs are estimated to be US$5,457 per tonne of LCE.

“The PFS confirms our initial confidence in the exceptional potential of the Arizaro Project, outlining a clear pathway to large-scale, cost-competitive lithium carbonate production. This achievement is a testament to the unwavering dedication and expertise of our Argentinian team, who have been instrumental in rapidly advancing the project,” commented Steve Cochrane, CEO of Lithium Chile.

READ: Lithium Chile Prepares To Spinout Gold, Lithium Assets In Chile

The study also established a reserve estimate for the Arizaro project, with the project now boasting probable miner reserves of 490,000 tonnes LCE at 273 mg/L lithium. Measured resources are estimated at 261,000 tonnes of LCE, while indicated resources come in at 2.24 million tonnes LCE, and inferred resources sit at 1.62 million tonnes LCE.

Lithium Chile last traded at $0.67 on the TSX Venture.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.