FULL DISCLOSURE: This is sponsored content for LNG Energy Group.

LNG Energy Group (TSXV: LNGE) posted a strong start to its time as a public issuer this morning, reporting net income of $18.5 million in its third quarter financial results.

While the results are for the three and nine months ended September 30, LNG Energy on August 15 completed the acquisition of Lewis Energy Columbia, with the financial and operational results being measured from this date through to the end of the quarter.

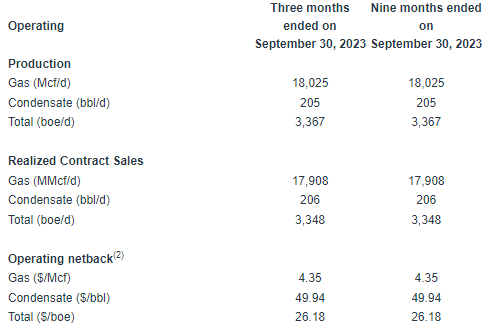

Revenue, net of royalties, for the quarter amounted to $4.0 million, driven by production before royalties of 18,025 Mcf/d natural gas and 205 bbl/d condensate, or 3,142 boe/d. Realized sales volumes meanwhile amounted to 17,908 Mcf/d and 206 bbl/d condensate.

READ: LNG Energy Sees Natural Gas Production Of 19.2 MMcfe/d in August

Operating netbacks meanwhile amounted to $4.35/Mcf natural gas and $49.94/bbl condensate.

Total expenses for the quarter came in at negative $14.4 million, as a result of a $24.4 million gain on acquisition, and leading to a net income of $18.5 million. Adjusted EBITADX amounted to $2.3 million for the quarter, while cash flow from operations came in at $0.2 million.

READ: LNG Energy Secures US$13.3 Million Of Non-Dilutive Capital

The company closed the quarter with total assets of $229.6 million, including $11.4 million in cash and cash equivalents, and total liabilities of $175.0 million.

Going forward, LNG has said that for the remainder of the year it is focused on the drilling and completion of the Bullerengue West #5 well, completing the 2023 well workover campaign, the repayment of debt and strengthening of its capital and liquidity, and strengthening its ESG initiatives.

LNG Energy last traded at $0.39 on the TSX Venture.

FULL DISCLOSURE: LNG Energy Group is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of LNG Energy Group. The author has been compensated to cover LNG Energy Group on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.