Luca Mining (TSXV: LUCA) has achieved commercial production at its new Tahuehueto operation, with the mine operating at a throughput rate of 800 tonnes per day. The achievement has resulted in the first guidance being released by the company for 2025’s performance.

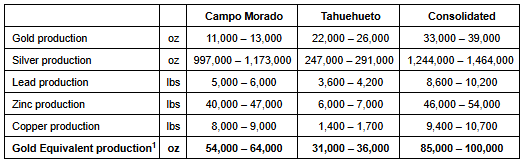

Luca in 2025 is expecting to produce 85,000 to 100,000 gold equivalent ounces between its two operating mines. Campo Marado is expected to produce between 54,000 and 64,000 gold equivalent ounces this year, while Tahuehueto will produce 31,000 to 36,000 gold equivalent ounces.

Payable ounces meanwhile are slated to range between 65,000 and 80,000.

In terms of capital expenditures, $23.5 million has been allocated to sustaining capital across both operations, while $3.9 million has been allocated to exploration expenditures. Planned exploration this year includes a 5,000 metre drill program at Campo Morado, which intends to expand the current mineral resources at the mine. A 5,000 metre drill program is also planned for Tahuehueto, which is targeting resource expansion and mine life extension.

Free cash flow before working capital adjustments is forecasted to be between $30 and $40 million, with Luca indicating it will use that free cash flow to pay down debt, with the goal of eliminating all debt by July 2026.

“With two operating mines generating robust free cash flow, we are well positioned to enhance our performance while identifying new growth opportunities, including potential M&A activity. Our long-term vision is to establish Luca as a leading mid-tier mining company with a production target exceeding 200,000 gold equivalent ounces annually,” commented Dan Barnholden, CEO of Luca Mining.

Luca Mining last traded at $1.27 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.