On May 26, Lucid Motors revealed the technology options available in its premium Lucid Air electric vehicle (EV), as well as the 34-inch, 5K-resolution curved instrument display. Amazon’s Alexa, Apple’s CarPlay, the Android’s Auto, and the Dolby Atmos systems, among others, can be integrated with the Lucid Air.

In just over a month, Lucid Motors is scheduled to complete its merger with its special purpose acquisition company (SPAC) partner, Churchill Capital Corp IV (NYSE: CCIV). Upon completion, the new company will be known as Lucid Motors and will trade on the NYSE under the symbol LCID. The market could view this event as a catalyst for the stock.

According to a mid-May 2021 Analyst Day Presentation, Lucid has built 74 pre-production Lucid Air vehicles. In June, the company intends to start a production run to ensure final quality validation. Deliveries to customers should then commence in July. Only about 500 Lucid Air vehicles will be delivered in 2021, but perhaps as many as 20,000 in 2022.

Bill Expanding U.S. EV Tax Credits Clears U.S. Senate Finance Committee

In a constructive development for Lucid and many other EV manufacturers (but perhaps not Tesla), a bill increasing tax credits to buyers of EVs assembled by union workers in the U.S. advanced out of the U.S. Senate Finance Committee on May 26 by a 14-14 tie vote. According to the potential legislation, EVs with a maximum retail price of US$80,000 would qualify for a tax credit of as much as US$12,500. The Lucid Air’s price starts at US$77,400.

The bill specifies that the US$12,500 credit would phase out over a three-year period when half of all passenger vehicles sold in the U.S. are EVs. At issue for Tesla: it does not have U.S. union workers.

The current maximum tax credit is US$7,500, regardless of the price of the EV purchased. It phases out when an individual auto manufacturer sells 200,000 EVs. Both Tesla and GM have exceeded that cap and no longer qualify for the current tax credit. The proposed new legislation would eliminate the 200,000 cumulative cap.

The bill of course still must pass the full Senate and the U.S. House of Representatives to become law. A potential issue could be its high price tag – an estimated US$31.6 billion through 2031.

Lucid Background Information

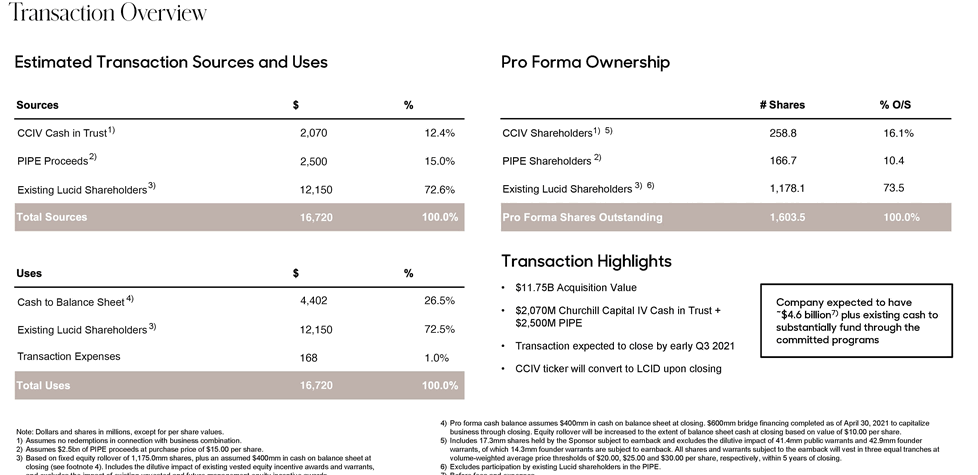

A SPAC deal was finalized on February 22 between Churchill Capital and Lucid. The equity value of the Churchill Capital-Lucid deal was announced at US$16.3 billion, and existing Lucid shareholders will receive a value of US$11.75 billion. Factoring in the stakes of the PIPE (Private Investment in Public Equity) investors and the original Churchill Capital SPAC investors, the deal values Lucid Motors at US$24 billion. When the deal closes, Lucid could have US$4.5 billion of cash to fund its initiatives.

According to its own projections, Lucid will not turn EBITDA positive or free cash flow positive until 2024 and 2025, respectively. By 2025 and 2026, the company hopes to realize gross margins of 22-23%. By 2026, the company plans to generate US$2.9 billion of EBITDA and US$1.5 billion of free cash flow.

If Lucid were to encounter difficulties in reaching its production targets (timeline and quantity produced), its shares could be affected. In addition, investors currently remain enthusiastic — albeit less so than a few months ago — about the future sales prospects of EVs. If that attitude were to change to a notably less optimistic one, Lucid’s stock could likewise suffer.

Unveiling details about the Lucid Air, as well as the Biden Administration’s and the Democratic-controlled U.S. Senate’s continued support for the EV industry, are positives for Lucid and Churchill. CCIV’s stock has corrected significantly over the last three months. If the SPAC deal closes in a few weeks, and if Lucid Motors does begin delivering its Lucid Air model to customers in July, the stock could begin to perform better.

Churchill Capital IV Corp (NYSE: CCIV) last traded at US$19.72 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.