Madison Square Garden (MSG) has been granted a permanent tax exemption by the New York State Legislature since 1982. The exemption was originally intended to be temporary, but it has cost taxpayers nearly $1 billion over the past 40 years.

The exemption is based on the argument that the New York Rangers and Knicks would leave New York City if it did not receive the break. However, there is no evidence to support this claim. In fact, MSG is located in a prime location in Midtown Manhattan, and it is unlikely that the teams would move.

The Knicks and Rangers packing up is not a concern anymore since its “transit-connected location, large market size and established fan base, coupled with restrictions on alternative places the franchises could relocate, signal that there are many reasons outside of the property tax exemption for the teams to remain located in New York City,” the Independent Budget Office (IBO) wrote in its report.

The exemption also does not require MSG to disclose any information about its operations, such as employee wages or labor standards. This lack of transparency has led to concerns that MSG is not paying its fair share of taxes.

MSG’s permanent tax break was granted in the early 1980s after the owner of the Garden, Gulf & Western Industries, argued that the team would leave New York City if it did not receive the break. The tax break was initially intended to be temporary, but it has been in place for over 40 years.

The tax break was negotiated by the administration of then-Mayor Ed Koch, who later admitted that he had intended to give MSG a 10-year exemption.

“Mayor Koch indicated he did not understand at the time that the exemption was in perpetuity, but instead thought the city had agreed to a 10-year exemption,” the IBO said.

Gulf & Western claimed that the team was losing millions of dollars annually, even with the concessions and abatements, but there is no evidence to support this claim.

Ultimately, the decision of whether to repeal MSG’s tax exemption will be up to the state legislature. However, the growing public opposition to the exemption makes it likely that the legislature will eventually take action.

In addition to the tax exemption, MSG has also received other financial benefits from the city. For example, the city has paid for renovations to MSG, and it has provided the team with discounted electricity. The IBO report said that the state government required Consolidated Edison (ConEd) to provide electricity to Madison Square Garden (MSG) at a discounted rate. ConEd was then allowed to adjust general utility bills to recoup the discounted price for MSG.

This arrangement lasted for about 30 years, not because the 1982 state law authorizing the energy discount was repealed, but because of a technicality related to how the discounted rate was set.

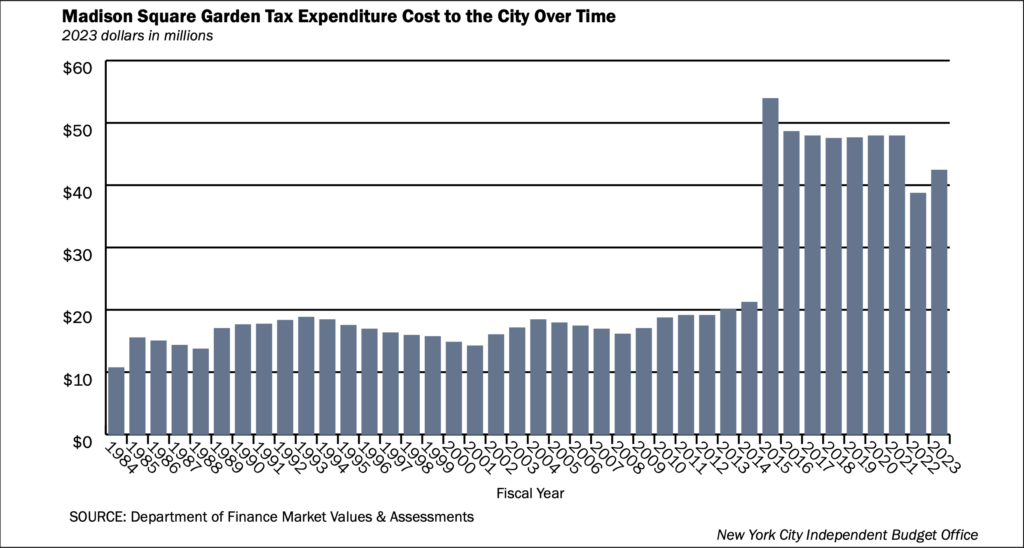

These benefits have come at a significant cost to taxpayers. The IBO estimates that MSG’s tax break and other subsidies will cost the city $43 million in 2021, for a total cost of nearly $948 million since the policy was implemented in 1982.

this part particularly sent me… "state legislation required Consolidated Edison (ConEd) to provide electricity at a discounted rate… ConEd was then authorized to adjust general utility bills to recoup the discounted price for MSG."

— Alex Konrad (@alexrkonrad) July 12, 2023

i'm sorry WHAT pic.twitter.com/abZ4leJakc

Rangers’ playoff game in Toronto put MSG’s tax break on the line

The New York Rangers played a playoff game in Toronto in August 2020 due to the COVID-19 pandemic. The game was designated as a “home” game for the Rangers, which means that it should have triggered the end of MSG’s tax exemption.

The tax break that MSG receives from the state of New York is contingent on the team playing its home games in New York City. The Rangers’ playoff game in Toronto could have triggered the end of the tax break, but the state tax department has argued that the game was a temporary relocation due to a global pandemic.

The Rangers and MSG have also argued that an “original agreement” between the city and MSG excluded relocations due to acts of God from triggering the tax renewal clause.

The tax implications of this designation are significant. The Rangers are estimated to have lost $10 million in ticket sales and other revenue due to the pandemic. If they are taxed on the Toronto game as if it had been played in New York, they could owe an additional $1 million to the city treasury.

It is unclear whether the state tax department’s interpretation of the law is correct. However, it is clear that the Rangers’ playoff game in Toronto highlights the need for reform of MSG’s tax exemption.

Information for this story was found via Commercial Observer, Gothamist, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.