The number one trader on the TSX Venture Thursday was Manganese X Energy (TSXV: MN). The 9.5 million share volume day brought with it a $0.30 fall and a -60% retracement of the 160% price jump the company made over the prior three sessions. MN recovered some to close at $0.81 Friday. The 34 million shares traded over the three days representing about half of the 69 million outstanding shares.

All of this action from a manganese company that had traded 24 million shares in the whole year prior at an average price of $0.105 means it’s time we had a chat about the obscure metals exploration stock industrial complex.

“Andy Dix is VERY interested. He’s seriously considering being involved in the picture in a BIG way…”

The commodities business is necessarily centered around large, standard, brand-name materials. Copper, aluminum, nickel and zinc are the most widely traded and best understood base metals. There is enough trading in them that their spot prices are quoted daily, if not in real time.

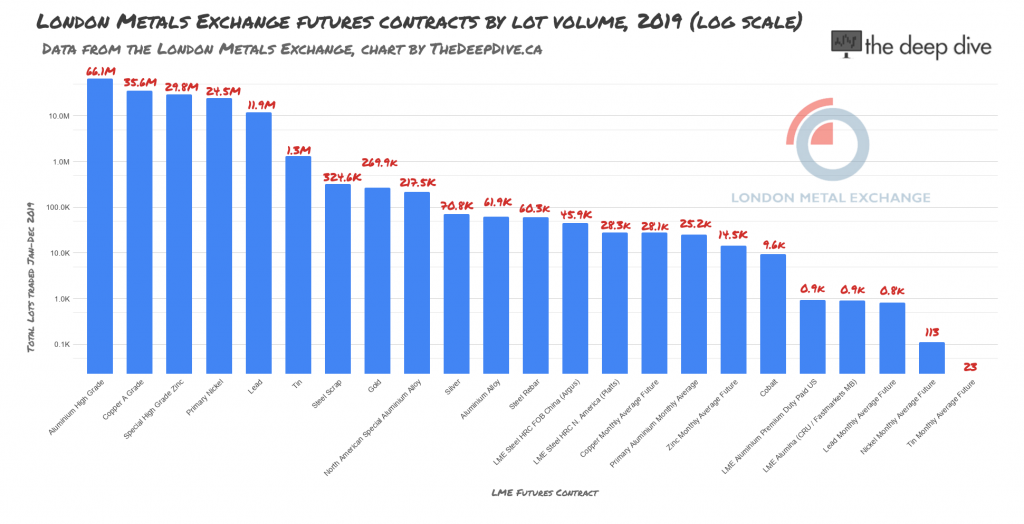

This is a chart of all of the metals futures traded on the London Metals Exchange in 2019 by volume. Metals exchanges are used by commodities brokers and producers to hedge their production and by investors to speculate on the swings in metals markets caused by ebbs and flows in global economic activity. The volume any specific contract generates on the LME is a reasonable proxy for the volume of that metal used by industry and speculated on by investors.

The mining industry is pulled by the use of these metals. The prices the markets sort out through supply meeting demand governs large companies’ decisions about asset development and asset purchases. Those decisions and the appetite they represent in turn pull the junior mining sector responsible for de-risking early-stage assets, and getting paid off as they are sold to larger producers.

If the base metals markets were a casting landscape, copper and aluminum would be the leading men and women. In the minerals exploration business, having one or more of them attached to the script of a project being developed with the objective of being made into a mine of a movie makes it a sure thing that – given a full commitment – the major mining companies (studios) are going to be interested. Mining companies need to replace every ton they mine with in-ground reserves, and will bid against each other for a large enough copper or zinc project, bringing with them a major payout for the investors who took the risk to build it.

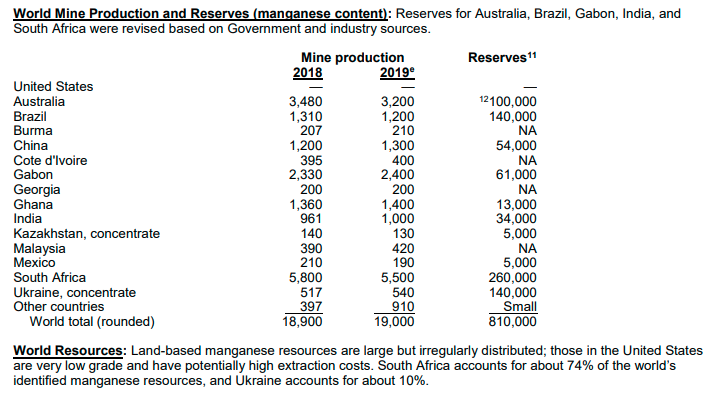

Manganese does not appear in the chart of 2019 LME volume, because it isn’t traded in that way. The volume is too small. There are no major manganese companies thirsty for reserves. South Africa is the metals’ largest producer at 5.8 million tons in 2019. A USGS-calculated 260 million tons of reserves will fuel the country’s production for 40 years at that rate.

There is no conceivable shortage of manganese in the present or future, and there’s enough geographic diversity among the suppliers that there’s no real risk of the industry being cut off by political shifts. In a mineral exploration sense, Manganese isn’t relevant. It doesn’t make any sense that this early-stage company planning to drill to prove resources they’d have to beg someone to buy draws this kind of attention, but here we are.

True dark horse contenders are never pitched

Every metals boom brings exploration companies who run stock promotions using bit player metals that aren’t liable to draw the interest of major mining companies, but are used enough in industry that retail punters will have heard of them. Weaving them into a compelling enough narrative can make a stock junkie feel like they’re ahead of the curve. EV growth and the rise of Tesla has fostered conditions that are perfect for convincing people that they can get rich by front running the coming graphite/manganese/cobalt shortage. The companies hang around in irrelevance, making websites with electric cars on them, then pop into the popular market consciousness like an algae bloom when the environment gets just right.

This particular event appears to have been set off by the market success of GIGA Metals (TSXV: GIGA), following reports last week of a meeting with Tesla. GIGA’s registered insiders have experienced some financial success on the trading created by that rumor as have, presumably, its early backers. We wrote earlier this week about Tesla’s supposed interest being based on a theoretical low-carbon footprint of what would be an enormous hole in the ground – a lofty concept that would represent a departure from convention – but is at least built around a target metal that is traded daily.

Manganese X’s Battery Hill project, by contrast, contains no verifiable resources, so it’s a bit early to be calculating the carbon footprint of its notional extraction. Work on the project by previous operators shows potential, and the company’s MD&A gives us the impression that Manganese X is most interested in using that potential to create the near term equity lift that it’s experiencing right now.

Manganese X optioned Battery hill from Globex Mining Enterprises (TSX: GMX) in 2019 for 8 million shares in an agreement that originally required that Manganese X produce a PEA on the property by 2020, a clause that has since been waived by Globex. MN’s other projects include an HVAC disinfectant system patent for which their treasury paid 1.5 million shares, and the Lac Aux Borleau graphite property in Quebec.

Remember that one?

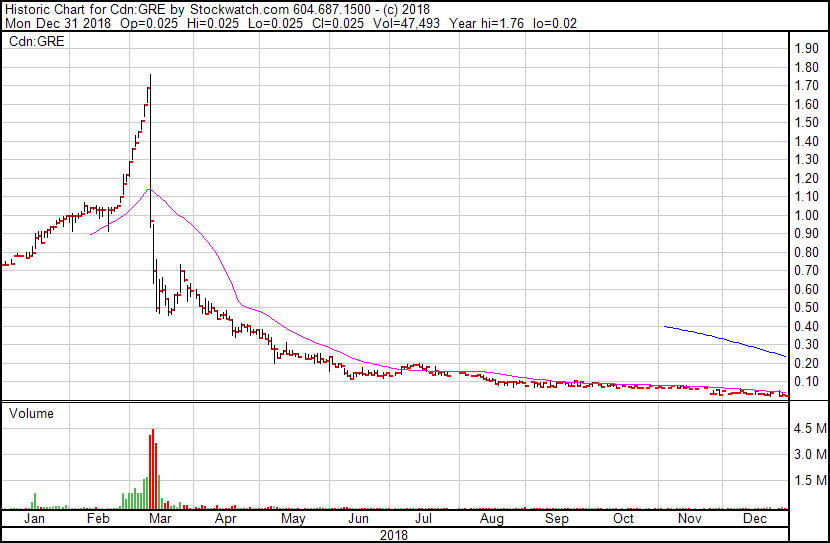

Those of us who pay close attention to metals minors remember Lac Aux Borleaux as the centerpiece of the Graphite Energy promotion of 2018. The property is adjacent to a Quebec graphite mine operated by a subsidiary of French aggregates company Imerys. Graphite Energy didn’t think it was necessary to include the “adjacent to” part in a spring 2018 email-based hard-sell campaign that had the company as the mine’s operator and the owner of a processing facility.

Following a staircase walk up that, frankly, looked orchestrated, the former GRE fell from $1.69 to $0.70 in two trading sessions, before slowly fading into irrelevance behind a Journal de Montreal exposeé on the scam (caution: French). GRE has since decided to get into the marijuana business, inking an LOI with some sort of international cannabis concern that we aren’t going to bother reading about. The CSE, having determined that Graphite Energy Corp. does not meet the exchange’s listing requirements, has added .X to the symbol, making it GRE.X.

Manganese X’s investor literature expresses an intention to spin the Lac Aux Borleau graphite property out into another pubco, perhaps an indication that management is aware of the means by which the property has historically best generated value.

One can expect Manganese X, presently trading at a $53 million market cap, to continue to defy gravity for as long as it can continue to generate interest among low-information investors with no mining background, oblivious to the mechanics of the business.

The company is fresh off a $2 million financing, having issued 25 million shares at $0.08 earlier in September, but would be foolish not to take advantage of this gift from the market gods with a flow-through financing. Proceeds from a flow through raise would be earmarked for exploration work, freeing up the cash balance for the aggressive marketing required to reach new retail interest ready to dream on the potential at Battery Hill.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.