TSX Venture listed PowerBand Solutions (TSXV: PBX) has been one of the highest volume traded issuers on the Venture this afternoon, seeing just under a million shares exchanged so far in intraday trading. The issuer has seen its price correspond by moving up a full cent to $0.11 on the day, giving the issuer a market cap of approximately $11.1 million.

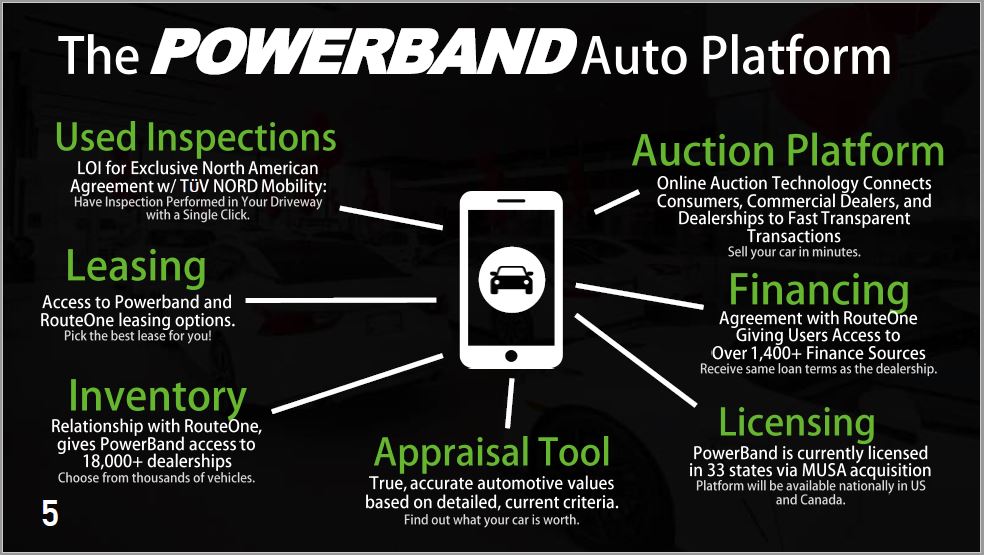

PowerBand is a technology firm focused on providing a new tech solution to the antiquated automotive space by disrupting the broken business model. The company is currently centered on developing a platform that enables consumers and dealers to buy, sell, lease, finance, and auction vehicles while removing the middleman from the transaction. Outfitted with consumer to dealer, dealer to dealer, and consumer to consumer functions, the platform is set to launch its beta tests in the first quarter of 2020 as per its recently refreshed investor presentation.

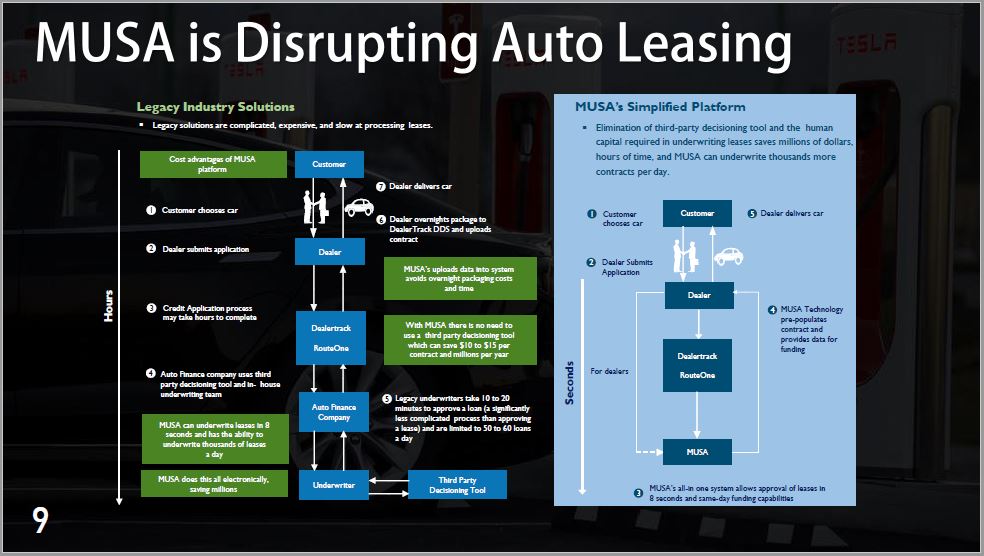

The company has managed to partner itself with a number of high profile firms along the way of developing the platform. Notably, the firm recently acquired a 60% stake in MUSA, an automotive leasing platform that partnered with Tesla Inc (NASDAQ: TSLA) in 2018 to provide quick approval for consumer vehicle leases. PowerBand has also seen a large stake taken in it by Brian Hunt of the JB Hunt Automotive Group. The company has developed a joint venture with Hunt to establish D2D Auto Auctions, a focal point of PowerBand’s automotive platform.

Other considerable partnerships include that of RouteOne LLC, a financial platform established by four automakers that include Ford and Toyota, which currently has access to over 18,000 dealerships across North America and over 1,400 financing sources which will be integrated to PowerBands platform. Vehicle inspector Tuv Nord Mobility has also become a partner, who’s vehicle inspections are anticipated to play a role in the appraisal value of vehicles listed on the platform as well.

The resulting platform is expecting to have multiple sources of revenues built-in. Revenue sources include lease and financing transactions, fees from auctions conducted, lead generation fees, revenues from inspections, vehicle export revenues, leased vehicle sales and finally, through the sale of add-ons associated with vehicle sales. In this regard, think of warranties, insurance, rust-proofing, etc.

Resulting comparables for the issuer include those of CarMax, Carvana, and Group 1 Automotive, all of which are valued in the billions on prominent US exchanges. The group as a whole has an enterprise value of approximately $45,000 per vehicle sold as per the PowerBand investor deck. With the company aiming for approximately 6,600 vehicle transactions to occur over the course of 2020, one can easily determine where the comparables would value the company.

The timeline provided by the company identifies that the platform is set to launch in beta form within the current quarter, with Texas-based beta testing to occur in the second quarter. Subsequent Canadian and US roll outs are then anticipated to occur later in the current year. Whether those targets are met will determine how many transactions, and the resulting valuation PowerBand ultimately achieves this year.

PowerBand Solutions last traded at $0.11 on the TSX Venture.

FULL DISCLOSURE: PowerBand Solutions is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover PowerBand Solutions on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.