The Deep Dive’s West Coast Office loves a good old fashioned BC Golden Triangle gold rush and, this summer, the market gods did not disappoint.

The venture-stage volume dials are indicating that the Treaty Creek property, having long been a promising prospect through various different owners, might have a future as a gold deposit. All three of its present owners have seen recent strong short term price movements on ample volume.

Tudor Gold (TSXV: TUD) is the corporate epicenter of this phenomenon. The project operator and 60% owner of Treaty Creek is under the care and guidance of CEO Walter Storm, whose bio leads with his role in having developed Quebec’s Malartic mine for Osisko Gold. Osisko generated consistent mining headlines in the late oughts and early 2010s through Malartic’s development stage and the company’s eventual buy-out in a white-knight-syndicate-led thwarting of a Goldcorp bid in 2015. Like any other true Canadian gold success story, Osisko’s name has since been repurposed as a gold royalty company (Osisko Gold Royalties (TSX:OR)), but the original Osisko built today’s largest open pit gold mine with a relentless attack on a large, middling grade system.

Tudor is an agressive company with an approach to the gold business that comes with an understanding of its unique dynamics. The early years of Osisko were marked by aggressive development and permitting that would eventually put the project in a position, post gold crash, in which it didn’t live and die with the gold price. It still mattered, but with a legitimate, bankable deposit on their books, the growth phase was over. The company didn’t need the price to stay up to raise operating cash. The gold price had become the variable determining how much it would get for the 10 million ounce deposit.

As Osisko spun around an inner orbit of the Canadian gold system in 2008 – 2012, the outer reaches were occupied by smaller exploration companies to whom the price of gold and the direction it trended in were all that mattered. American Creek Resources (TSXV: AMK) and Teuton Resources Corp. (TSXV: TUO) spent years amassing land positions in areas that investors had no trouble associating with previous mining success, using the properties’ potential to finance their ongoing exploration and hoping to either make a discovery or live to drill another day.

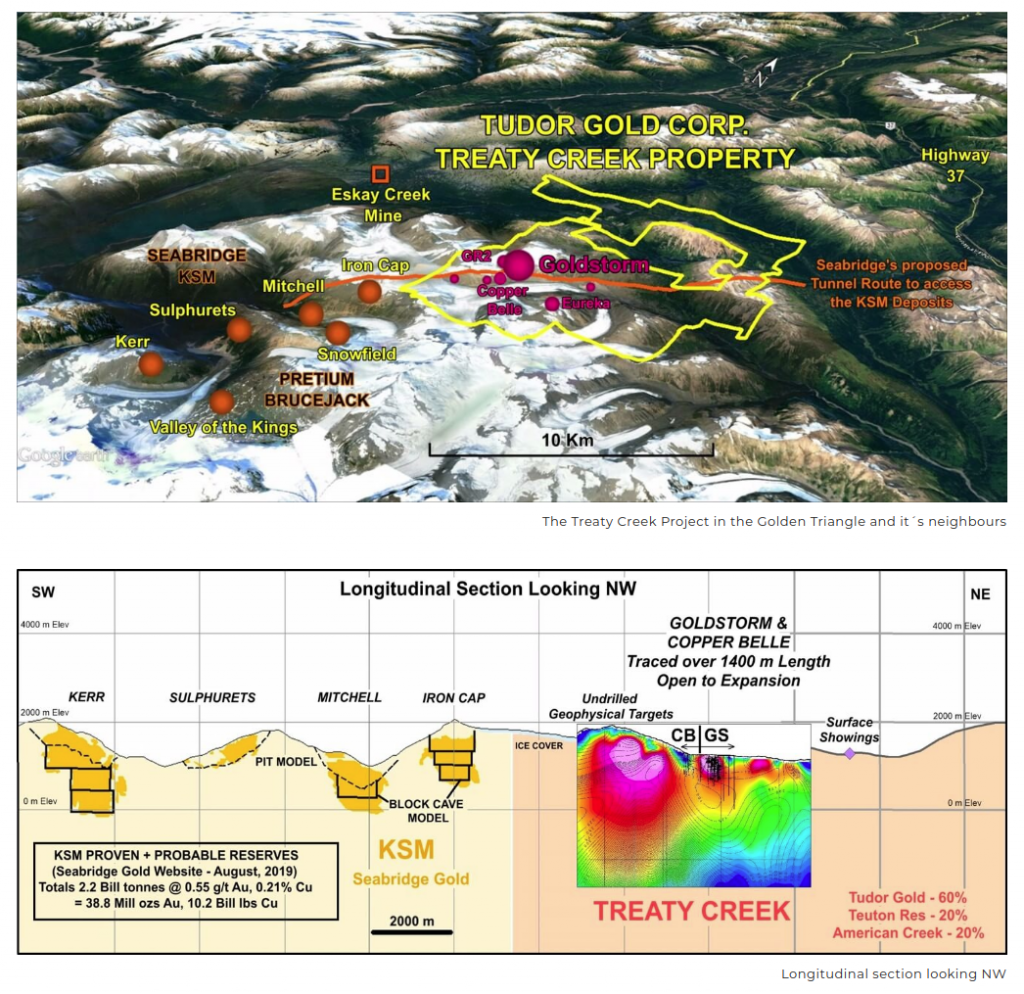

BC’s Golden Triangle was the home of various known deposits and operating gold mines when American Creek and Teuton first became active in the area, and has seen the development of world class deposits in the years since, including Pretium Resources’ (TSX: PVG) Brucejack project and Seabridge Gold’s (TSX: SEA) KSM project. The MO of prospect generating exploration companies is to control ground and de-risk it to the extent that the budget allows. The companies often raft together in joint ventures to pool their resources and share the load.

A JV on the Treaty Creek property paid off in 2016 when Walter Storm and Tudor called, because the trade winds of the gold market were picking up and it was time to get drilling somewhere good. An agreement was reached that gave Teuton and American Creek each a 20% carried interest through such a time that there is a production decision made on the property, giving Teuton an opportunity to use the still building investor interest in gold to efficiently de-risk the property, learning more about the size of the system and hunting for high-grade. It’s got the market’s attention for the moment, and if there’s ever a time for a risk on trade in junior mining, it’s while the gold price is being sucked up into an inflationary vacuum.

This particular situation is presently occupied by three different companies with two different strategies that compliment each other. American Creek and Teuton are prospect generators. They prefer to work on property in its early stages, hoping to catch a value lift by a combination of early stage work, the work of companies with neighboring properties, and the rising tide of metals markets, then using that lift to raise money or cause deeper pockets to option it.

Tudor presents as a company more inclined towards aggressive development. The property is in the right area, historic drill holes are turning up the right numbers, the gold price is moving in the right direction, and management is inclined to “get while the gettin’s good,” so to speak.

The companies cut a deal that leaves Teuton and AMK with 20% carried interests through a production decision, and are now telegraphing an intention to drill Treaty Creek into Swiss cheese in a serious, aggressive stab at the long-prospected property.

The Straight Goods

Tudor Gold

To that end, Tudor is raising $9.3 million in a non-brokered private placement with Eric Sprott, from whom investors could learn a thing or two about investing in the gold market.

Storm’s Osisko pedigree doesn’t change the fundamentals of the Treaty Creek property itself. But, in the context of the $9 million private placement, it shortens the odds it will become more valuable in the near term.

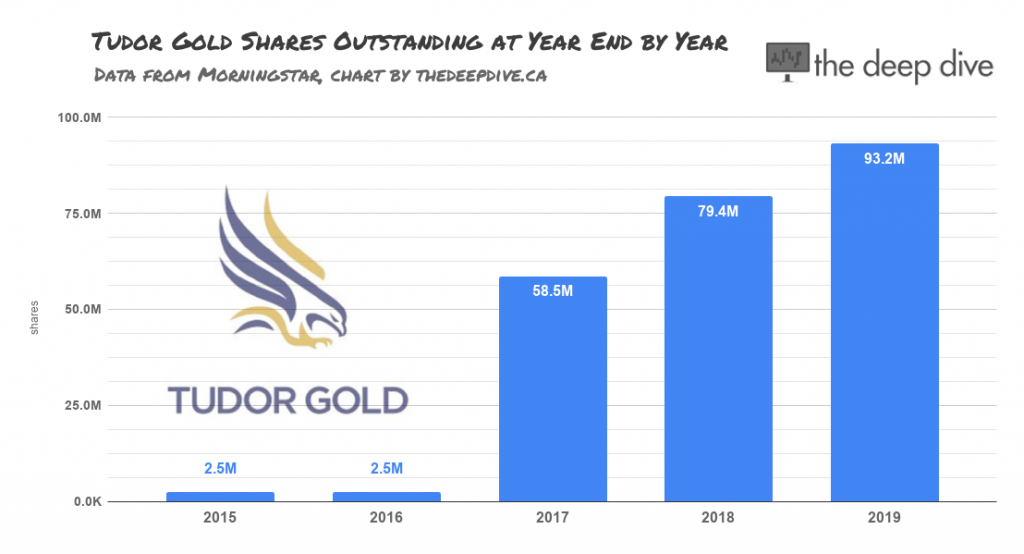

Cap table expansion comes with the territory in gold exploration, and Tudor is no exception.

The effects of that expansion on the value of the equity can be squelched, obviously, by creating price action, and that’s the race: conduct exploration capable of putting together a strong asset base in an environment where the gold price is co-operating, so that the company doesn’t have to give away too much of the cap table along the way.

Tudor recently added a third drill rig to Treaty Creek.

American Creek Resources and Teuton Gold

These companies don’t have to give up any equity to maintain their interest in the near term, but they likely will.

Teuton’s balance sheet is presently carrying about $1 million worth of marketable securities that we presume include some of the Tudor stock they got in the Treaty Creek deal. American Creek had flattened out its position, but recently optioned another property – the Electrum property – to Tudor for $250,000 and 1.4 million shares of Tudor.

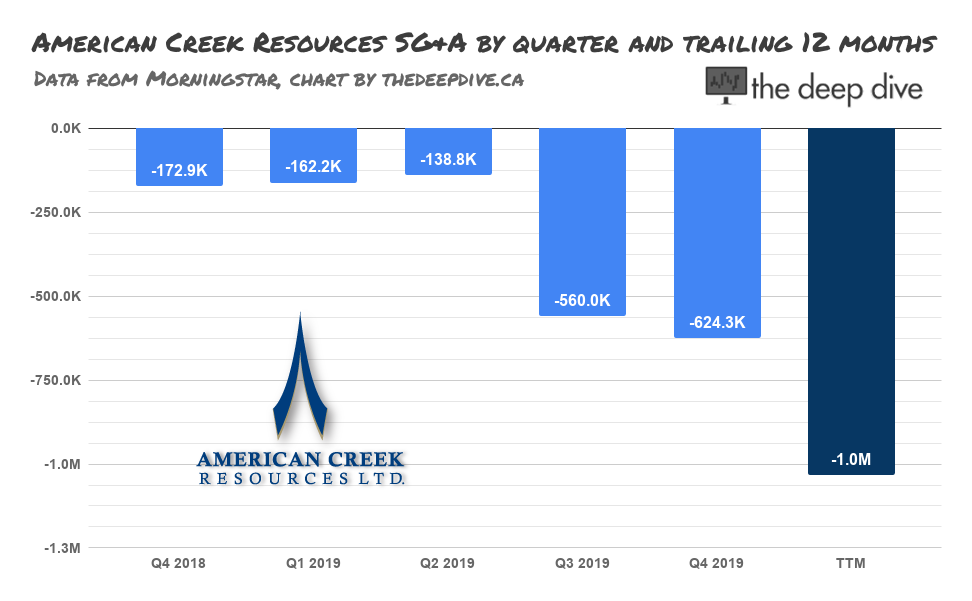

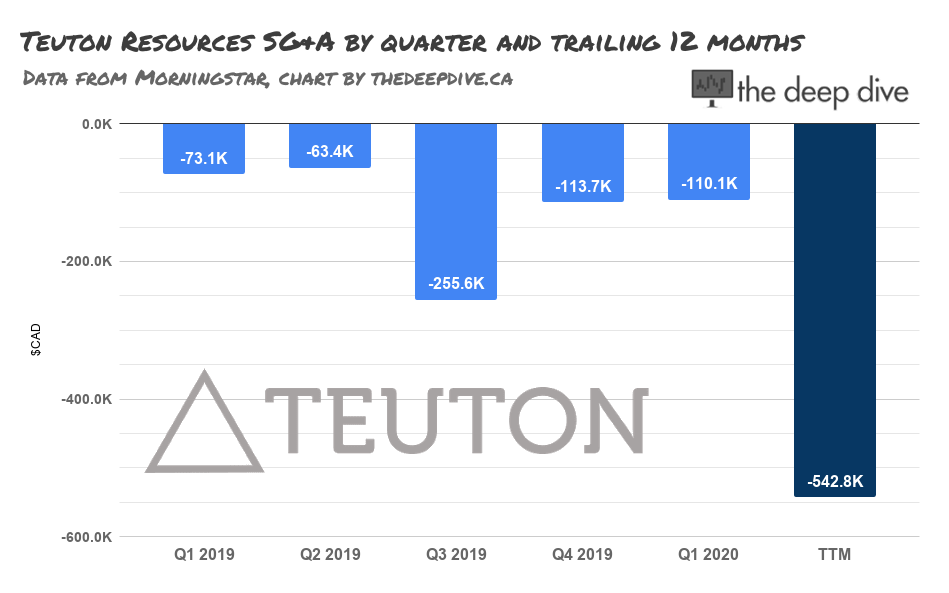

We like to chart the SG&A expenses of exploration companies to get an idea of what it costs to maintain the company outside of exploration efforts.

It’s appealing to ride an AMK/Teuton position as far as it goes, reasoning that they’ll endure less dilution, but that isn’t often the way these things end up. Both companies have deep portfolios of early-stage gold projects, whose exploration won’t finance itself. Look for them to take advantage of their market success to cash up. If they show an intention to put money they raise into the ground efficiently, investors might be inclined to see the juniors as a bet with increased upside potential.

Information for this briefing was found via Sedar and the companies mentioned above. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.