Mastermind Toys, Canada’s independent specialty toy and children’s books retailer, recently applied for an initial order for creditor’ protection. The protection was sought under the Companies’ Creditors Arrangement Act (CCAA) from the Ontario Superior Court of Justice (Commercial List) in Toronto.

In a press release, Mastermind Toys explained the decision to seek creditor protection under the CCAA was made after a “thorough evaluation of available alternatives and in consultation with legal and financial advisors.”

“Over the past several years, Mastermind Toys has faced a range of challenges including increasing competition, disruptions from the COVID-19 pandemic, and more recently a deteriorating macro-economic environment,” the company said.

Despite implementing operational improvements, cost reductions, a strategic review, and a robust sale process, the difficulties facing the business have proven insurmountable.

Throughout this process however, the network of 66 Mastermind Toys stores will continue their operations, and ongoing sales and holiday promotions, including the Black Fri-Play event, will persist both in stores and online.

Mastermind Toys plans to request the court’s authorization to initiate the closure of an initial group of stores and explore strategic alternatives for the remaining locations.. Alvarez & Marsal Canada, an accounting company, has been appointed to monitor the CCAA process.

Market conditions contributing to this decision include heightened competition from major retailers such as Walmart, Amazon, Costco, and Canadian Tire, disruptions from the COVID-19 pandemic, and a slowing economy. Despite this, the company claimed a 3% stake in the $2.39 billion Canadian toy retail marketn and a further 2% of the online toy market.

Earlier in the year, Mastermind enlisted Alvarez & Marsal Canada to identify potential buyers. However, most interested candidates withdrew from the sales process due to the retailer’s deteriorating financial position. Despite these setbacks, Mastermind remains determined to pursue a buyout and is seeking additional time from the court for negotiations.

In the red for 6 years

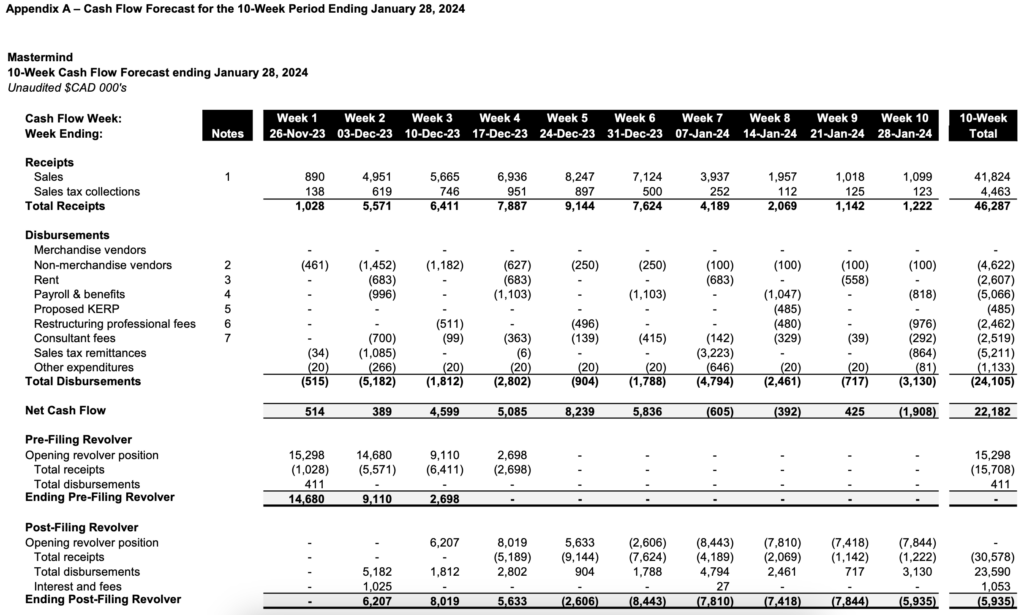

According to motion materials, Mastermind has been operating at a deficit since 2018, with 2023 sales totaling US$47.9 million (excluding Black Friday sales) and a year-to-date operating loss of approximately US$13.5 million. While tangible assets amount to US$34.9 million, liabilities surpass US$45.5 million. The company is also seeking the court’s approval to initiate the closure of an initial group of stores as it explores alternative strategies.

For the 12-month period ended October 31, 2023, Mastermind reported revenue of $111.6 million and EBITDA of negative $7.2 million. Same store sales has been identified to have declined approximately 22% below prior year results.

At the end of that period, Mastermind had approximately $35.0 million of inventory at cost across its store network, distribution centre and third-party warehouse provider. On top of this, the firm also have payables to unsecured trade creditors totaling approximately $22.2 million and approximately $5.6 million in outstanding gift card liabilities.

Among its list of trade creditors, LEGO Canada appears to be the largest, at $5.2 million, followed by Mattel Canada at $1.3 million, and Grosnor Distribution Ajax at $1.2 million.

The firm also benefited from the Business Credit Availability Program with a $6.25 million term loan. While this provided much needed liquidity, the company wasn’t able to generate sufficient cash flow to pay down the debt.

In fact, the company said it has been in default of its obligations to CIBC under an outstanding $36.3 million credit facility since October 2022 and has failed to maintain the minimum EBITDA covenant required since April 2023.

“In fiscal 2022 and for the trailing twelve-month period ended October 31, 2023, Mastermind LP reported EBITDA of negative $4.0 million and negative $7.2 million, respectively, and a net loss in each of its past six fiscal years,” the firm said in its filing.

The company prepared a weekly cash flow forecast as it anticipates undergoing the creditor protection process, expecting net cash flows to be $22.2 million at the end of ten weeks. The company indicated within a November 30 filing that should the forbearance agreement not be approved under the CCAA process, CIBC intended to exercise their enforcement remedies, making the firm unable to meet its payroll and rent obligations.

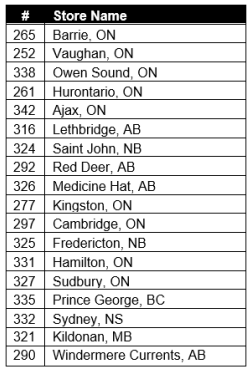

Currently, Mastermind operates 66 storefronts across eight provinces in Canada, contributing to 90% of its annual sales. As part of the proceedings, the company intends to liquidate the inventory and equipment from an initial 18 stores, while attempting to sell off the remaining locations under a potential transaction. If such a transaction can not be reached, the remaining locations will then also be liquidated.

These potential transactions are expected to close by January 14, 2024, with Mastermind requesting a stay until January 26, 2024, under the forbearance agreement.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.