On April 12th, Canaccord Genuity raised their 12-month price target on Maxar Technologies (TSX: MAXR) saying, “Competitive position strong, but 2023 still dependent on timely Legion deployment.” They raised their 12-month price target from US$32 to US$42 while reiterating their hold rating. This comes after the stock is up more than 30% year to date as the company’s satellite images have been used by many outlets covering the Russia-Ukraine conflict.

Maxar currently has 7 analysts covering the stock with an average 12-month price target of US$44, which represents a 15% upside to the current stock price. Out of the 7 analysts, 1 has a strong buy rating, 3 have buys and the last 3 analysts have hold ratings. The street high comes in at US$52 by two analysts.

Canaccord says that Maxar has seen an elevated profile on the global stage due to the war, but has also strengthened its competitive edge in its Earth Intelligence segment. Canaccord believes that its imagery collected by its WorldView telescope,s “was critical in providing actionable intelligence to the US government, its NATO allies, and Ukraine.” Specifically, the spotting of the military hospitals, attack helicopters, and Su-25 Grach air support jets along the Ukraine/Belarus border.

As a result of this increased media attention, Canaccord says that increased usage has been a significant tailwind to its bid on the EOCL program, though worries that Maxar will be too capacity constrained in the event this happens. The National Reconnaissance Office and the National Geospatial-Intelligence Agency have significantly increased their purchases of EO imagery since the war started.

Though management has repeated that much of the time they do not have a lot of spare capacity in the satellites that they have deployed in LEO. Though, not all is good as management has suggested that their plans to use Ukrainian Antonov cargo aircraft to airlift the Legions to Cape Canaveral is now put on hold indefinitely. This has been a series of setbacks for Maxar, as the company had looked to do this prior but was delayed by ground workers getting COVID-19.

Management now indicates that their new route will be to transport the Legion satellites by truck from California to Florida for the launch integration and this will tack on “a couple of extra weeks” to the June-July timeframe. Though these satellites have to go through additional testing as it’s a first-of-its-kind spacecraft on top of doing the process for two of them. Canaccord believes that this process will be closer to 90 days rather than the 45-day checkout time per satellite.

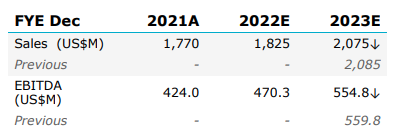

Lastly, Canaccord says that with more delays in the Legion launch, the more Maxar’s guidance of $110 million in incremental Adjusted EBITDA in 2023 will be impacted. With the recent news of the additional delays and increased checkout time, Canaccord has slightly lowered its 2023 Earth Intelligence estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.