On May 17th, MediPharm Labs (TSX: LABS) Labs reported their first-quarter financials. The company announced revenue of 5.5 million, down 9.3% quarter over quarter and down 50% year over year. The company reported a negative gross profit for the third quarter in a row. Shares of the cannabis company have slumped more than 19% year to date.

There are currently six analysts who cover MediPharm Labs with a consensus 12-month price target of C$0.74, an 83% upside. One analyst has a strong buy rating, two analysts have buy ratings, and the rest, three analysts have a hold rating. The street high comes from Roth Capital with a C$1 price target while Mackie has the lowest on the street with a C$0.50 12-month price target.

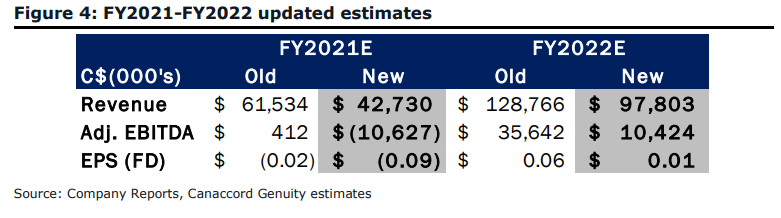

The guys over at Canaccord reduced their 12-month price target from C$1 to C$0.75, but reiterated their speculative buy rating on the company. They are now expecting Labs to take a smaller piece of the Canadian market share, have reduced shipments out to international countries, and have lower margins on all their products. Shaan Mir writes, “We note that MediPharm continues to be a leader in International medical markets and, in our view, is the most suitable partner for large-scale pharmaceutical companies looking to enter the space.”

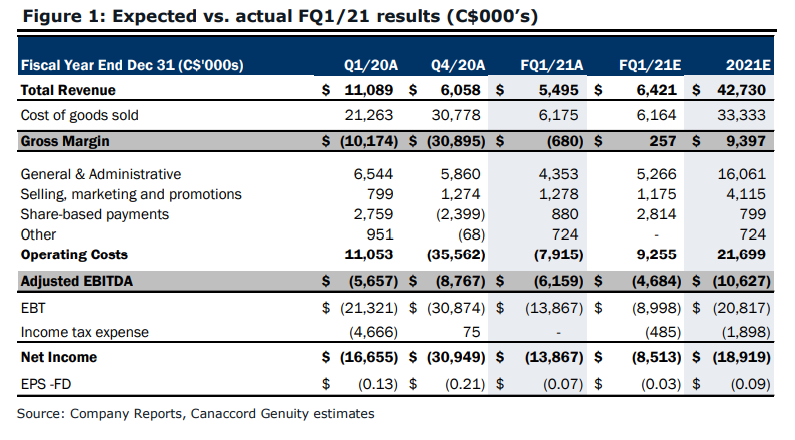

MediPharm’s numbers all came in lower than Canaccord’s estimates with them forecasting first-quarter revenue to come in at $6.4 million compared to the $5.5 million. Gross margins of $257k versus ($680k), adjusted EBITDA was forecasted to come in about $1.5 million better than actual while their bottom line was basically half of what Canaccord expected.

Mir tends to agree with management’s commentary around why this quarter was so bad. Management noted that they got double wacked this quarter with the general operating conditions being challenging while provincial shops re-aligned their inventory. Although, Mir believes there is a “shining light” from this quarter, which would be their international sales. Their international sales grew to C$2.1 million, up from $0.3 million in the last quarter which could mainly be attributed to their agreement with Stada.

Below you can see the updated 2021-2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.