Carmakers’ rapid pace of electrifying their vehicle offerings accelerated even further on July 22. On this date, Daimler AG’s Mercedes-Benz announced plans to invest more than 40 billion euros (US$47 billion) over the 2022-2030 period to transform its vehicle fleet.

Mercedes had been among the most reticent of the large automakers to adopt a comprehensive electric strategy. Mercedes’ announcement suggests confidence that its generally affluent customer base will transition quickly to electric vehicle (EV) technology.

Perhaps an impetus for this broad move was the warm reception that Mercedes’ new electric EQS model received from car critics and analysts several months ago. The EQS is the electric version of Mercedes’ flagship S-class passenger car.

Mercedes intends to launch three new all-electric vehicle platforms by 2025: the MB.EA for passenger cars; the AMG.EA for performance cars; and VAN.EA for electric vans and commercial light vehicles. Indeed, from 2025 and forward, any future Mercedes vehicle platform will reportedly be all-electric. To accomplish all this, Mercedes plans to build, with partners, eight battery plants. According to the company’s CEO, its spending on traditional combustion engine technology will be almost nil by 2025.

Many Automakers Have Announced Significant Commitments to Electric Vehicles

Counting Mercedes’ announcement, at least seven major automakers have announced plans to invest a cumulative US$200+ billion in electric vehicle development over the next few years. Given the size of the investments, many any of these entities are “betting the future of the company” on electrification strategies.

| Investment Commitment to Develop Battery-Powered Electric Vehicles | Target Date When All New Cars Are Fully Electric | |

| Mercedes-Benz | US$47 billion over the 2022-2030 period | 50% by 2025 |

| General Motors | US$35 billion through 2025 | 2035 |

| Ford | US$30 billion by 2025 | 40% by 2030 |

| Stellantis | 30 billion euros through 2025 | 70% of sales in Europe and 40% in the United States to be either battery or hybrid electric by 2030 |

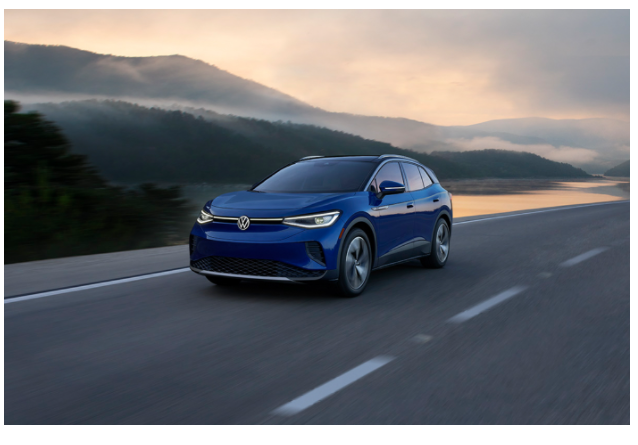

| Volkswagen | 73 billion euros through 2025 | 2035; 70% by 2030 |

| Volvo | 2030 | |

| Renault | 90% of sales to be all electric by 2030 |

The transformation of the companies should be quite dramatic. In many cases, the carmakers expect that half their 2030 sales will be all-electric vehicles, up from current de minimis amounts.

These developments should be considered quite positive for battery makers and for miners of key battery components like lithium and cobalt. On the other hand, competition continues to increase for start-up EV manufacturers like Lucid Motors and Lordstown Motors, as well industry bellwether Tesla.

Few industries are poised to grow as rapidly as the EV industry, as combustion engine propulsion technology seems to be giving way to battery-powered vehicles at a breakneck pace. It is difficult to pick which company could become the next Tesla, but companies and commodities linked to EV battery manufacturing seem like reasonably safe investments.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.