In a note sent to investors this morning, Andrew Partheniou of Stifel GMP headlined, “A thought piece on GTII-TRUL merger chatter.” As there has been growing speculation of a Trulieve Cannabis (CSE: TRUL) and Green Thumb Industries (CSE: GTII) merger. Partheniou walks us through the details.

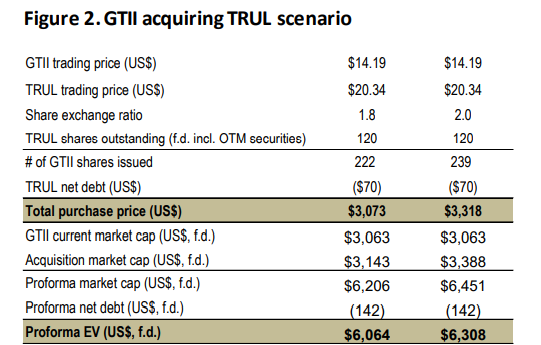

In the scenario, Partheniou believes Green Thumb would buy Trulieve at a 30-40% premium.

Partheniou states that the pro-forma enterprise value would be between $5.3 to $6.3 billion and could go as high as $7.3 billion on re-rating. Combined revenues are estimated to be roughly $5.4 billion yearly and would be double the sales of the next peer down the line, but with better profitability and a stronger scaling advantage which could warrant a higher multiple by the street.

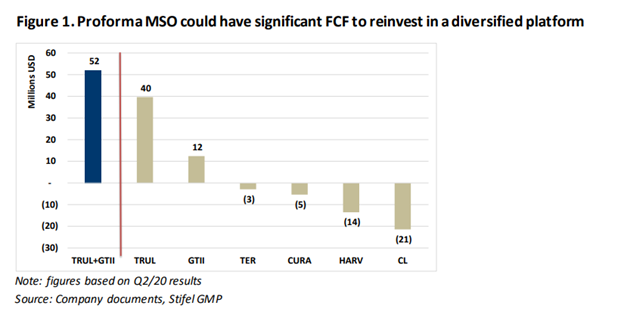

Partheniou then goes on to say that this merger would remove “growth obstacles for both companies.” He then states that the free cash flow generated by Trulieve’s Florida operations could be put towards Green Thumb’s attractive markets such as IL, PA, NJ, and OH and possibly NY if it approves recreational. This deal would also benefit Trulieve as they get a “diversified platform, removing a long-standing share overhang.”

In terms of what would happen to management, Partheniou says that in one scenario, as Green Thumb has not appointed a COO, Trulieve’s CEO Kim Rivers could be appointed and work with Green Thumbs current CEO. The second scenario would be for Mr. Kolver to step down and transition to become the executive chairman of the board, while Kim Rivers becomes the CEO. While the third scenario would be to only integrate the back office and keep the business running separately.

Partheniou sees the main obstacle to the rumoured merger as being the will of management with the US cannabis market hitting ~$16 billion in 2020. The US market could have multiple cannabis giants that can grow rapidly and not take on M&A risk as Canada did, and even if a merger were announced, it wouldn’t be risk-free, with Partheniou outlining a transition risk.

Partheniou states that there is also some asset overlap between the companies, specifically in MA, which would mean the company would have to divest their assets in MA completely. Although MA is an attractive market, the M&A market has been depressed for some time as companies have been rethinking their growth strategies and not expanding into new markets as a result.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

GTI / Liberty deal would be a much less painful transaction, e$pecially for GTI.