Meridian Mining (TSX: MNO) has released a preliminary feasibility study for its Cabacal gold-copper-silver deposit in Brazil. The study has outlined an after-tax net present value of $984 million for the project alongside an IRR of 61.2%, which is based on $2,119 an ounce gold and a 5% discount rate.

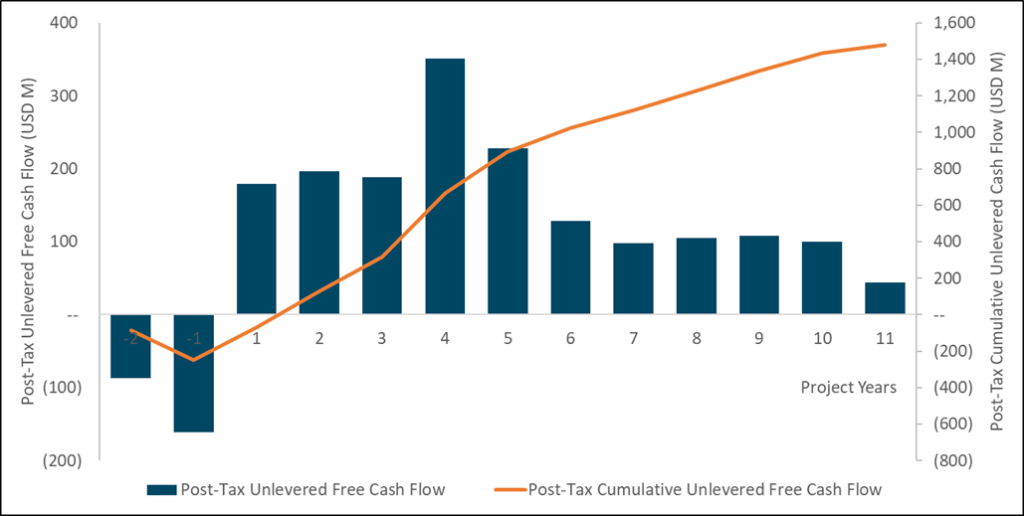

At $2,917 gold, the net present value of the project is said to jump to $1.41 billion, while the IRR comes in at 79.5%. The payback period is estimated at 17 months under the base case scenario, and just 12 months under the current spot price scenario.

The estimate is based on a scenario where 141,000 ounces of gold equivalent would be produced annually over a ten year mine life, with much of that production front-loaded to the first five years. The first five years are expected to have an annual production rate of 178,000 ounces of gold equivalent.

Over the life of the mine, 744,301 ounces of gold, 169,647 tonnes of copper, and 1.3 million ounces of silver are expected to be produced.

Those ounces are expected to be recovered at a total cash cost of $685 per gold equivalent ounce, while all in sustaining costs are expected to come in slightly higher at $742 an ounce. Initial capital expenditures are estimated at $248 million, while expansion capital is expected to cost $56 million, and sustaining capital is expected to come in at $54 million.

The Cabacal deposit meanwhile is estimated to contain measured and indicated resources of 904,310 ounces of gold, 204,470 tonnes of copper, and 2.5 million ounces of silver, for total gold equivalent resources of 1.6 million ounces. Reserves meanwhile total 849,880 ounces of gold, 2.2 million ounces of silver, and 405,380 tonnes of copper.

A detailed feasibility study is expected to be completed in the first half of 2026.

Meridian Mining last traded at $0.58 on the TSX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.