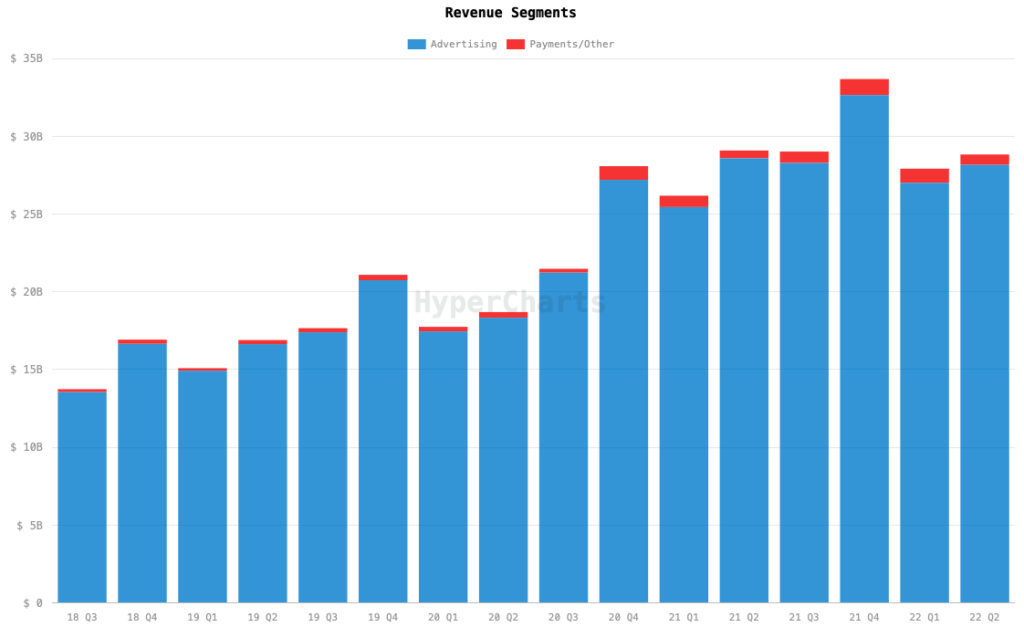

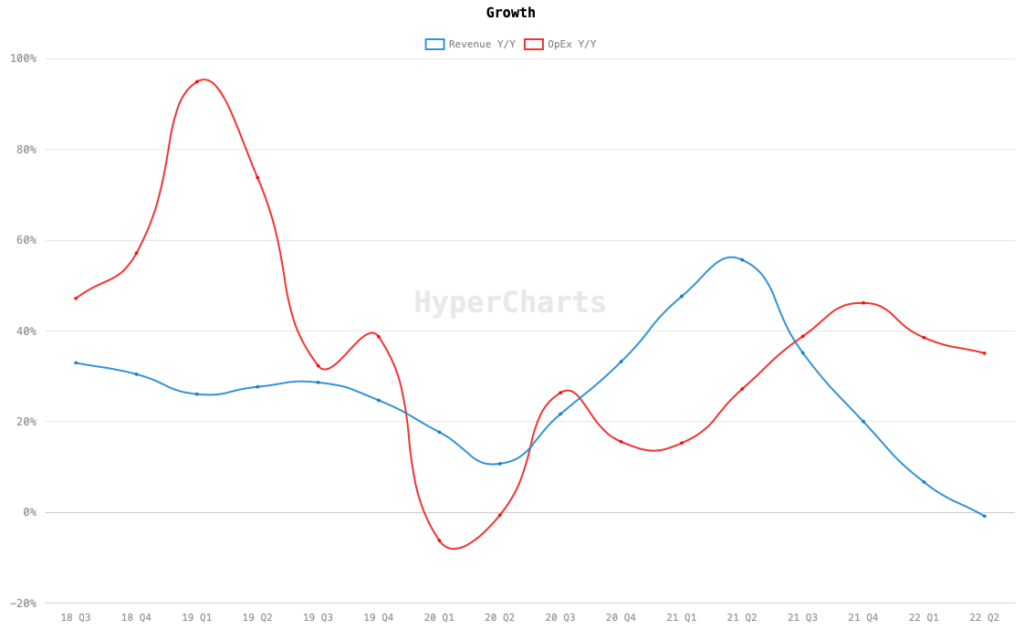

Meta Platforms (Nasdaq: META) reported its first-ever year-on-year revenue decline in Q2 2022. The tech giant recorded US$28.82 billion in quarterly revenue, down from Q2 2021’s US$29.08 billion and also missed the consensus estimate of US$28.93 billion.

The declining trend is expected to continue in the third quarter when the firm projects recording US$26 – US$28.5 billion in revenue, also a decline from Q3 2021’s US$29.01 billion.

“This outlook reflects a continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty,” said outgoing CFO David Wehner, who’s transitioning to the Chief Strategy Officer position. He will be replaced by Meta’s current VP of Finance Susan Li.

What increased year-on-year in Meta’s financials is total operating costs, ending at US$20.46 billion for the quarter, up from last year’s US$16.71 billion. This also led the firm to record a lower operating income at US$8.36 billion compared to previous year’s counterpart of US$12.37 billion.

Hugely dragging the income down is the net operating loss coming from the Reality Labs segment, amounting to US$2.81 billion.

“We also anticipate third quarter Reality Labs revenue to be lower than second quarter revenue,” Wehner added.

Despite this, Meta seems to be cutting fat from other parts as it projects 2022 full-year expenses to be US$85 – US$88 billion, down from its previous guidance of US$87 – US$92 billion. For the first six months, the firm has so far incurred a total of US$39.85 billion.

“We have reduced our hiring and overall expense growth plans this year to account for the more challenging operating environment while continuing to direct resources toward our company priorities,” Wehner explained. For the quarter, the tech firm recorded a 32% year-on-year increase in its company headcount, now standing at 83,553-strong.

This follows CEO Mark Zuckerberg’s pronouncements that the firm will slash down 30% of its hiring plans this year, attributing it to what he thinks is one of “the worst downturns” in recent history. The firm is also tightening its employee performance evaluation which could include to layoffs for “a bunch of people at the company who shouldn’t be here,” according to the Meta chief.

The lower revenue and increased expenses led the firm to end the quarter with a net income of US$6.69 billion, down from last year’s US$10.39 billion. This decline also translates to US$2.46 earnings per diluted share, down from US$3.61 in the year-ago period and also missing the estimate of US$2.50 per share.

The firm also generated a lower net operating cash amount of US$12.20 billion compared to last year’s US$13.25 billion. Free cash flow also declined to US$4.45 billion from last year’s US$8.51 billion.

This further led to the company ending the quarter with US$13.48 billion in cash, cash equivalents, and restricted cash. This puts the balance of the current assets at US$55.99 billion while current liabilities ended at US$22.22 billion.

“It was good to see positive trajectory on our engagement trends this quarter coming from products like Reels and our investments in AI,” said Zuckerberg. “We’re putting increased energy and focus around our key company priorities that unlock both near and long term opportunities for Meta and the people and businesses that use our services.”

Meta Platforms last traded at US$155.71 on the Nasdaq.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.