MicroStrategy (NASDAQ: MSTR), the largest public, non-crypto holder of Bitcoin, reported its first profit in nine quarters after claiming a tax gain due to its bitcoin hoard.

In Q1 2023, the software firm headed by Bitcoin advocate Michael Saylor earned $461 million, or $31.79 per share. During the period, the rise in the price of Bitcoin allowed MicroStrategy to reduce a reserve, resulting in a $453.2 million one-time tax benefit.

The bottomline is a turn around from the firm’s net loss last year of $131 million.

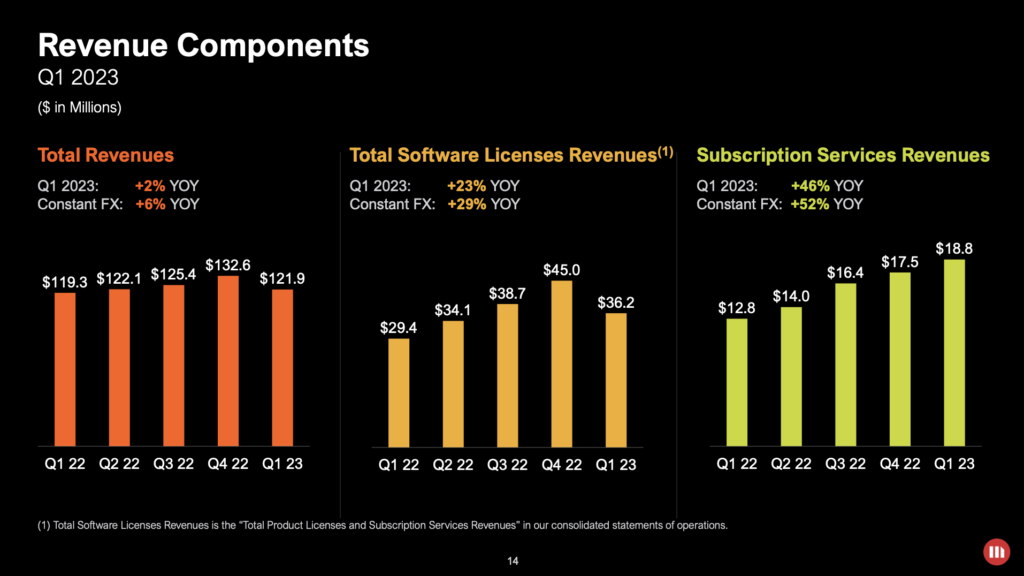

Revenue increased 2.2% to $121 million, exceeding $119 million, the analysts’ estimate as well as the topline figure in Q1 2022. For the three months ended March 31, the company took a $18.9 million impairment charge on digital assets, a huge drop from last year’s $170.1 million.

“The durability of our enterprise BI platform and the depth of our existing customer base continued to act as the drivers of growth in total revenue during the first quarter of 2023. The conviction in our bitcoin strategy remains strong as the digital asset environment continues to mature,” said CEO Phong Le.

CFO Andrew Kang added that the firm strengthened its capital structure in Q1 “by reducing leverage by fully repaying our bitcoin-backed loan.”

MicroStrategy stated that it paid Silvergate Bank $161 million to fully and voluntarily repay a $205 million Bitcoin-backed loan. As a result, Silvergate returned MicroStrategy’s 34,619 bitcoin in collateral. Silvergate Bank went bankrupt in March, and MicroStrategy stated at the time that it had no other exposure to the bank other than the loan.

$MSTR's income not enough to pay their debt interest, heaving cash, admit they may have to sell some assets including BTC to keep the lights on.

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) May 1, 2023

Capitulation odds rising. https://t.co/HozBe5WlSM pic.twitter.com/jFqqKRcPFc

$MSTR beat earnings by $30 a share. I don’t care if it’s based on their BTC strategy. They decreased operating losses by 61%. Gross profit increased by 79%. Its a win no matter how you look at it and if they need to sell BTC that’s okay. It’s part of their business strategy. 🤷🏻♀️ https://t.co/DMh1tsa1vb

— Canadian Jennifer 🇨🇦 (@cdntradegrljenn) May 1, 2023

MicroStrategy’s stock has risen in tandem with the rise of Bitcoin. So far this year, they are up 118%. Bitcoin has increased by almost 70% so far this year. Saylor stepped down as CEO of MicroStrategy last year to focus on advancing his approach for holding Bitcoin on the company’s balance sheet.

Saylor began purchasing Bitcoin in 2020 in order to lower the company’s cash holdings. According to its financials, MicroStrategy had a total cache of 140,000 Bitcoins at the end of March. During the quarter, the company added 7,500 Bitcoins.

Despite the fact that the total’s current market value is $3.9 billion, MicroStrategy noted that the amount’s carrying value is $2.0 billion due to cumulative impairment losses.

Since @MicroStrategy adopted a #Bitcoin Strategy: pic.twitter.com/rrYTbvOkUS

— Michael Saylor⚡️ (@saylor) May 1, 2023

The firm ended the quarter with $94.3 million in cash and cash equivalents, leading to accumulate $259.7 million in current assets. Meanwhile, current liabilities ended at $312.4 million

Snippet from $MSTR earnings tonight.

— J (@theirish_man) May 1, 2023

"Long-term cash requirements are primarily for long-term debt obligations, which exceed $2.2b"

They expect cash + cash equivalents not to be able to satisfy these obligations and *highlighted below* plan to dump assets, including $BTC 🫡 pic.twitter.com/Ex921aAUb3

MicroStrategy last traded at $312.92 on the Nasdaq.

Information for this briefing was found via Edgar, Bloomberg, Cryptoslate, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.