The list of countries shunning the US dollar is increasing. Ghana, a developing country located in West Africa, is carving out a new policy that will switch its mode of payment for oil products from US dollar reserves to gold.

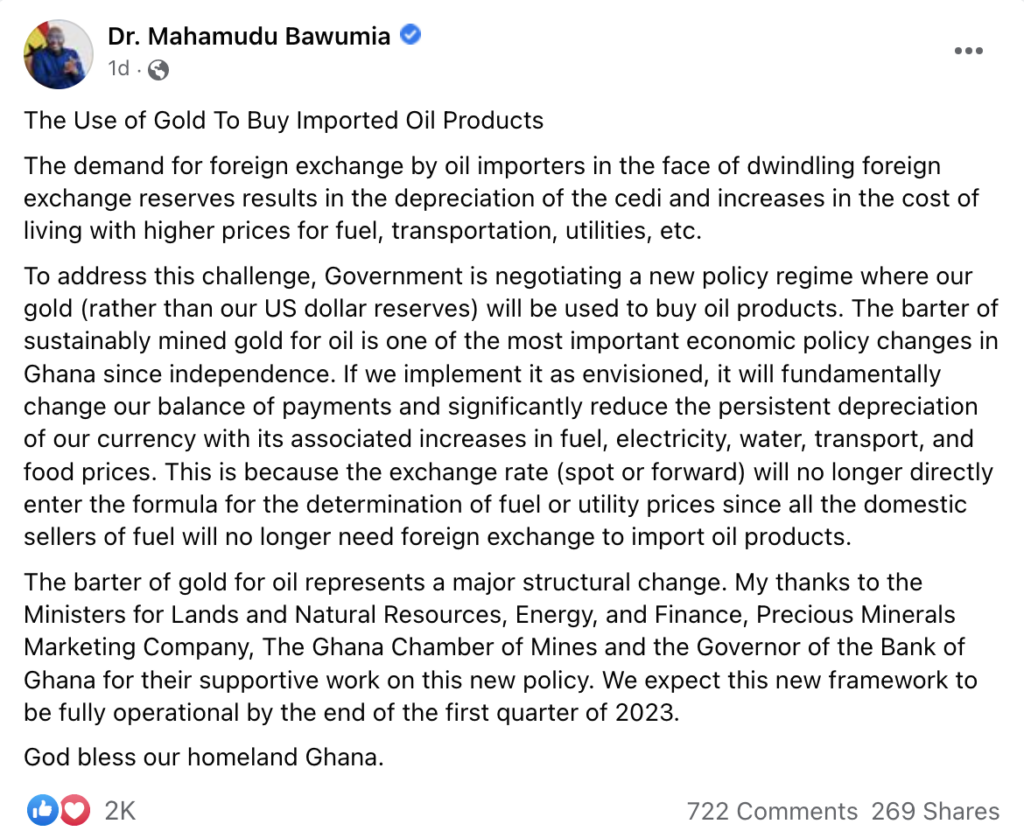

According to a Facebook post published by Ghana vice president Mahamudu Bawumia on Thursday, the government plans to introduce a bill that will use gold to purchase refined oil imports, amid a decline in foreign currency reserves and a simultaneous rising demand for dollars by importers, both of which are weakening the country’s currency and raising the cost of living.

“The barter of gold for oil represents a major structural change,” said Bawumia. The new policy “will fundamentally change our balance of payments and significantly reduce the persistent depreciation of our currency.”

By reverting to gold as the default payment method for oil, fuel and utility prices would be spared from the volatile impact of exchange rates, as domestic sellers wouldn’t need to rely on foreign exchange to purchase crude products. As of September 2022, Ghana had about $6.6 billion in gross international reserves, which would only pay for about three months-worth of imports. The figure is a substantial decline from the $9.7 billion in reserves reported at the end of 2021.

Still, such a move is somewhat unheard of. Although nations occasionally exchange oil for other commodities, such transactions are generally comprised of an oil-exporting country receiving non-oil goods rather than vice versa. Ghana does produce some crude oil, but largely relies on refined oil imports after its sole refinery closed following a 2017 explosion. The country’s government is currently working on a relief package with the IMF, as the African nation struggles to overcome one of the worst economic crisis in decades.

Information for this briefing was found via Facebook and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.