As widely expected, the Fed hiked rates half a percentage point on Wednesday, bringing the feds fund rate to the highest since December 2007. However, FOMC members signalled there is more pain to come, with projections of imminent hikes lessening the chances of a soft landing.

Fed Chair Jerome #Powell says he understands the hardship high #inflation is causing and forceful actions have been taken to tighten the stance of monetary policy; full affects of rapid tightening so far is yet to be felt.

— NYC Sidewalker🚶🏻 (@NYCsidewalker) December 14, 2022

FED Raises rates 50BPS #USA pic.twitter.com/TrFfgWBh5X

“Inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases,” said Fed Chair Jerome Powell in his follow-up press conference. “But it will take substantially more evidence to have confidence that inflation is on a sustained downward” trajectory.

On my way to save the market, hang on pic.twitter.com/ORkUF0etEN

— Not Jerome Powell (@alifarhat79) December 5, 2022

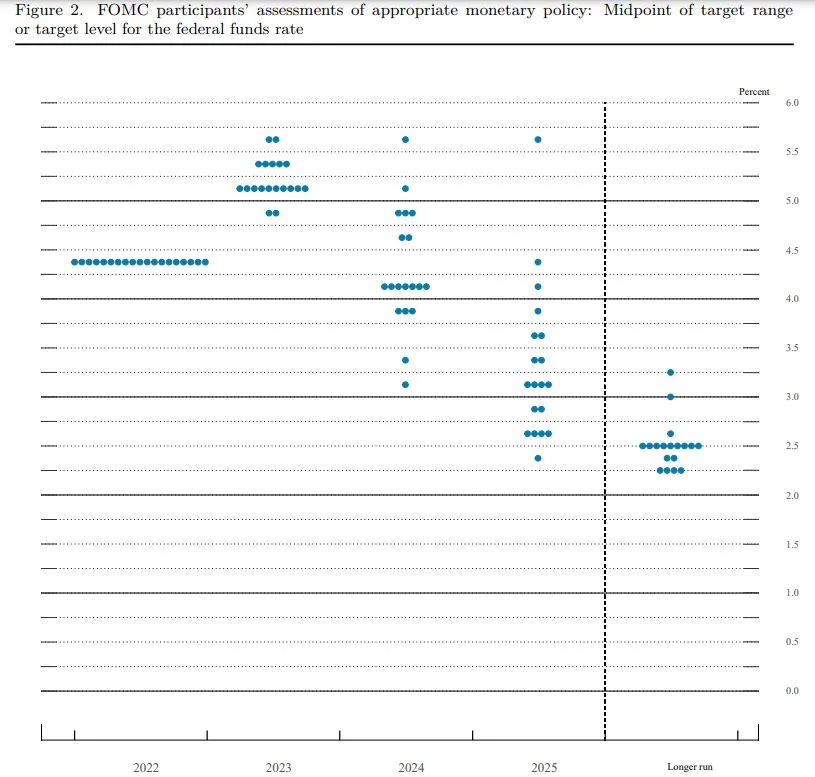

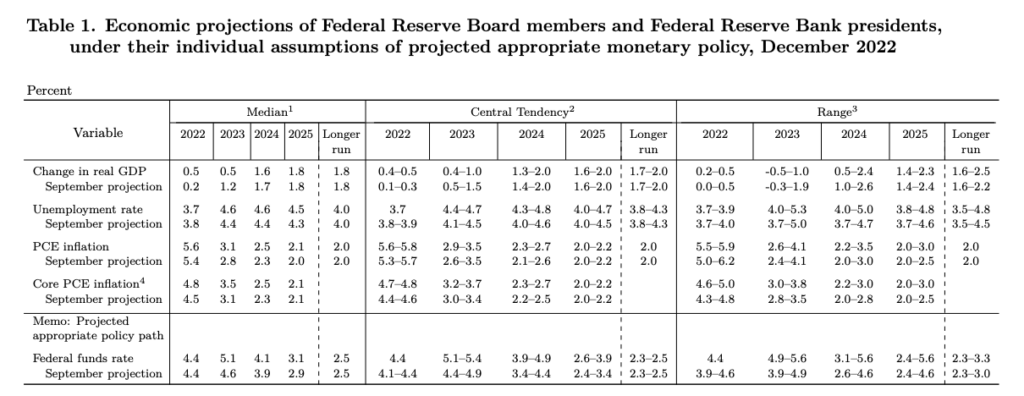

FOMC members voted to bring the feds fund rate to a target range between 4.25% and 4.5% on Wednesday. Along with the increase, officials are prepared to keep raising borrowing costs and keep them high until at least 2024. The FOMC’s infamous dot plot, which gauges individual members’ projections, suggests the terminal rate will sit at 5.1%, with 17 of the 19 dots showing rates above 5% throughout 2023, while seven members expecting rates above 4.1% the following year.

The dot plot peaking at 5.1% indicates that the Fed is taking a more aggressive approach to managing monetary policy. This could have significant implications for the broader economy, including the impact on Bitcoin. Time to brush up on your macroeconomics! #finance pic.twitter.com/jdr9glW5f2

— db (@tier10k) December 14, 2022

“I would say it’s our judgment today that we’re not in a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes will be appropriate,” Powell explained. With no reduction in interest rates until sometime in 2024, the FOMC slashed its growth forecasts for 2023, with GDP growth downgraded from 1.2% to a paltry 0.5%— just slightly above what economists would define a recession. Likewise, this year’s economic expansion was also put to 0.5%.

With respect to inflation, the committee increased its core inflation gauge by 0.3 percentage points from September’s outlook to 4.8%. “There’s an expectation really that the services inflation will not move down so quickly, so we’ll have to stay at it,” Powell explained. “We may have to raise rates higher to get where we want to go.”

When asked if a soft landing is no longer possible given the gloomy economic expansion against the most hawkish tightening cycle since the 1980s, Powell said there is still a chance to avoid a recession, albeit a diminished chance. “No, I wouldn’t say that. No, I don’t say that,” he said during the press conference. “To the extent we need to keep rates higher and keep them there for longer inflation … I think that that narrows the runway, but lower inflation readings, if they persist in time, could certainly make it more possible.”

Information for this briefing was found via the Federal Reserve and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.