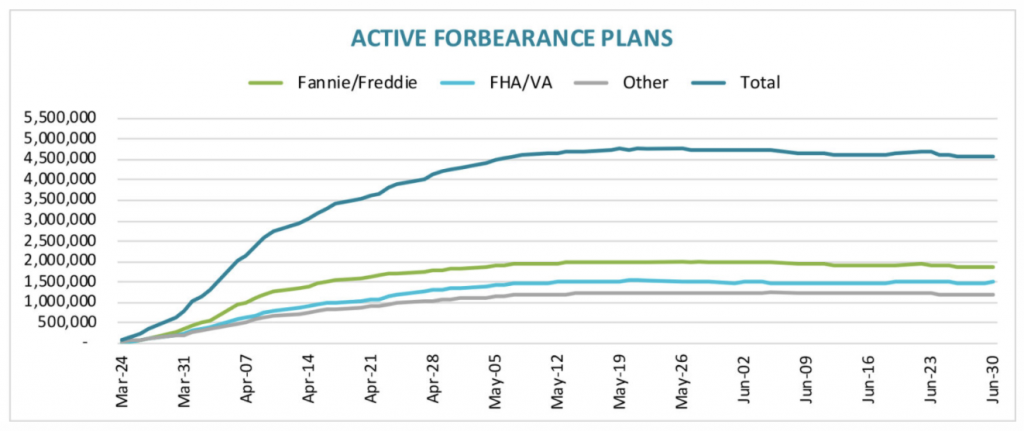

During the height of the pandemic, many homeowners in the US found themselves in some form of financial trouble, and as a result, had no other option but to put their mortgage into a forbearance plan. Luckily for those mortgage loans that were government-backed, the CARES Act included a mortgage bailout program that would allow homeowners to forego their monthly payments for anywhere between three months to a year.

However, given the severity of the financial ruin stemming from the coronavirus pandemic, many other private lenders and banks also followed suit with similar forbearance options of their own.

Now that it has been nearly four months since such forbearance programs have been introduced, the severity of the financial ruin left behind by the pandemic is becoming more evident. According to mortgage data and technology firm Black Knight, the total number of mortgages in forbearance plans topped 4.58 million as of June 30.

The figure depicts 8.6% of all active mortgages in the US, which have declined by 2% since the week prior. When added up, the total number of mortgage loans on forbearance programs are equivalent to approximately $995 billion in unpaid principal.

The total number of loans in forbearance declined by 104,000 since the previous week, paving the way for the biggest weekly drop since such programs began back in late March and early April. According to Black Knight economist Andy Walden, the shift to a decrease in forbearance volumes comes amid late fees that came into effect on the 15th of June, which in turn deterred homeowners from entering into further forbearance plans. Furthermore, over half of current forbearance plans came affixed with 90-day-periods, which are now beginning to expire or are due for a review in the event of an extension.

According to data that tracks mortgage payments daily, the end of June saw approximately 25% of those homeowners in forbearance programs make their June payment regardless, suggesting that further extensions are not required. However, there are still many more homeowners that do still need to forego their mortgage payments due to continued unemployment, and the scheduled conclusion of employment benefits on July 31.

Information for this briefing was found via CNBC and Black Night. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.