Save Canadian Mining (SCM), a movement that aims to “return market rules to the fair and transparent standard” particularly fighting against the practice of short selling, has announced that it will be holding an emergency session on this coming Black Friday, November 24.

“The world is changing and now is the time for Canadian markets to deal with this problem. A problem that is costing Canadian investors billions of dollars!” the movement said in its announcement.

The event is said to be attended by industry names like Eric Sprott, Wes Christian, and David Wenger.

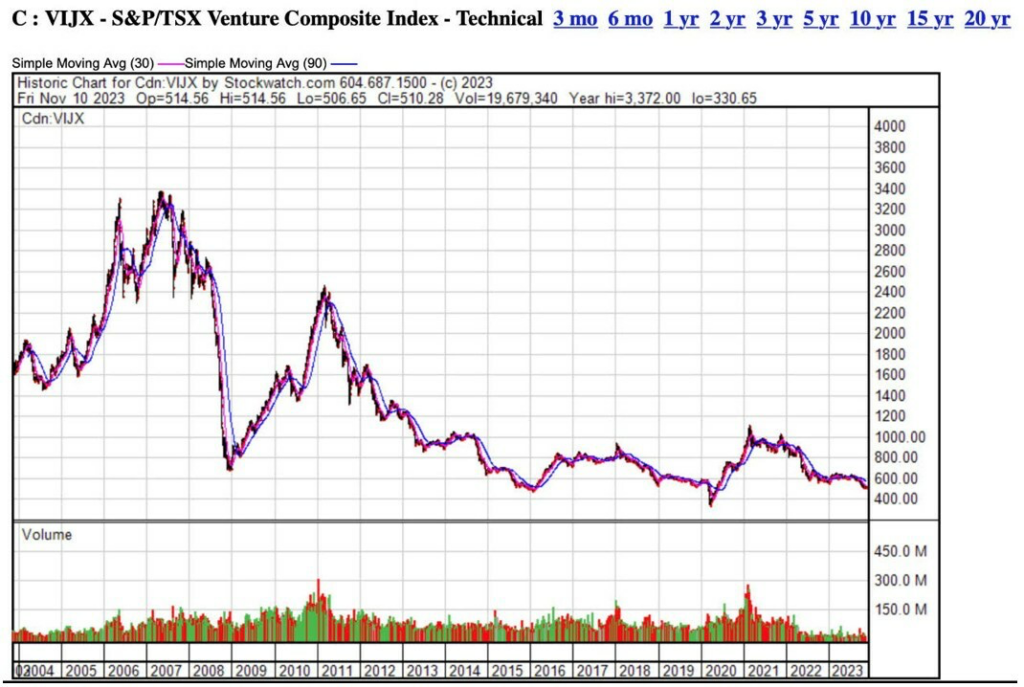

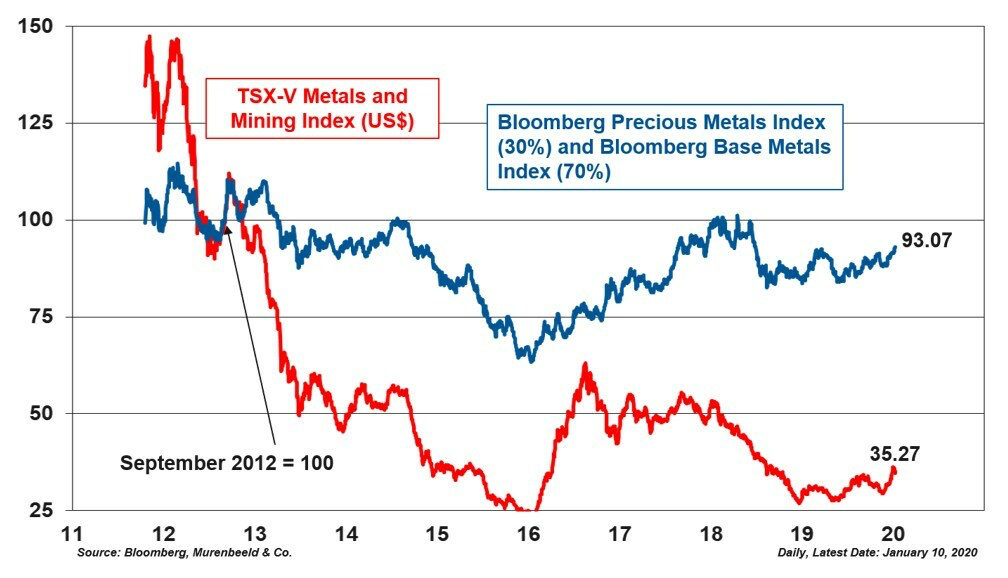

SCM points to the TSX Venture “trading at all time non-pandemic lows despite robust commodity markets” as the reason for the emergency session.

“This is not a normal cyclical market cycle… World leaders are finally recognizing the real root of the crisis. On Nov 5th South Korea banned short selling. Their leadership cited concerns about increasing market volatility and illegal short-selling practices undermining market stability,” the movement said.

SCM highlighted that there’s a $26.4 billion TSXV market cap of index participants, noting that the exchange is at 35.27% versus the commodity index of 93.07%, when comparing valuations to a baseline figure established in September 2012.

“We used to be at or above that level. What does this loss represent in market value… $42 billion,” the group emphasized.

The movement added that subsequent to the decision on September 29th in the case of Harrington Global Opportunity Fund Ltd. v CIBC World Markets Inc et al., broker-dealers may now face primary liability if they fail to meet their “Gatekeeping Responsibilities” concerning the monitoring of their clients’ trading activities.

“This case about spoofing and abusive naked short selling is reverberating in brokerage compliance offices around the world,” they added.

Alongside the protest against short selling, a Change.org petition is ongoing to implement a temporary ban on short selling in Canadian stock markets. Launched by Jay Roberge, the petition is only around 400 signatures away from its goal.

“As a deeply concerned Canadian investor, I am witnessing the devastating impact of short selling on our stock markets. Every day, investors and issuers across Canada are losing millions of dollars due to this practice. This is not just an abstract economic issue – it affects real people’s lives and livelihoods,” Roberge said.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.