FULL DISCLOSURE: This is sponsored content for Nations Royalty.

There’s a new type of royalty on the block – at least for the common investor. Benefit agreement royalties, which can be viewed as the last untapped reservoir of royalties. These royalties, which have been established between resource companies and Indigenous communities, present a unique opportunity to bridge historical gaps in resource ownership and benefit distribution, setting a new standard for socially responsible investment.

These royalties empower First Nations to harness the financial benefits from their lands. This approach not only enhances the economic sovereignty of Indigenous communities but also ensures that the wealth generated from natural resources is equitably shared and managed.

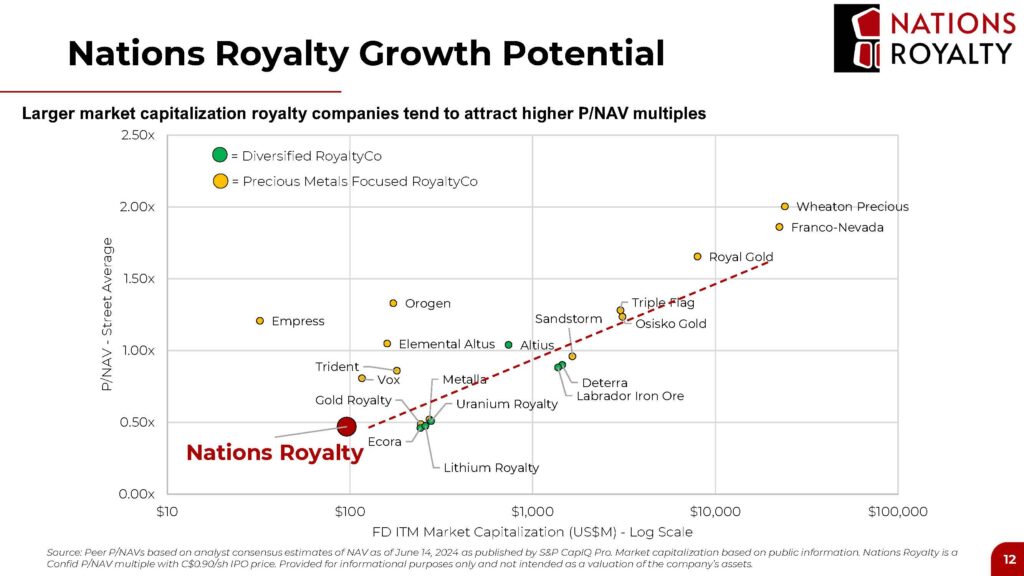

Small-cap issue Nations Royalty Corp. (TSXV: NRC) is a pioneer in this space, having been presented on February 1, 2024, as the first company to capitalize on the opportunity. The firm, founded by the Nisga’a Nation of British Columbia and mining legend Frank Giustra, aims to bring a new spin to the royalty space by offering a socially equitable investment. Nations Royalty is set to revolutionize the royalty space by tapping into the largely untouched reservoir of Indigenous-owned royalties, enabling First Nations to unlock significant net asset value (NAV) multiples on their current agreements, while enabling them to diverse their royalty holdings.

I believe that Nations Royalty will be as impactful in the mining and royalty space as when we founded Wheaton Precious Metals and introduced the concept of Metals Streaming in 2004

Frank Giustra, founder

The Indigenous royalties

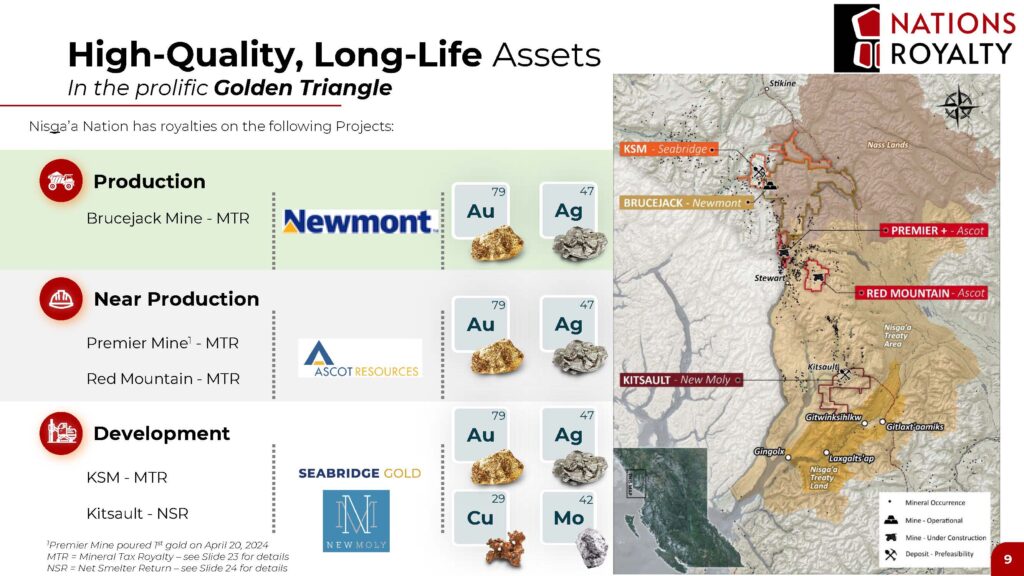

Nations Royalty’s portfolio is centered around high-quality, long-life assets within the prolific Golden Triangle. The company has secured royalties on several significant mining projects, categorized into production, near-production, and development stages.

- The Brucejack Mine, operated by Newmont Corporation (TSX: NGT), is already operational and projected to produce an average of 310,000 ounces of gold annually. This mine, with reserves of 11.5 million tonnes grading 8.44 grams per tonne (g/t) gold and 34.71 g/t silver, operates under a Mineral Tax Royalty (MTR) agreement, with an all-in sustaining cost (AISC) of US$743 per ounce.

- The Premier and Red Mountain Projects, managed by Ascot Resources Ltd. (TSX: AOT), are near production. These projects are expected to produce an average of 137,000 ounces of gold equivalent annually. The Premier project holds reserves of 3.63 million tonnes at 5.45 g/t gold and 19.11 g/t silver, while the Red Mountain project has 2.54 million tonnes at 6.52 g/t gold and 20.60 g/t silver. Both projects also operate under MTR agreements with an AISC of US$769 per ounce.

- In the development stage, the KSM Project by Seabridge Gold Inc. (TSX: SEA) is one of the world’s largest undeveloped gold-copper projects. This project is projected to produce an average of 1,452,000 ounces of gold equivalent annually from open pit mining and 1,147,000 ounces from block cave mining. The reserves for KSM include 2,292 million tonnes at 0.64 g/t gold, 0.14% copper, 2.2 g/t silver, and 76 ppm molybdenum, with an estimated AISC of US$601 per ounce. This project also falls under an MTR agreement.

- The Kitsault Project, developed by New Moly LLC, focuses on molybdenum and silver. This project is expected to produce 24 million pounds of molybdenum and 93 million pounds of copper equivalent annually. The reserves include 231 million tonnes at 0.082% molybdenum and 5.3 ppm silver, with a total cash cost of US$4.80 per pound. This project operates under a Net Smelter Return (NSR) royalty agreement.

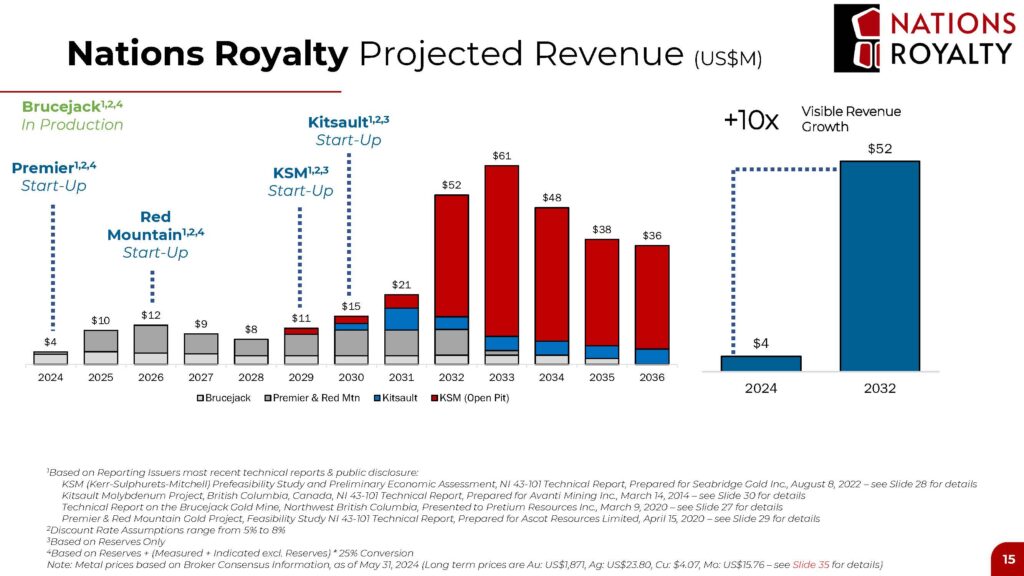

Nations Royalty projects a significant growth trajectory, anticipating a tenfold increase in visible revenue from 2024 to 2032. The company’s diversified portfolio is expected to generate substantial revenues, with Brucejack and KSM being the primary contributors in the near term.

According to revenue forecasts, the company expects to earn $4 million in 2024, growing to $52 million by 2032. These projections are based on comprehensive data from technical reports and public disclosures by the respective mining companies, considering factors such as metal prices, production forecasts, and operational costs.

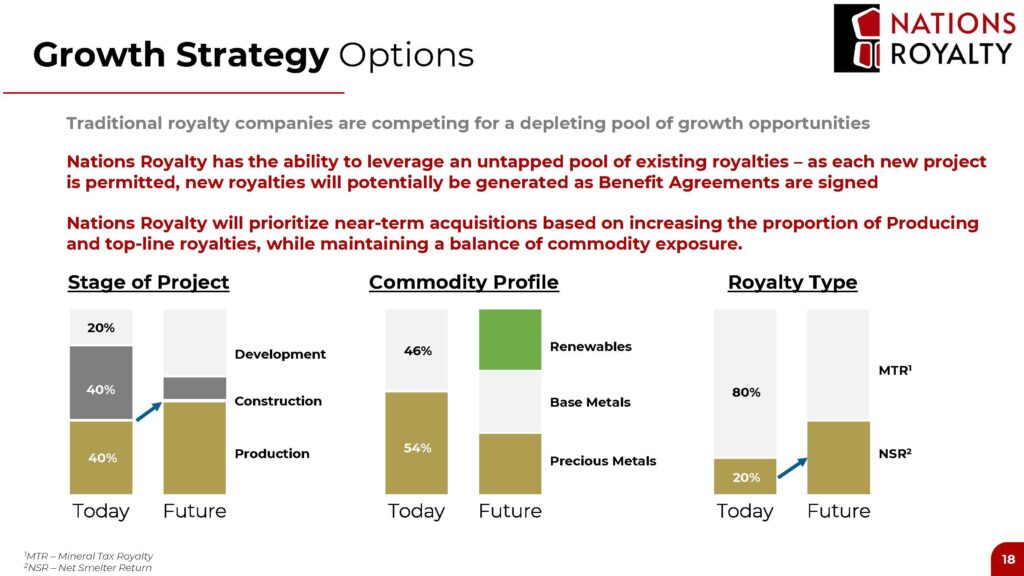

And there’s plenty of room for growth in the space. This sector of the market has been previously untapped, yet Canada is home to over 150 benefit agreements that have been put in place between mining operations and Indigenous communities, which resulted in Indigenous payments of $236 million in 2022. Nations Royalty has a vision to add further First Nations groups as long term shareholders, which will be subjected to contractual escrow, while broadening the exposure to a diversified set of commodities.

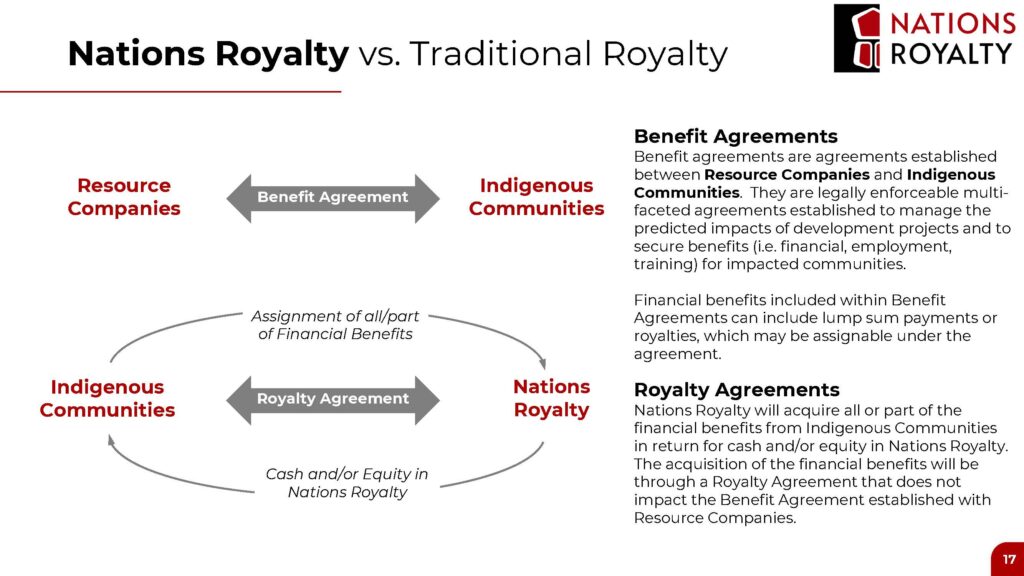

Benefit Agreement Royalties

Nations Royalty distinguishes itself from traditional royalty companies through its focus on Benefit Agreement Royalties. Traditional royalty companies typically acquire royalties directly from resource companies, often competing for a dwindling pool of growth opportunities. In contrast, Nations Royalty’s model involves acquiring financial benefits from Indigenous communities in exchange for cash and/or equity.

These agreements do not impact the original Benefit Agreements established with resource companies, allowing Indigenous communities to retain control and derive financial benefits from their resources. According to the company, Nations Royalty leverages an untapped pool of existing royalties, with new opportunities arising as additional projects are permitted and Benefit Agreements are signed. This strategy ensures a steady pipeline of new royalties, promoting sustainable growth and financial stability for both investors and First Nations.

Nations Royalty represents a significant advancement in the integration of Indigenous communities into the financial benefits of natural resource development. By unlocking the value of Benefit Agreement Royalties, Nations Royalty not only provides substantial economic opportunities for First Nations but also offers investors a unique and socially responsible investment opportunity.

“To be a self-sustaining Nation, independent of Government transfer payments, Nisga’a will require Assets under Management of over $8 Billion. We intend to grow Nations Royalty as a cornerstone Public Company and Investment,” said Charles Morven, Secretary & Treasurer, Nisga’a Lisms Government.

FULL DISCLOSURE: Nations Royalty is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Nations Royalty on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.