The still-halted Neotech Metals (CSE: NTMC) appears to have been made into an example by Canadian regulators, whom are cracking down on excessive “close-ology” comparisons on junior mining investor decks and websites.

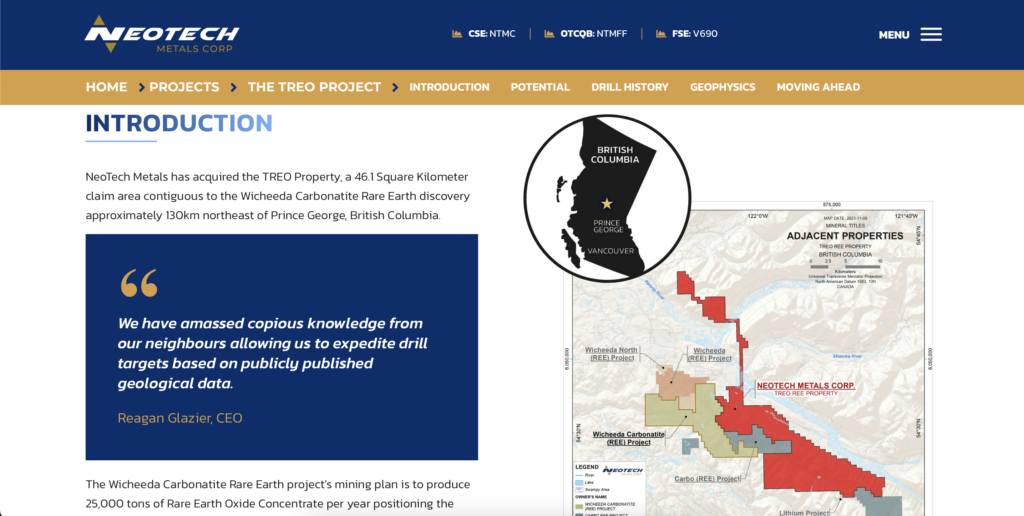

The company last night was made to issue a clarification on its technical disclosures, identifying that it had gone too far in comparing its TREO property in British Columbia to that of the Wicheeda project, which sits next door and is owned by Defense Metals (TSXV: DEFN). The company had previously extensively discussed the project who’s open pit design under current modeling is said to be within 350 metres of historical drilling at TREO.

“The Wicheeda Property is adjacent to the Company’s TREO Property; however, the Company wishes to reiterate that the proximity of the Wicheeda Property to the TREO Property does not mean the properties share similar mineralization attributes, nor that any mineral resources or mineral reserves that may be contained in the Wicheeda Property are indicative of any mineralization at the TREO Property,’ reads the statement issued by Neotech last night.

READ: Neotech Metals Faces Prolonged Trading Suspension For “Unexplained And Unusual Fluctuations”

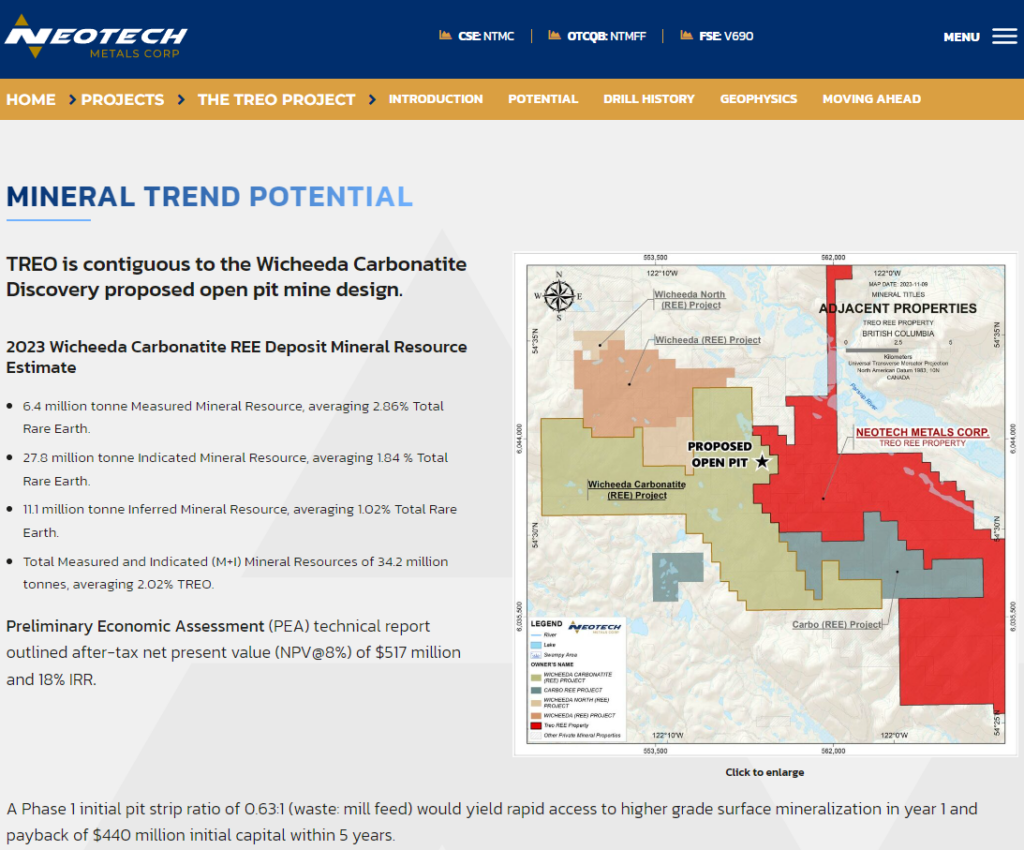

While issuers are permitted to compare their mineral properties to peers under National Instrument 43-101, the information should be clearly distinguished between the issuers asset and the comparison asset. This is arguably where Neotech fell short, with the upper portion of the webpage dedicated to the TREO project instead discussing Wicheeda, going as far to provide details on a recent preliminary economic assessment, strip ratios, and CapEx estimates.

The company has since removed any mention of Wicheeda from its TREO page, and the investor presentation has been removed by the company, with a new version yet to be released.

To add salt to the wound, the British Columbia Securities Commission, in conducting a full review of the company, identified that Neotech failed to include required technical disclosures on data verification and QA/QC in recent press releases.

The clarification of technical disclosures and full probe by the BCSC follows Neotech being halted in late December following a sharp run-up in its share price. The regulator, noting that it ran from $1.06 to $2.575 per share following an influx of volume over a five day period, on December 21 elected to halt the trading of Neotech until January 8, citing “unexplained and unusual fluctuations” in the equity.

Neotech Metals last traded at 3.19 on the CSE.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Kinda disheartening to get these news. How much its gonna affect the stock?

Why