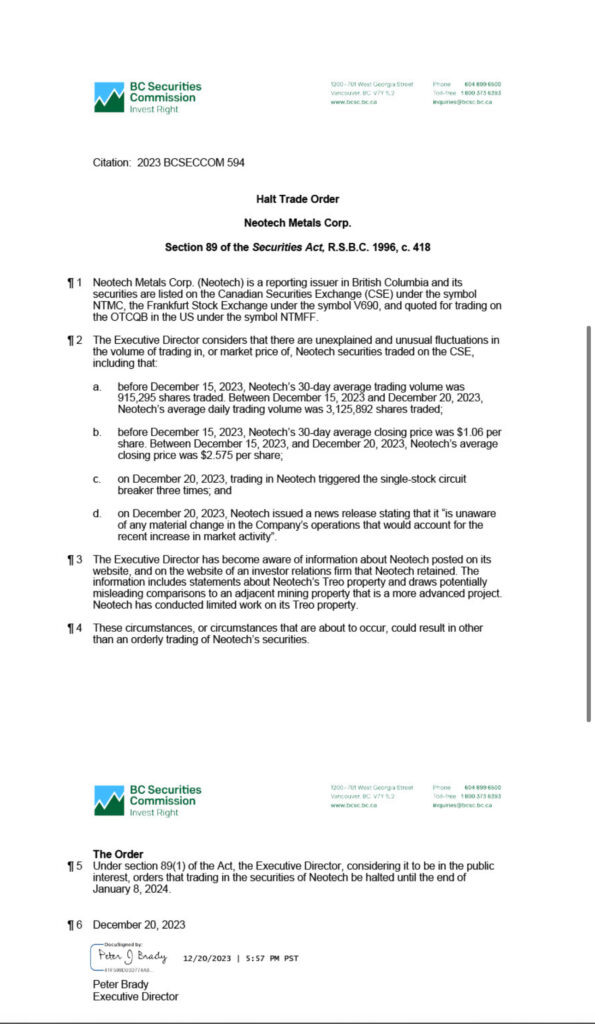

The Canadian Securities Exchange (CSE) has taken the decision to suspend trading in Neotech Metals Corp. (CSE: NTMC) until January 8, 2024, citing “unexplained and unusual fluctuations” in the company’s stock. The British Columbia Securities Commission (BCSC) issued the trading halt order, pointing to concerning trading patterns and potentially misleading statements made by Neotech.

Neotech Metals experienced a significant surge in both trading volume and stock price between December 15, 2023, and December 20, 2023. The BCSC highlighted that the 30-day average trading volume surged from 915,295 shares to 3,125,892 shares during this period. Similarly, the average closing price rose from $1.06 per share to $2.575 per share.

The BCSC expressed particular concern about the single-stock circuit breaker being triggered three times on December 20, 2023. Neotech issued a news release on the same day, stating that it was “unaware of any material change in the Company’s operations that would account for the recent increase in market activity.”

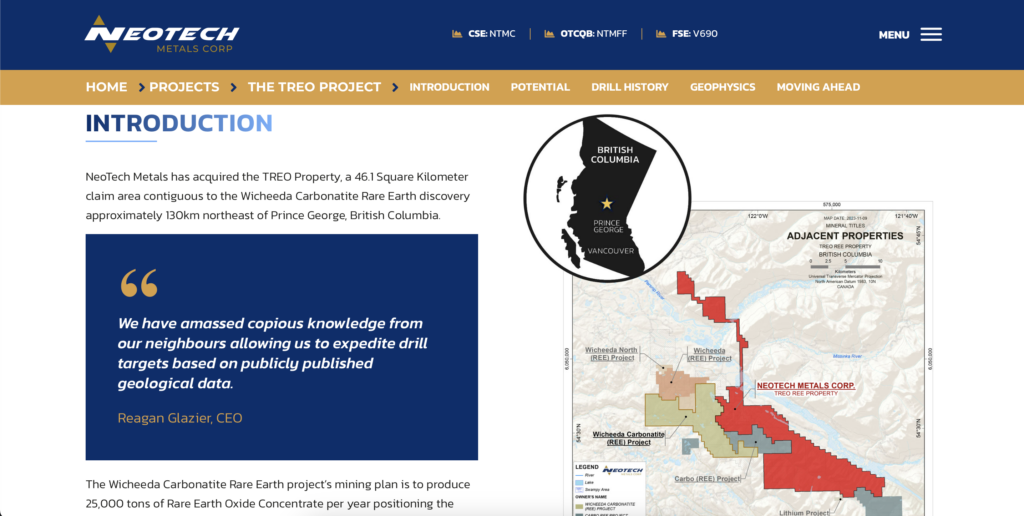

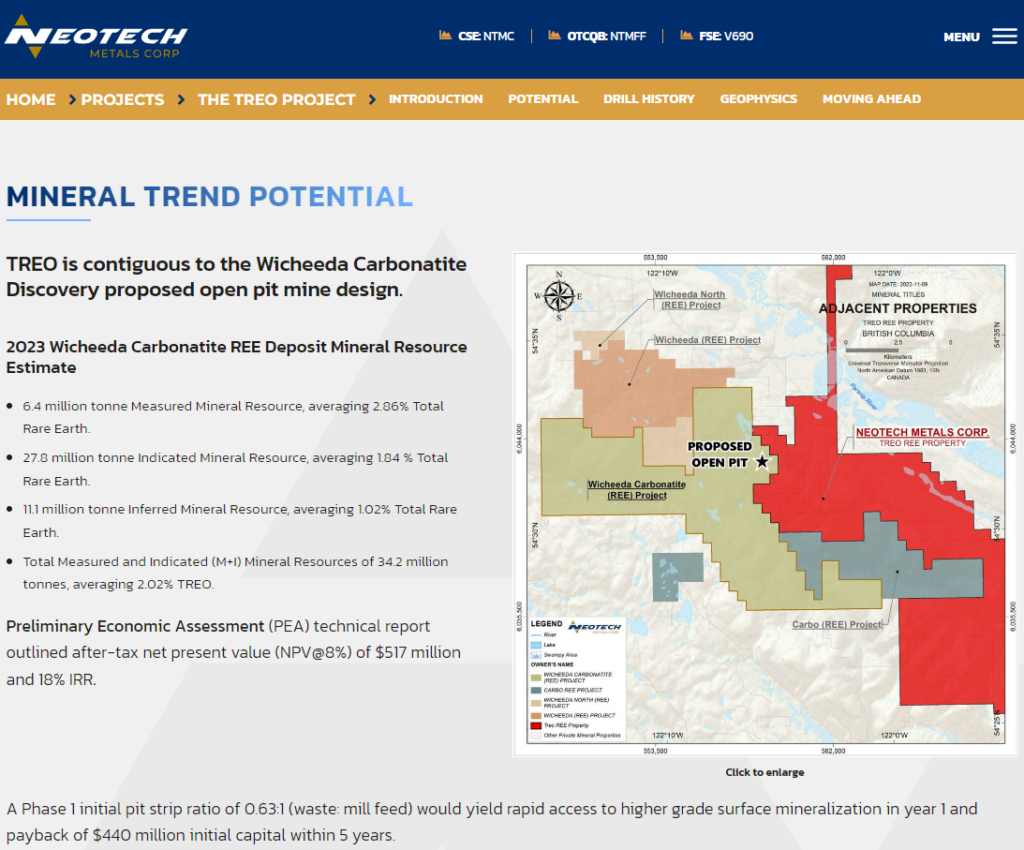

The BCSC also pointed out potentially misleading statements on Neotech’s website and a third-party investor relations firm’s website. These statements included comparisons between Neotech’s Treo property and an adjacent mining property, despite Neotech having conducted limited work on its Treo property. The BCSC emphasized that such circumstances could lead to disorderly trading of Neotech’s securities.

Under section 89(1) of the Securities Act, the Executive Director of the BCSC ordered the halt, deeming it to be in the public interest. The suspension will remain in effect until the end of January 8, 2024.

Neotech’s recent trading activity raised eyebrows as its stock, previously under $1 until November 30, 2023, reached a high of $4.15. The BCSC noted that the company’s website extensively covers its Treo property, drawing comparisons to an adjacent property called Wicheeda, which is owned by Defense Metals (TSXV: DEFN).

The company’s website goes as far as specifically detailing the mineral resource estimate of the property being developed by Defense Metals, including details of a preliminary economic statement, strip ratios, and where it is situated within the industry amongst peers. The company then goes on to highlight that the open pit design of the project is within just 350 metres of certain holes drilled at the TREO property.

The BCSC emphasized that Neotech’s work at Treo has been limited, with only 20 drill holes from 2010 and 2011 listed on its website.

While Neotech continues to trade in the U.S. on the OTC Markets, the BCSC’s intervention reflects regulatory concerns about the company’s recent market behavior and the potential impact of misleading information on investors.

Neotech Metals Corp. had acquired the majority of claims underlying Treo in September 2023 for $50,000 and 100,000 shares. The company had also recently added the Thor property in Nevada to its portfolio. The market capitalization of Neotech stood at $147.4 million before the trading suspension.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

So I understood every aspect of what Neotech was reporting that it was speculative. However being of sound mind and judgement I decided to invest based on global demand for rare Earth metals. My strategy was based on the needs to develop mining of this type in the Americas. I did not find the statements on Neotech’s site misleading in any way. However, the canadian exchanges desire to step in and ruin this investment because they either do not understand or are working for the best interests of CCP had major financial consequences. The big government meddling produced major decline in stock trading price and a total loss of liquidity. I could go on about the criticality of rare Earth minerals and how they are the backbone of all our modern technology and the importance of removing the dependence on Chinese mining, but I have a feeling that would go right over the head of the canadian regulators.