Last week, Netflix (NASDAQ: NFLX) announced that Universal and Netflix have extended their exclusive license deal for animated feature films. It is also notable that Netflix is one behind HBO/HBO Max for Emmy nominations at 129. Netflix also announced that it wanted to get into the gaming industry.

Netflix currently has 45 analysts covering the stock with an average 12-month price target of $614.18, the street high sits at $1,154 from Elazar Advisors and the lowest comes in at $340. Out of the 45 analysts, 14 have strong buy ratings, and 21 have buy ratings. 6 analysts have hold ratings, three have sell and a single analyst has a strong sell rating on Netflix.

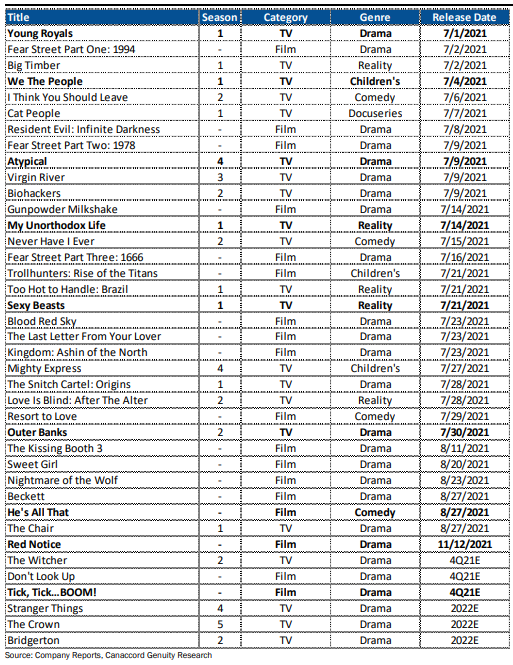

Canaccord put out a note following the announcement, revising their estimates. They are raising their full-year 2021 global subscriber estimates but keeping revenue estimates basically the same. They believe that the second half of 2021 is where Netflix starts to have more subscriber growth as their release schedule gets better. For the second quarter, Canaccord is estimating subscriber growth will be slightly higher than management’s guidance at 1.1 million net adds.

Netflix is expected to release many fan favourites that have been delayed by COVID-19 such as Ozark, The Crown, and Stranger Things. This comes as Netflix is also boosting their children’s content and will be expanding local language content.

Below you can see Canaccord’s updated 2021, 2022, and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.