Netflix (Nasdaq: NFLX) reported its Q4 2022 financials, headlined by $7.85 billion in revenue. This is a decrease from Q3 2022’s $7.93 billion but an increase from Q4 2021’s $7.71 billion.

“Revenue was slightly above our beginning-of-quarter projection, as paid net adds of 7.7M (vs. 8.3M in Q4’21) came in higher than our 4.5M forecast, due to both strong acquisition and retention, driven primarily by the success of our Q4 content slate,” the company said in its letter to shareholders.

Paid membership base at the end of the quarter came in at 230.75 million subscribers, rising by 7.66 million users from the previous quarter. The Europe, Middle East, and Africa (EMEA) market took the lion share of this increase with 3.2 million new memberships–putting the region now as the firm’s largest market ahead of US & Canada group.

However, operating income fell down to $549.9 million from last quarter’s $1.53 billion and last year’s $631.8 million. Nevertheless, the figure was above the firm’s forecast of $330 million.

Net income further slumped to $55.3 million, down from Q3 2022’s $1.40 billion and Q4 2021’s $607.4 million. The huge decline is mainly due to a $340.0 million expense under interest and other income stemming from the “foreign currency remeasurement on Euro denominated debt” when the US dollar depreciated against the Euro during the quarter.

The bottomline translates to $0.12 earnings per share, below the firm’s $0.36 per share forecast.

The streaming giant also announced that CEO Reed Hastings is stepping down and will assume the Executive Chairman role. COO Greg Peters will be ascending to serve alongside current co-CEO Ted Sarandos.

“Our board has been discussing succession planning for many years (even founders need to evolve!),” Hastings said in a blog post. “The board and I believe it’s the right time to complete my succession.”

In addition to these adjustments, Scott Stuber has been named Chairman of Netflix Film, and Bela Bajaria, formerly Head of Global TV, has been named Chief Content Officer.

The firm also noted that it plans to “start rolling out paid sharing more broadly” in Q1 2023, saying that widespread account sharing–estimated to be around 100 million households–“undermines [their] long term ability to invest in and improve Netflix.”

READ: Netflix To Offer Cheaper Ad-Supported Plan For $6.99

In the first quarter of 2023, Netflix forecasts revenue to grow by 4% considering foreign currency exchange. Net additional paid memberships are also expected to be “very different” as it launches paid sharing.

Operating margins for the next quarter is expected to be down year-over-year “due primarily to the timing of content spend.”

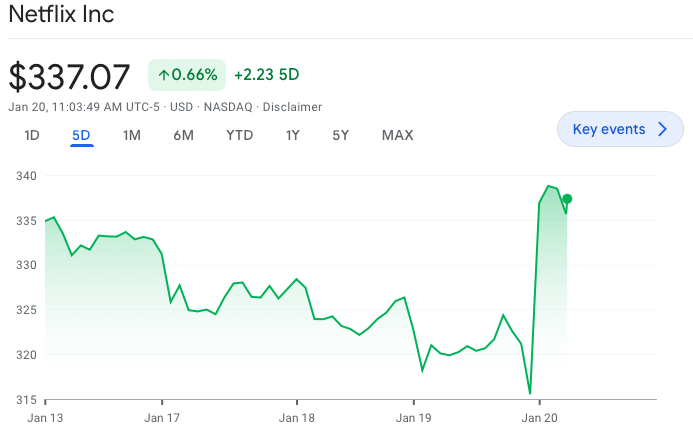

The firm’s share prices rallied by as much as 7.4% when the markets opened following the financials release.

Netflix last traded at $336.94 on the Nasdaq.

Information for this briefing was found via the the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Canadian Capital Doesn’t Have The Guts to Make Movies

As the members of the US Screen Actor’s Guild join their counterparts in the Writers...