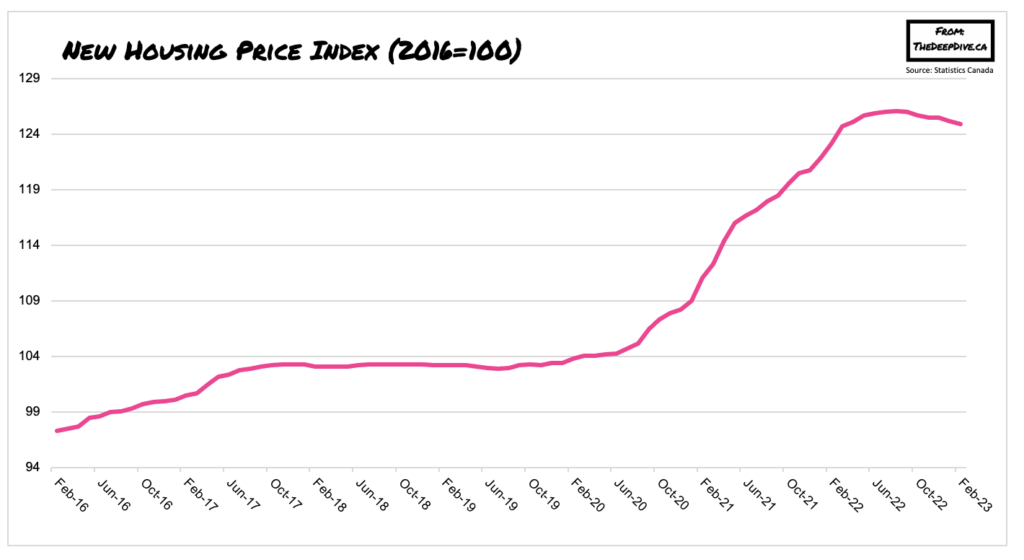

The price of a new home in Canada continues to decline, as rising borrowing costs put downward pressure on demand.

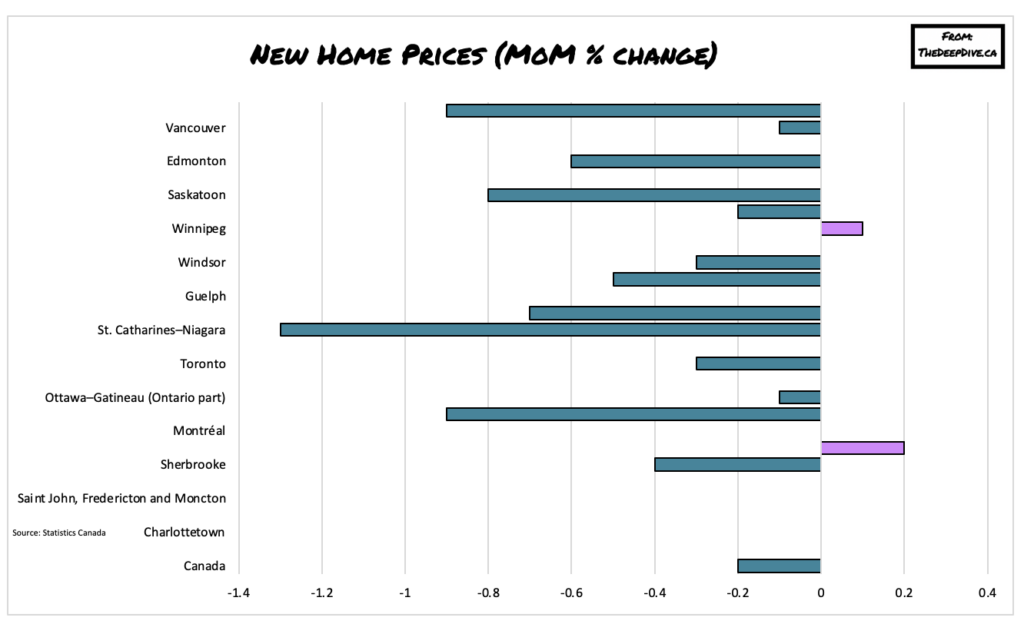

The new housing price index dropped 0.2% between January and February, with 25 of the 27 census metropolitan areas noting declines. Compared to one year ago, however, the price of a new home was up 1.4% nationally, which is still substantially lower than the 10.9% annual increase recorded in February 2022, when the Bank of Canada’s overnight rate sat at 0.25%.

In some of Canada’s most costly housing markets, including those located in Greater Golden Horseshoe (Oshawa, Toronto, Hamilton, St. Catharines–Niagara, Kitchener–Cambridge–Waterloo and Guelph), Vancouver and Victoria, new home price growth failed to escalate, remaining stagnant between a range of -1.1% to 0.3%. On the other hand, though, the less expensive housing markets of Calgary, Windsor, and Ottawa reported some of the biggest year-over-year price increases, with gains of 6.8%. 4.9%, and 4.5%, respectively.

Separately, the Canadian Home Builders’ Association reported a 58.7 point annual decline in builder confidence for the final quarter of 2022, citing a substantial decline in housing market uncertainty and rising borrowing costs.

Information for this briefing was found via Statistics Canada and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.