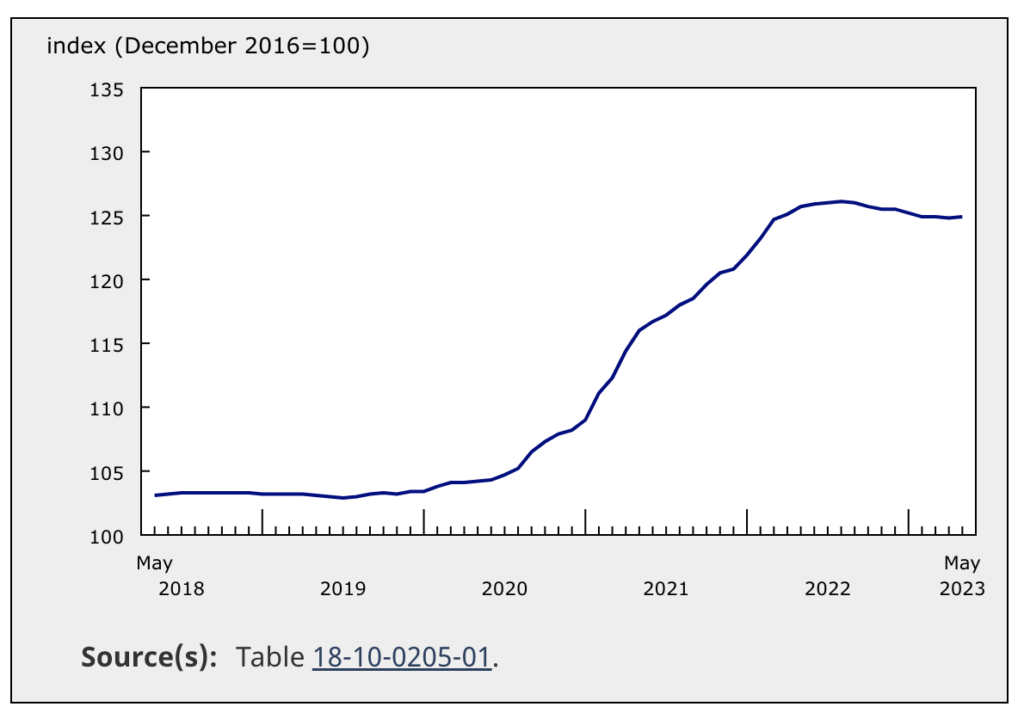

The price of a new home in Canada climbed upwards in May thanks to higher building material costs, but the price growth witnessed during the low-interest rate era is rapidly losing momentum.

Statistics Canada’s New Housing Price Index edged up 0.1% month-over-month in May, marking the first such increase since August 2022 with price gains noted across 7 of the 27 census metropolitan areas (CMAs) surveyed.

The CMAs of Quebec, Calgary, and Kelowna reported the largest increases, with prices of new homes rising 0.9%, 0.8%, and 0.6%, respectively. Builders blamed elevated construction costs for the sudden price growth rather than higher demand for housing. The CMAs of Sudbury and Sherbrooke, meanwhile, suffered the largest monthly declines in new home price growth, declining 1.2% and 0.7%, respectively, as builders in those regions reported dismal market conditions.

Compared to one year ago, however, national home prices slumped 0.6%— a stark contrast to the 8.4% year-over-year increase reported in May 2022. The annual decline comes in light of the impact of higher interest rates on the housing market. Nineteen of the 27 CMAs noted year-over-year declines, with the largest drop in new home prices occurring in Victoria, St. Catharines-Niagara, and Edmonton.

Information for this story was found via Statistics Canada. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.