When it comes to juniors within the mining space, regardless of the metal that is being searched out, there is one common problem that we hear among investors: risk. Inherently, there is a large risk in any junior explorer whom has taken the time to acquire property in search of high grade or bonanza grade metals, which is simply that the metal may not be in the ground as perceived or hoped. For this, the juniors are typically punished in the form of small market caps until they manage to prove out a sizable resource.

But what if this process could be avoided? The process of spending millions of dollars to determine a viable resource, the endless financings to fund such operations, the years of waiting for production (or a potential buyout) to hopefully one day occur. While a practical solution to this problem rarely presents itself, Newlox Gold Ventures (CSE: LUX) might have just the fix for this tedious process.

Newlox Gold has managed to set itself apart from its junior peers in a way that many probably did not think would be possible. Rather than focus on assembling a big resource estimate, the company went right to work with production. Instead of focusing on massive resources, large budgets, and huge production facilities, Newlox has instead decided to focus on small mine operations. Artisanal, in fact – while also placing an emphasis on environmental remediation.

This might seem counterintuitive, and out of place in the world of capital markets, but let us explain.

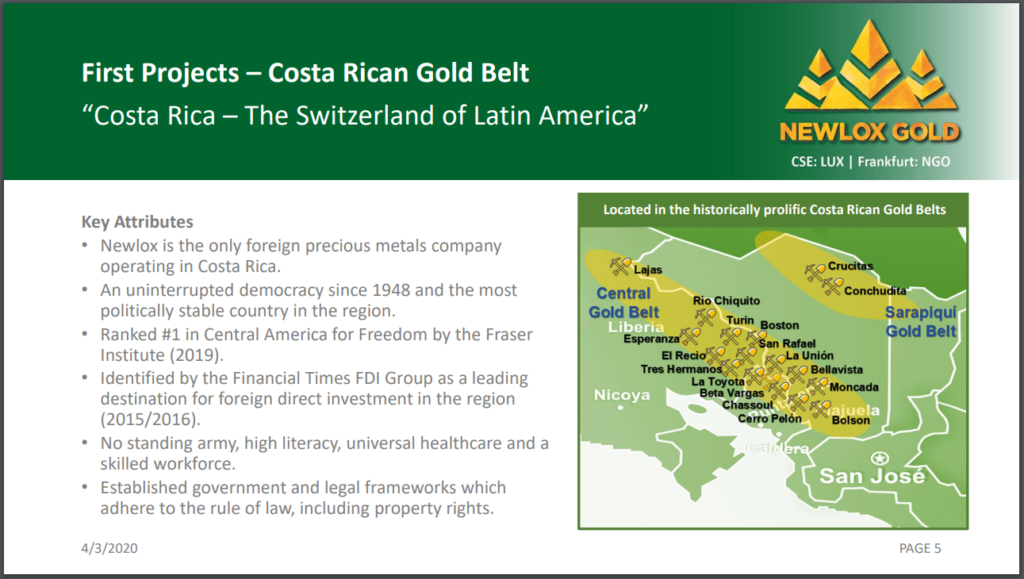

Newlox Gold is focused on what is known as artisanal tailings remediation. Effectively, they are able to produce gold with a positive environmental impact, thanks to some technological advancements. The company is currently focused on operating in Costa Rica, where they have partnered with all the major local mining cooperatives in the area, covering over 30 mining sites. Essentially, they have agreements in place to re-process artisanal tailings, which will remove contamination in the material while the company benefits from the recovery of gold and silver at what is said to be remarkably low capital and operating costs.

Globally, artisanal mining accounts for 20% of annual gold production as per the Artisanal Gold Council, while also accounting for roughly 90% of the global mining workforce. Artisanal mining has effectively become a great tool to lift people out of poverty, while also promoting development. While a net benefit in a lot of respects, the downside to artisanal mining is that typically, artisanal miners only have a 40% recovery rate of gold. Further, chemicals are used to extract the gold from the ore, which can create environmental issues. Most commonly, mercury is used to extract the gold, which is then left residually in the rock, posing a problem for governments.

Newlox however is able to remove the mercury that is left behind by these artisanal operators. Their tailings remediation as a result actually makes their gold production a net benefit to the environment, which is unheard of in the mining industry. Essentially, the company processes the tailings to remove this contamination, while also conducting gold recovery at a rate of up to 91% recovery. The benefit here, is that the majority of gold is actually left behind in the tailings from artisanal operations, enabling the company to focus on processing feedstock that has a cut-off grade of 9 grams per tonne.

The additional benefit of processing this feedstock, is that crushing, one of the most expensive functions in any mining operation, is already complete, with only minimal grinding being required. The company as a result is able to post low capital and operating costs.

In terms of production, the company has completed the design and construction of its first processing facility. Designed to process 80 tonnes per day, the facility is expected to turn a handsome profit given the low operating costs of the operation, combined with feedstock that has a cut off grade of 9 grams per tonne.

While previously operational earlier this year, the company was forced to halt production with rising cases of COVID-19 in Costa Rica occurring. During that time, the facility was moved to a better location, with production set to restart imminently.

This summer, the company also announced its second processing facility, known as the Boston Project. The processing facility has entered definitive agreements to mill and process all feed mined from the Boston Mine, located in Costa Rica. Arrangements are slightly different from the first processing facility, with net revenues from the operation split on a 50/50 basis with Sindicato Nacional De Mineros, the artisanal firm responsible for exploration, exploitation and feedstock. Capital costs associated with the operation will be recovered from revenues on a prioritized basis.

The new mill is expected to have a throughput of 150 tonnes per day, nearly double the capacity of its first processing facility, while also working with feedstock that has an average grade of 15 grams per tonne gold. Newlox is working on a rapid timeline for the project, with construction set to begin this year, and commissioning currently set to take place within the first half of 2021.

The idea here, is for Newlox to have several small scale production facilities in operation, that when combined amount to a significant operation, while being a net benefit to the environment. The facilities, due to their small stature, are able to be commissioned within just three to six months, with capital expenditures estimated at approximately US$1.5 million per facility.

Productivity from the first processing facilities established by the company is expected to be able to generate sufficient cash flow that will allow for an aggressive growth strategy throughout Latin America, with the company already having multiple projects in the due-diligence stage.

The result, is that these small facilities are expected to make a positive impact in terms of environmental clean-up while also potentially providing strong returns to the company – all while not having to spend big money drilling for a resource estimate, like the typical junior gold operation does.

Newlox Gold Ventures Corp last traded at $0.15 on the CSE, with a market capitalization of $14.2 million.

FULL DISCLOSURE: Newlox Gold Ventures Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Newlox Gold Ventures Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.